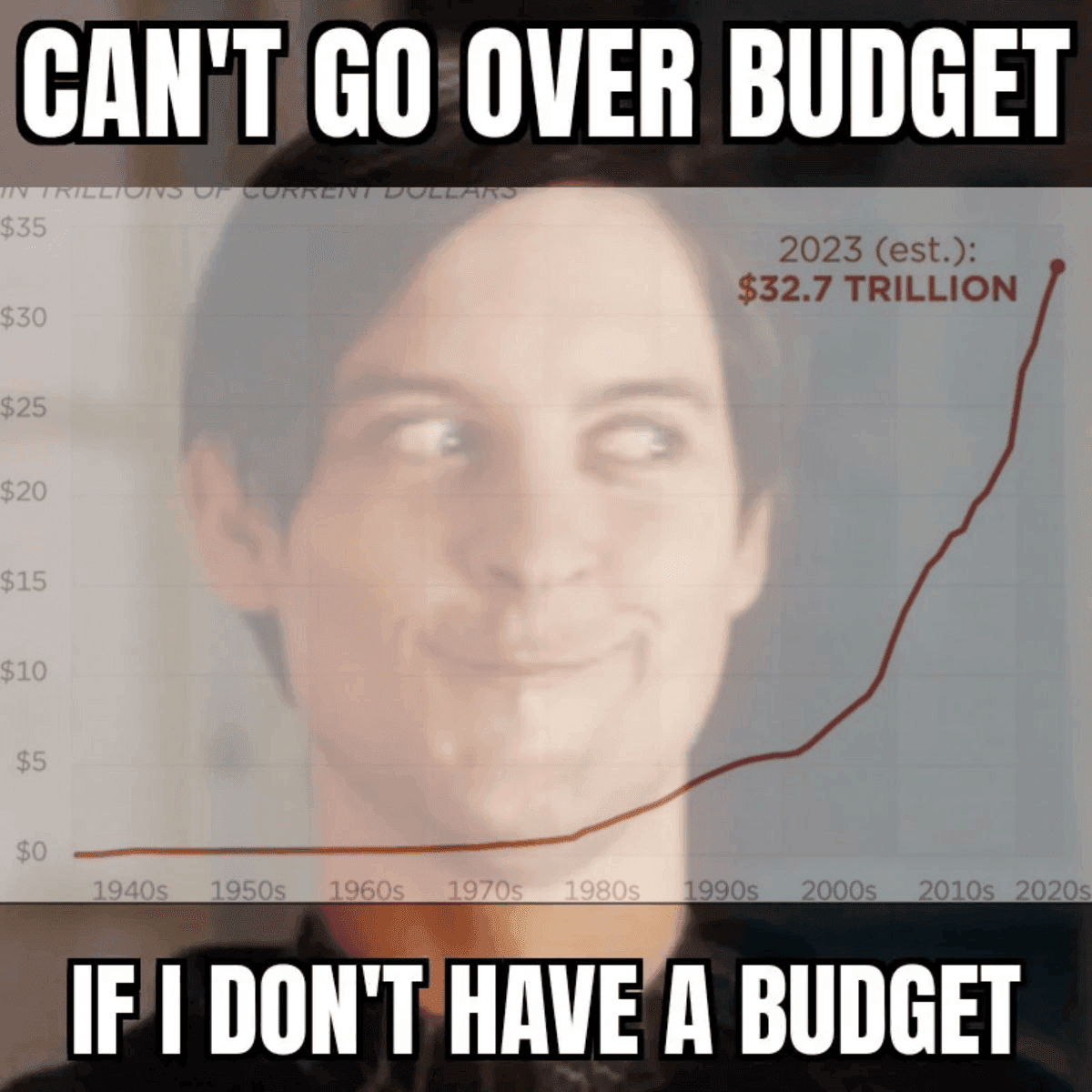

Weekly Digest: Fitch Cuts U.S. Credit Rating, Gold Faces Weekly Loss

05/08/2023: Fitch downgrades the U.S. credit rating on debt ceiling drama and governance worries, gold is set for its worst week in six, Bank of England raises rates for the 14th time in a row. And more.