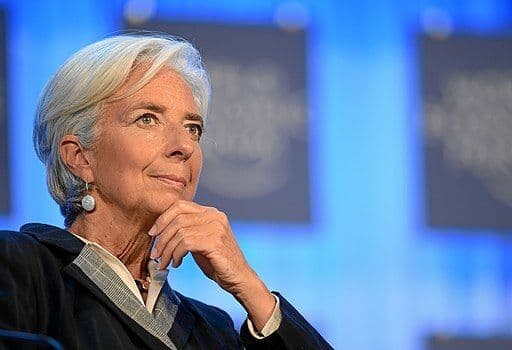

Weekly Digest: Hot U.S. Inflation Data, ECB Rate Hike

16/09/2023: U.S. consumer prices surged more than expected in August, making it the hottest month for inflation in 2023, ECB hikes rates to a record level despite the threat of recession, euro set for the longest weekly losing streak since 1997. And more.