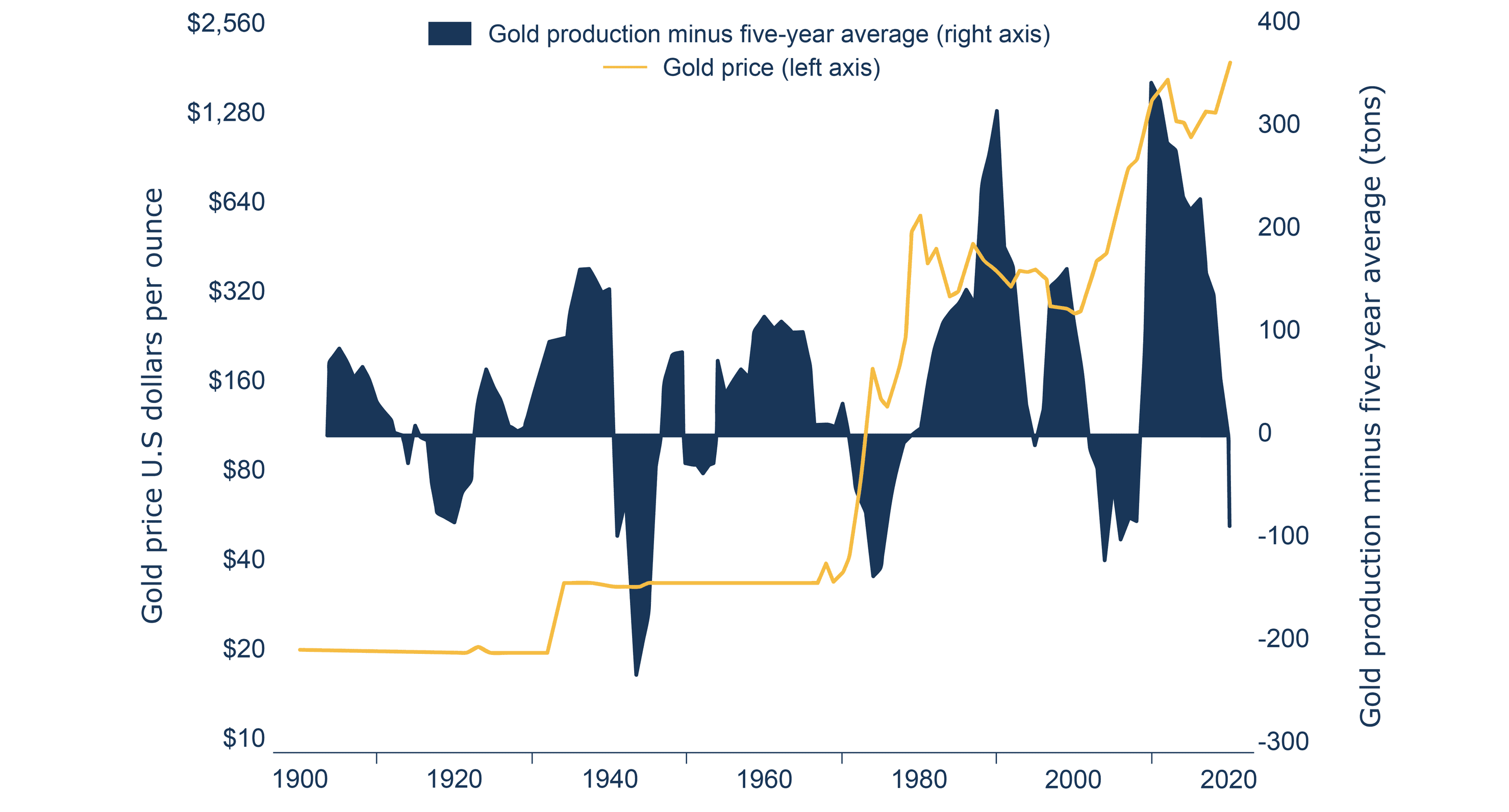

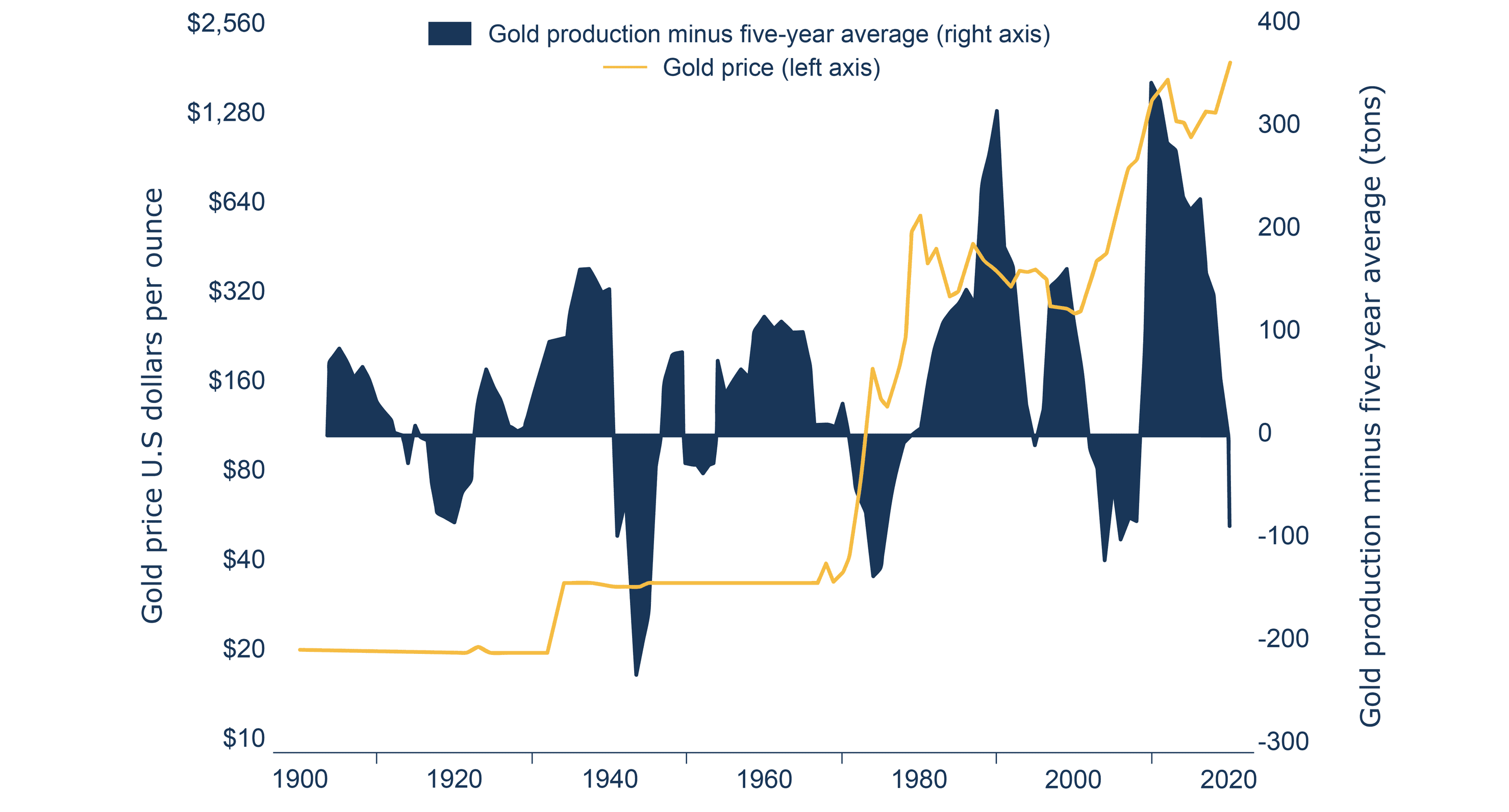

Could Deficient Gold Supplies Push Gold Price Up?

Gold could be on the eve of a new commodity bull super-cycle as it entered a rare phase of deficient gold supplies.

Gold could be on the eve of a new commodity bull super-cycle as it entered a rare phase of deficient gold supplies.