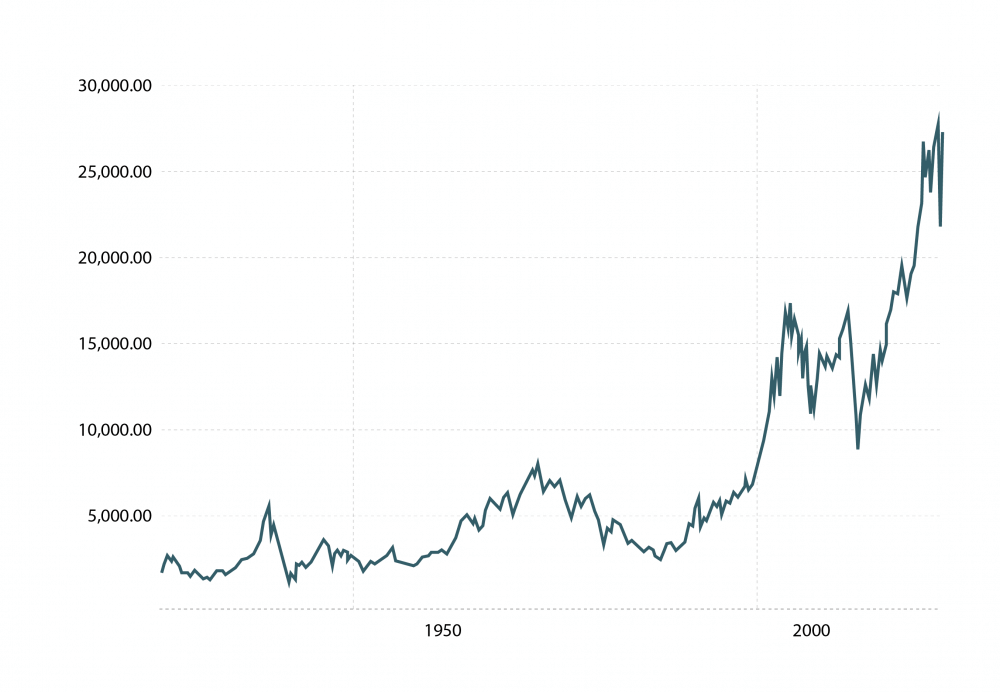

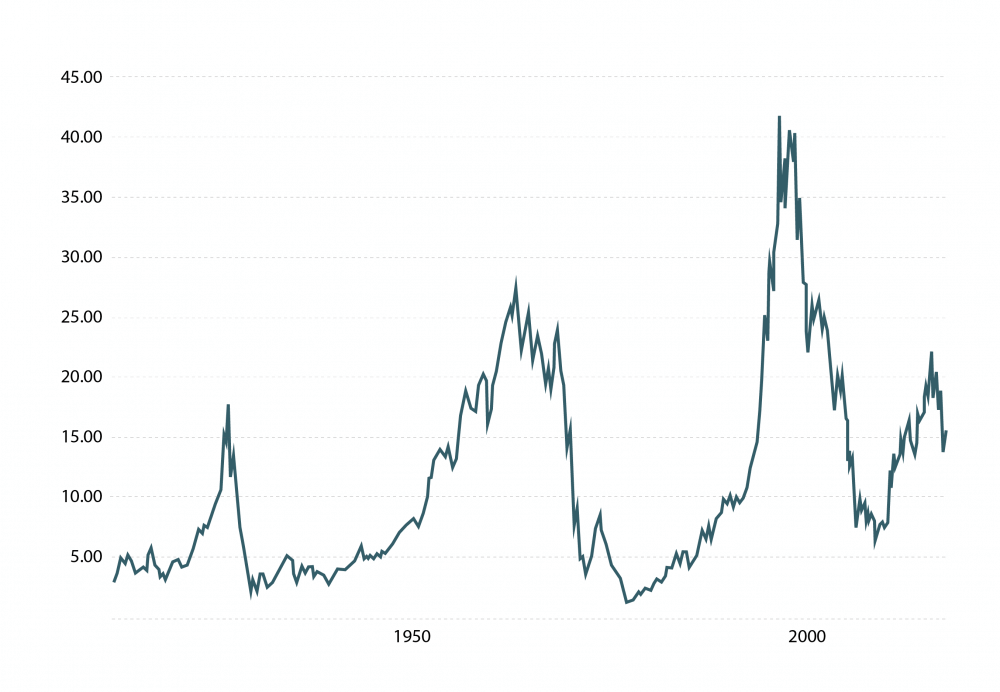

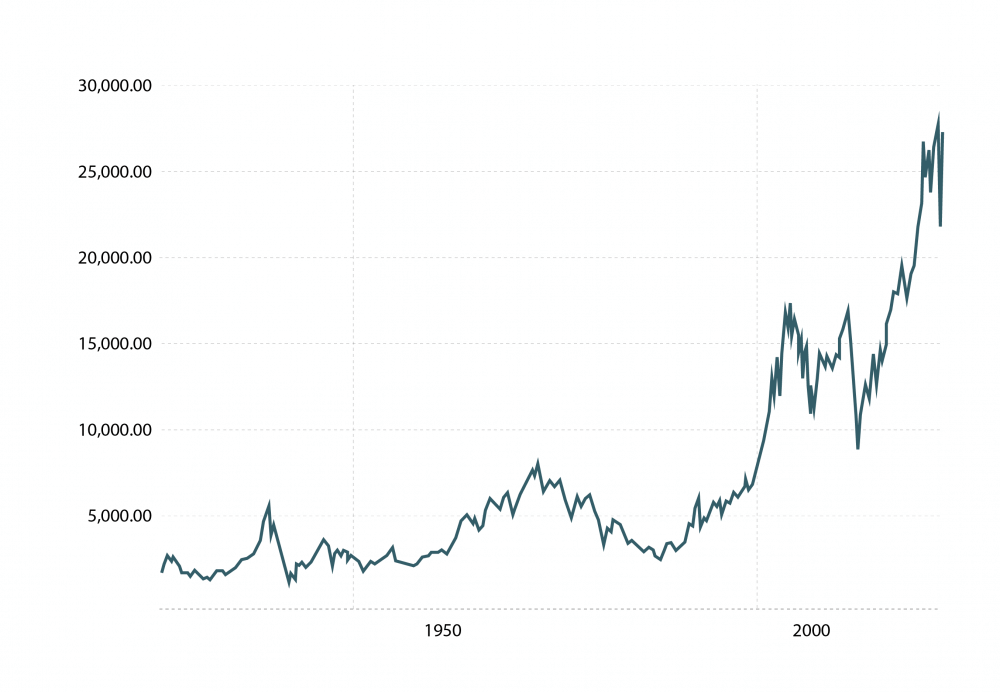

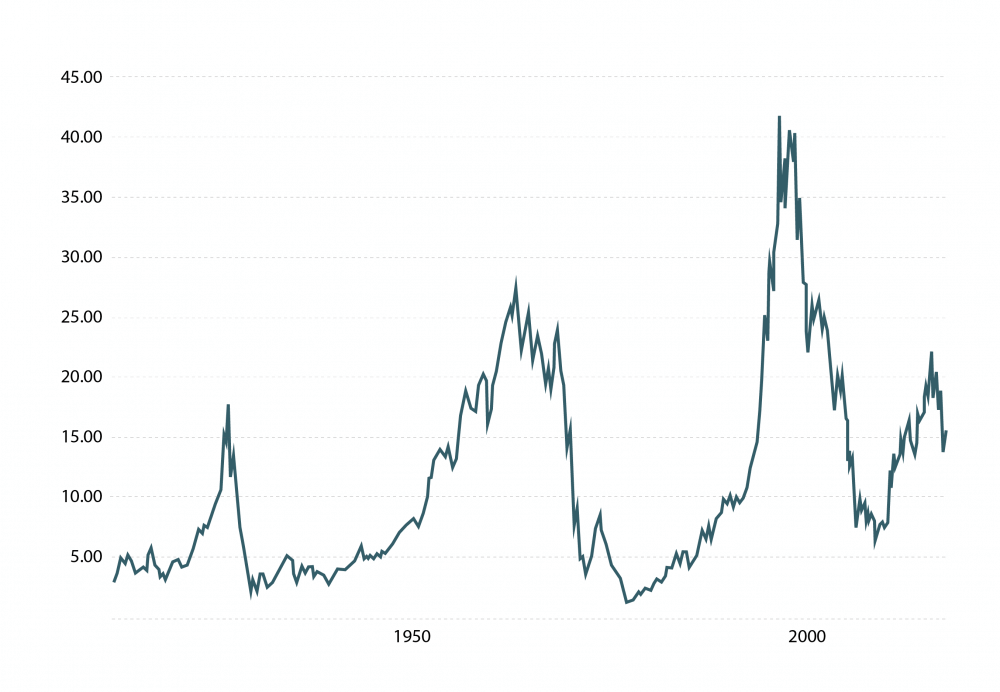

How Can We Tell the Real Value of Any Asset?

To calculate the real value of an asset it's important to take into account the changes in value of its unit of account.

To calculate the real value of an asset it's important to take into account the changes in value of its unit of account.