How to Use the Gold-to-Silver Ratio to Make Better Investment Decisions

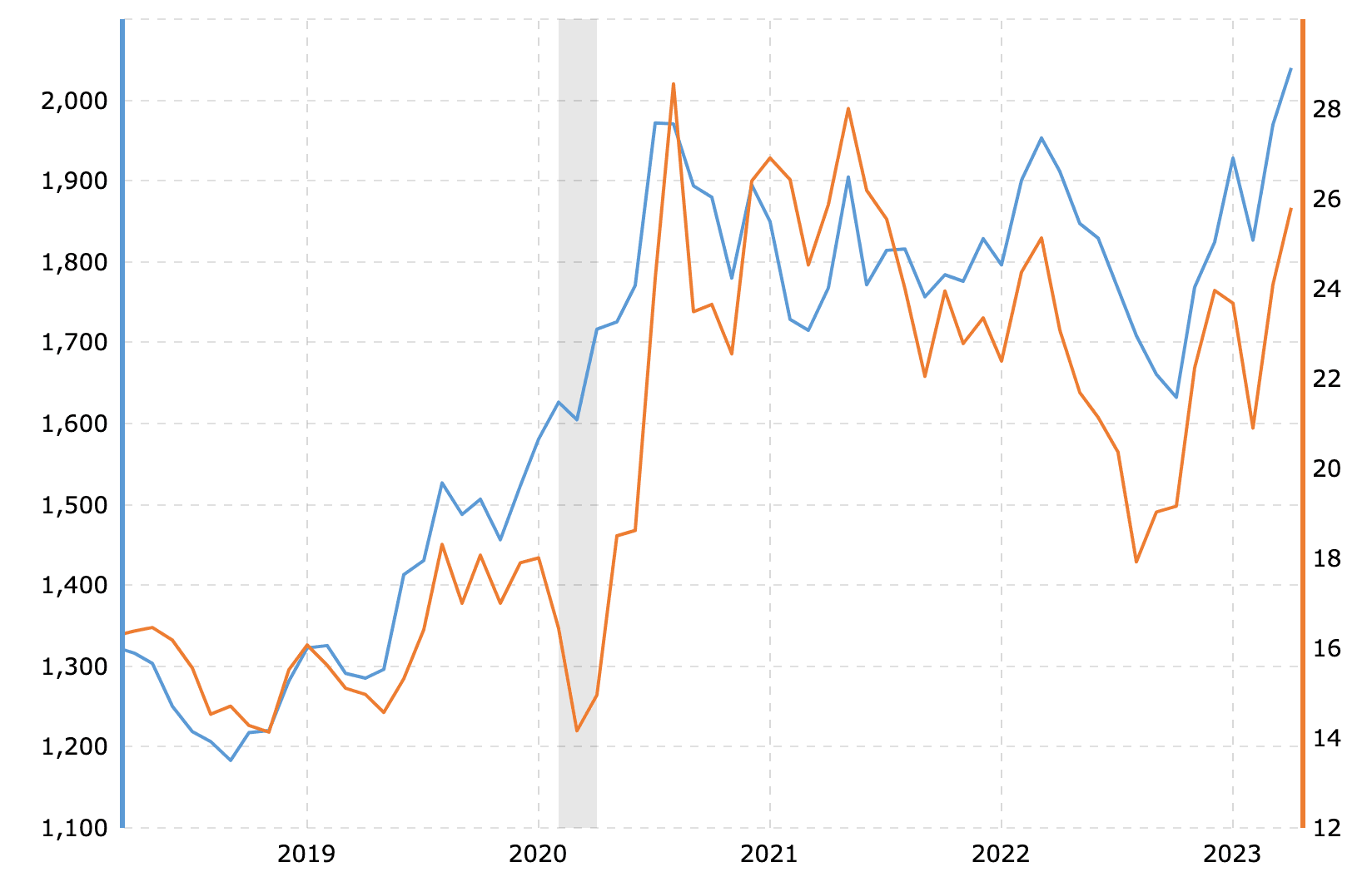

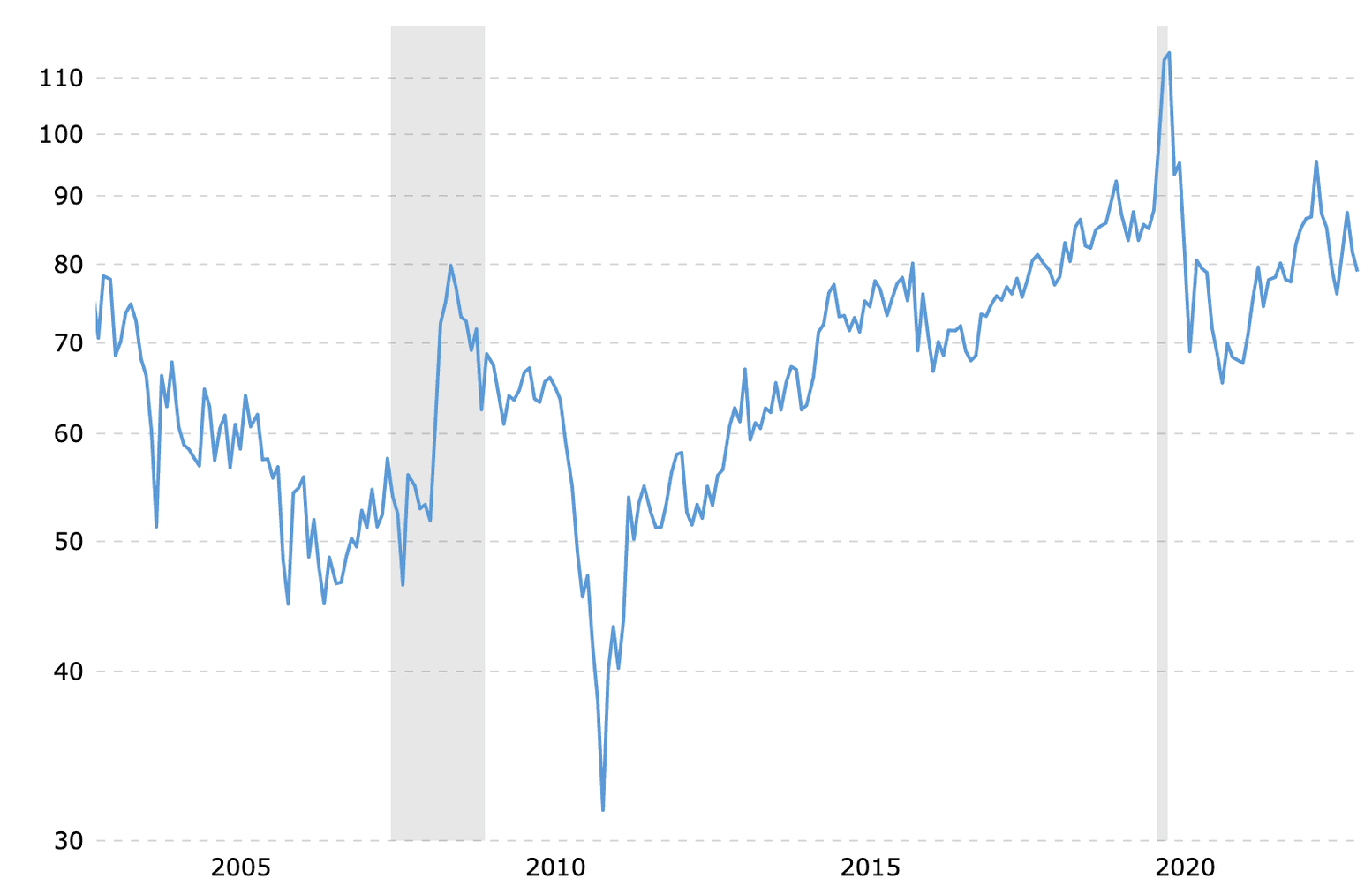

Wondering whether to invest in gold or silver, and how much of your investment should be allocated to each? The good news is that the gold-to-silver ratio can give you some answers!