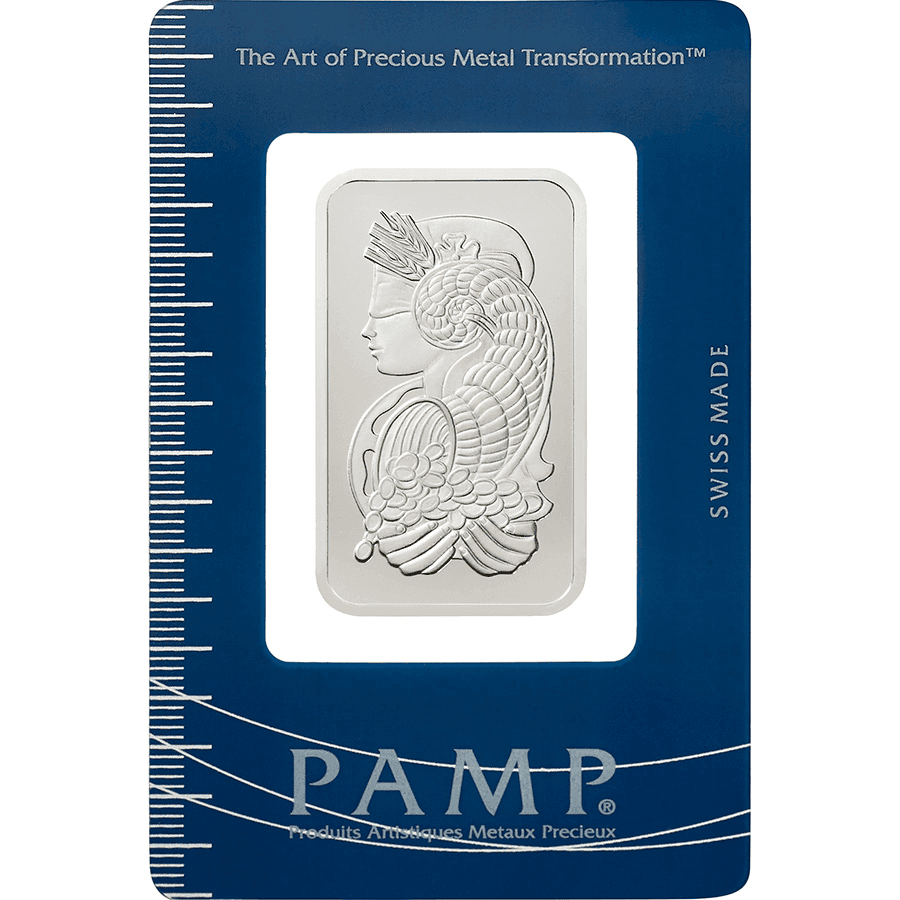

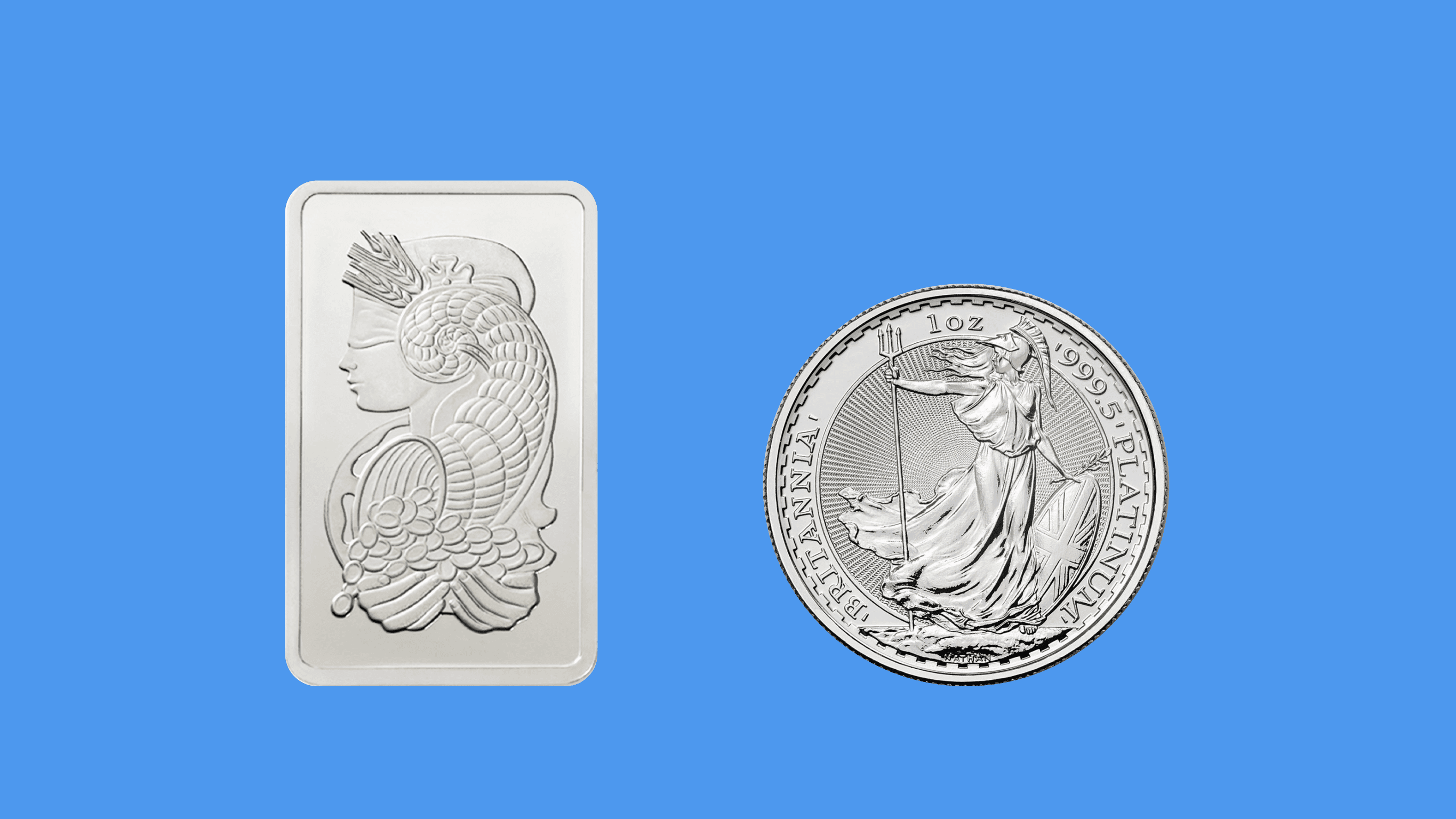

Investing in Platinum: A Beginner’s Guide

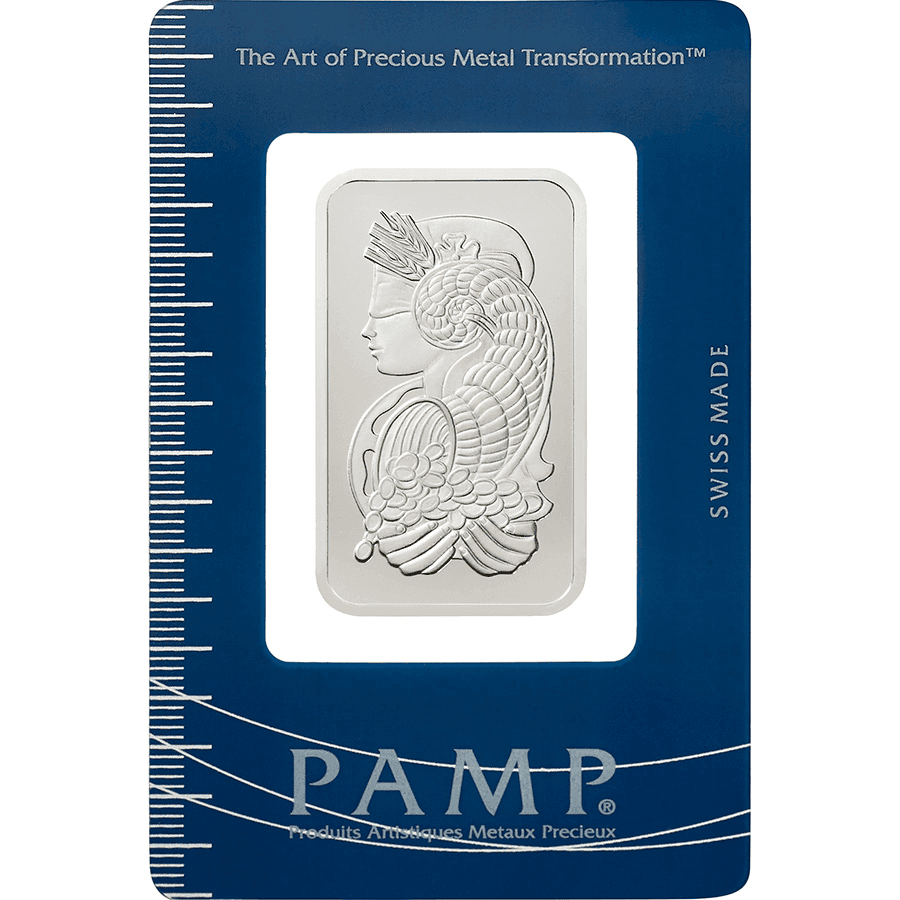

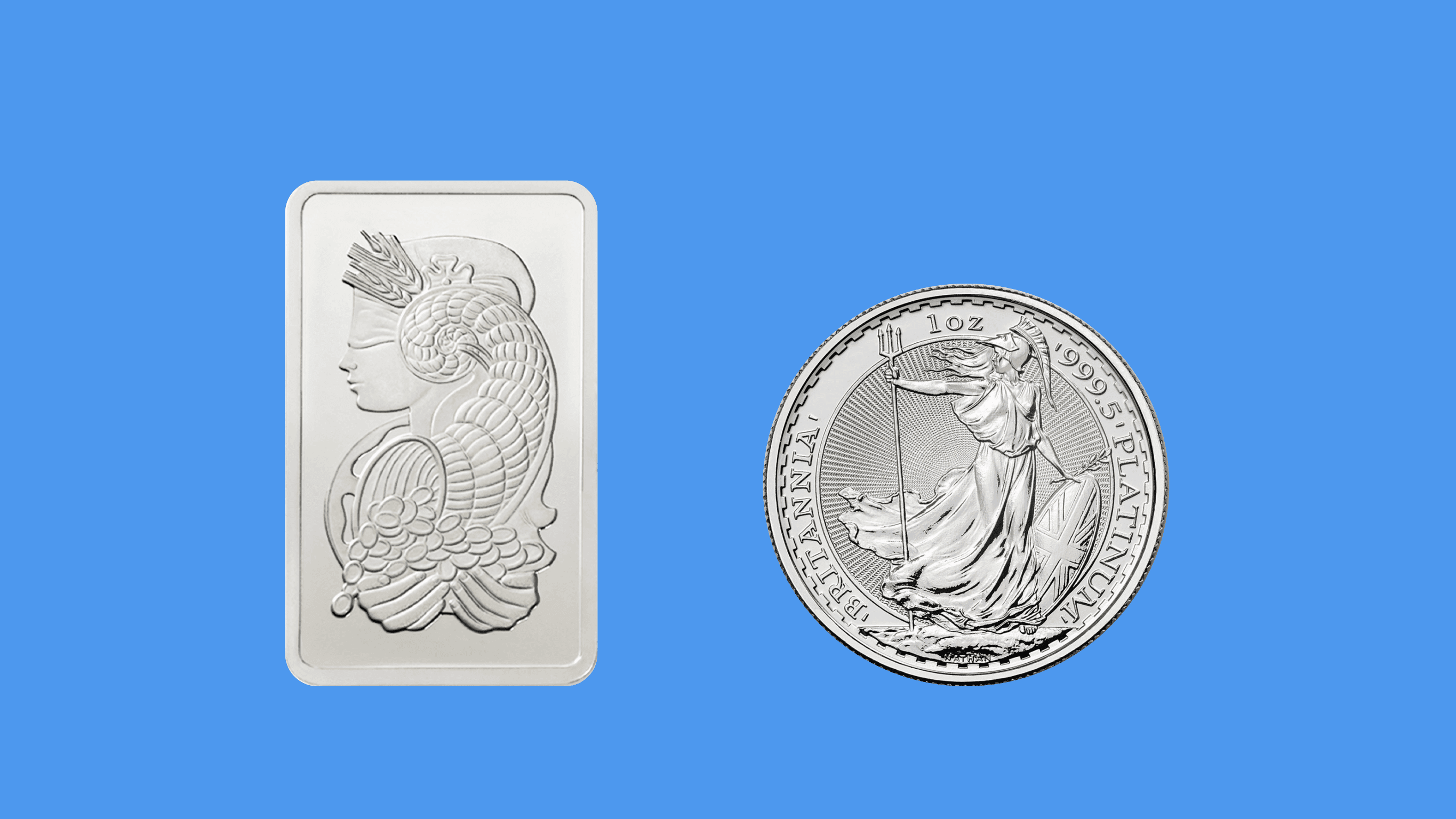

Have you been thinking of investing in platinum bars and coins? Here’s what you need to know about one of the world’s rarest precious metals.

Have you been thinking of investing in platinum bars and coins? Here’s what you need to know about one of the world’s rarest precious metals.