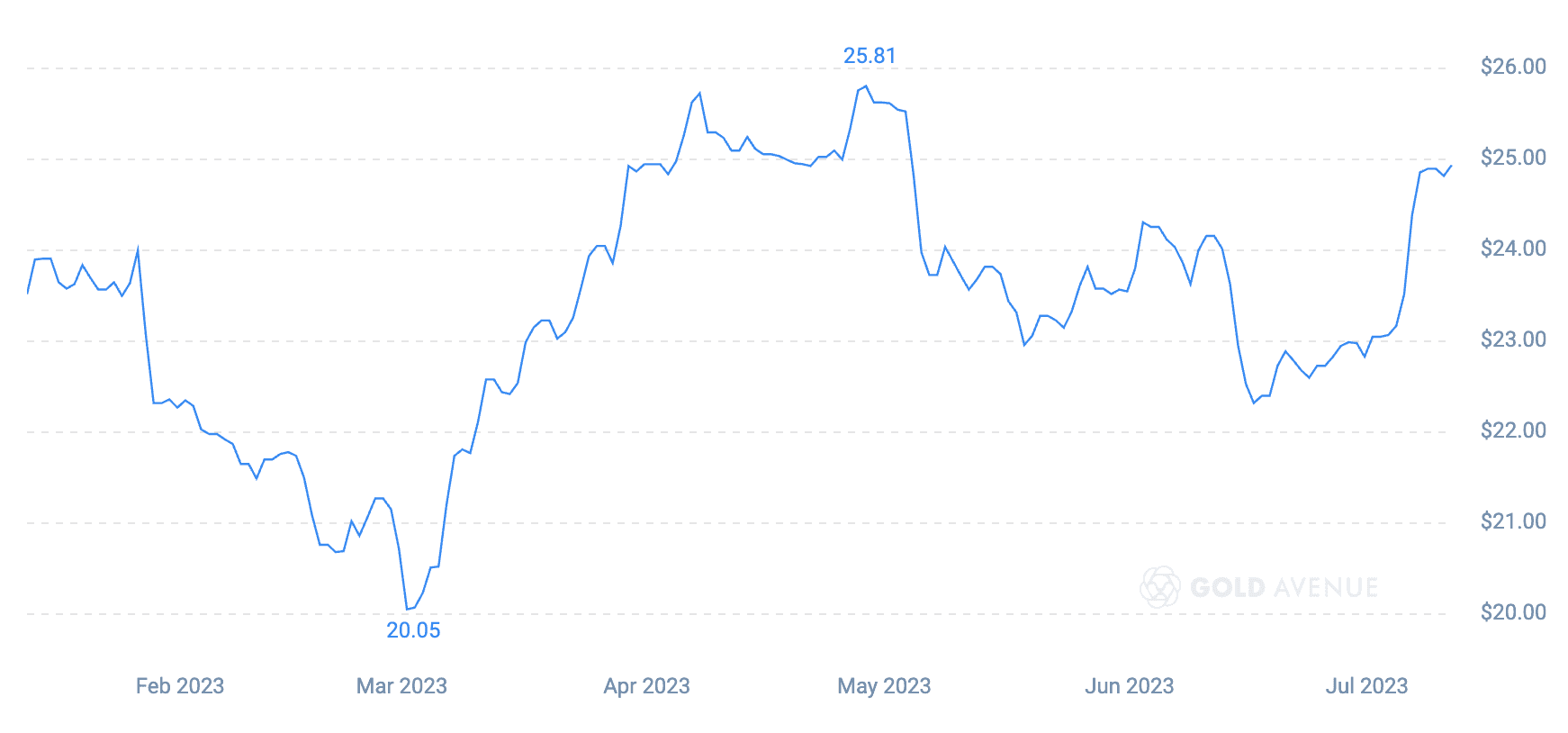

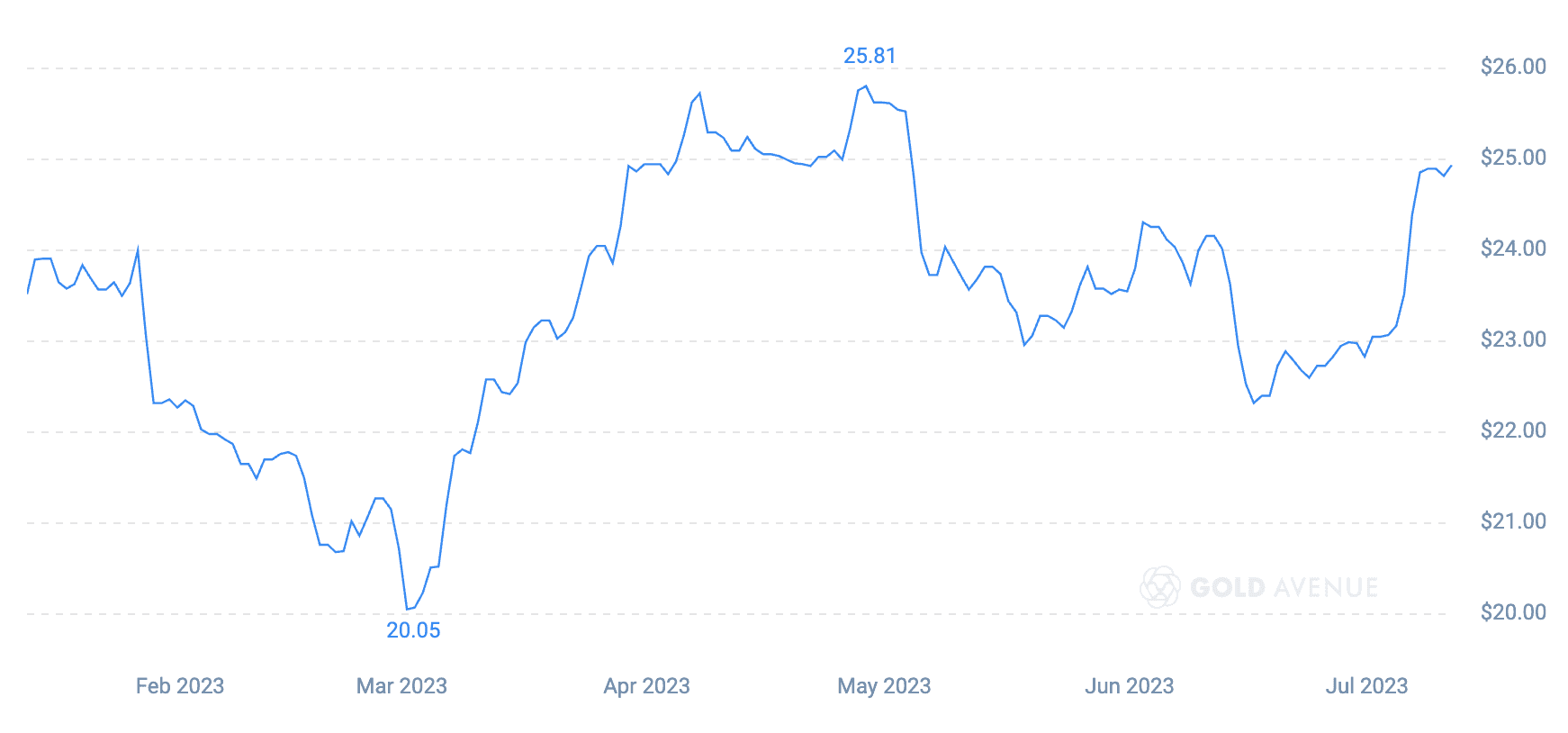

Is silver a good investment in 2023?

Unlock the potential of silver!🚀 As the demand for physical silver surged during the health crisis, what can you expect from the white metal for the rest of 2023?

Unlock the potential of silver!🚀 As the demand for physical silver surged during the health crisis, what can you expect from the white metal for the rest of 2023?