Is Silver Setting the Stage for a Breakout?

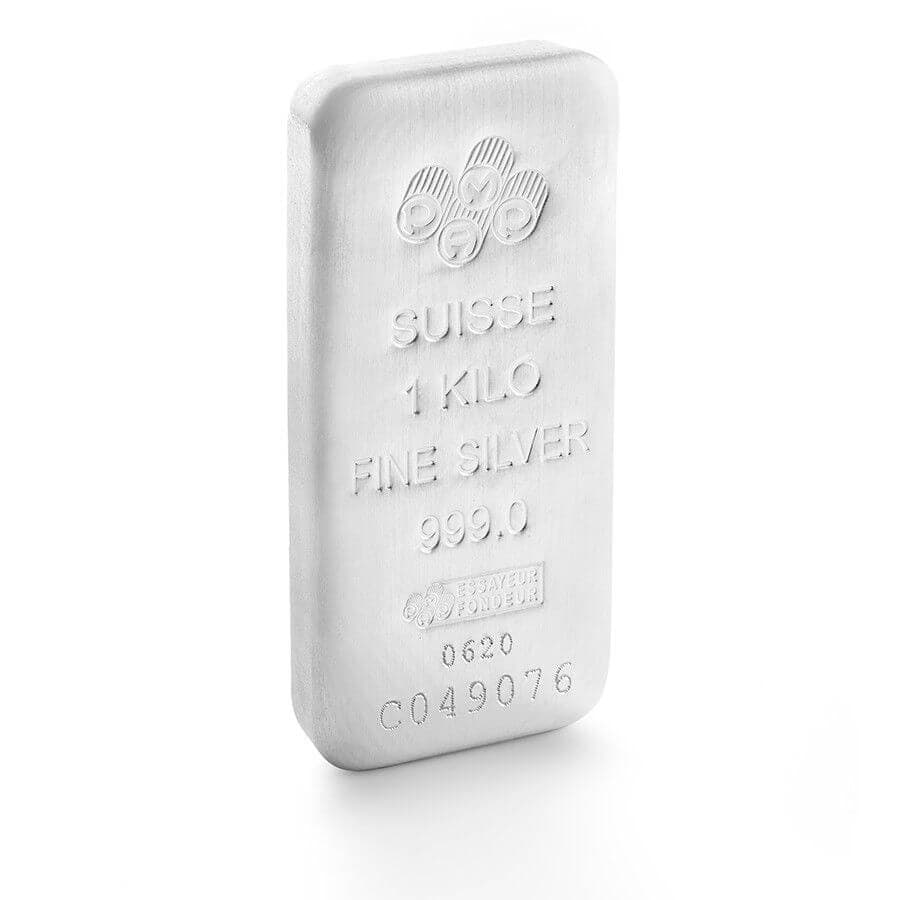

Despite slowing down, the frenzy around silver has kept prices up, and demand for physical bars and coins strong, while doubts over the state of the silver stocks emerge. Is Silver Setting the Stage for a Breakout?