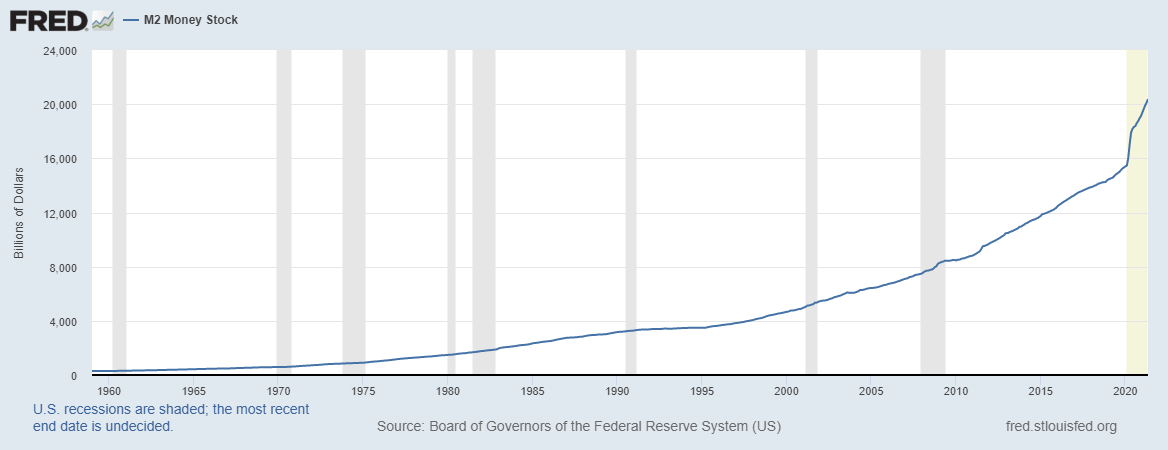

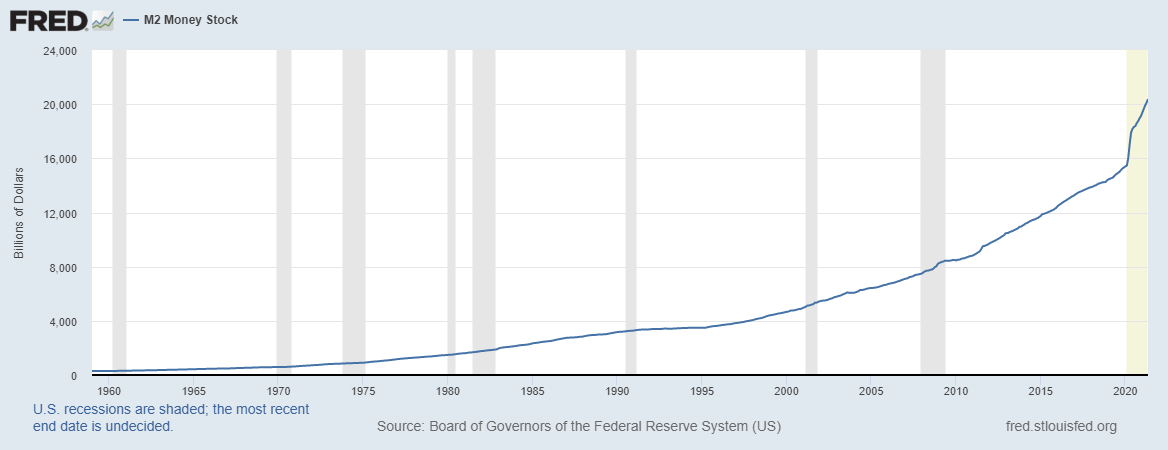

Massive Money Printing: What It Means for Gold?

Reckless money printing devaluates the currency, making investors turn to physical assets like gold that cannot be printed or created out of thin air.

Reckless money printing devaluates the currency, making investors turn to physical assets like gold that cannot be printed or created out of thin air.