Recession Risk is Rising, Economists Say. Here's What It Means for Investors

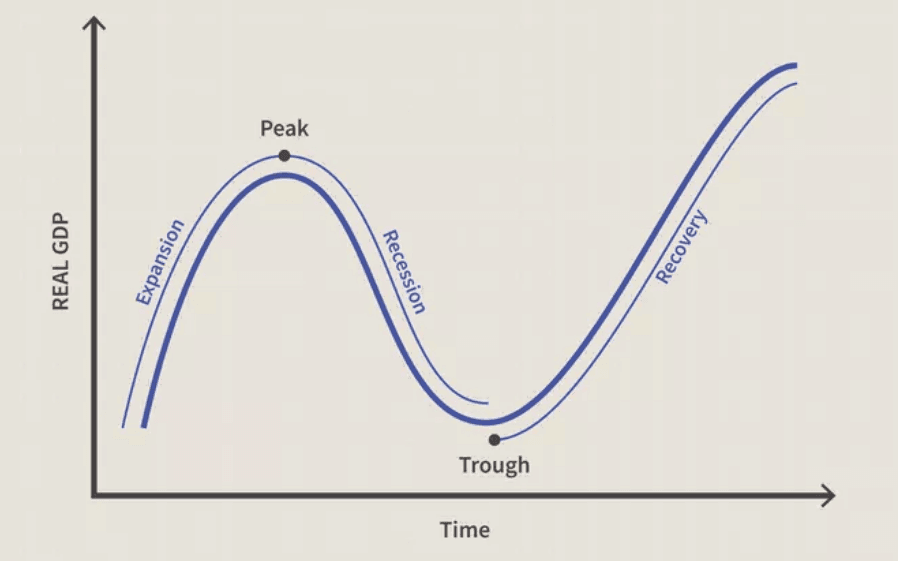

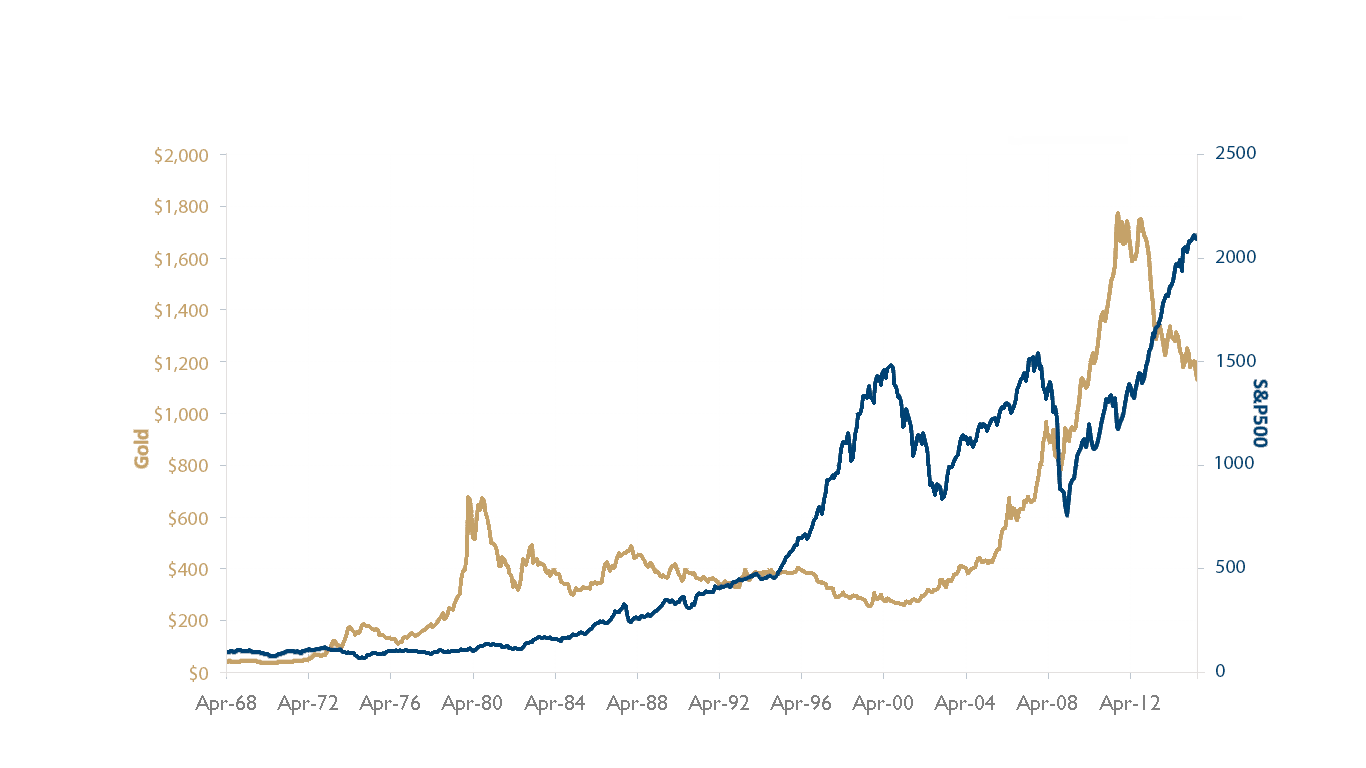

Leading world banks say we should get ready for a new recession shock. What does it mean exactly, and what investments might be the best place to stash your hard-earned money?