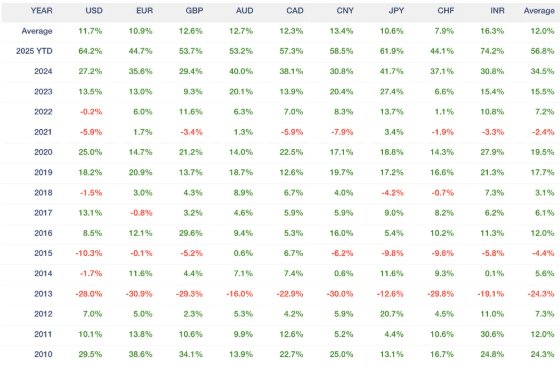

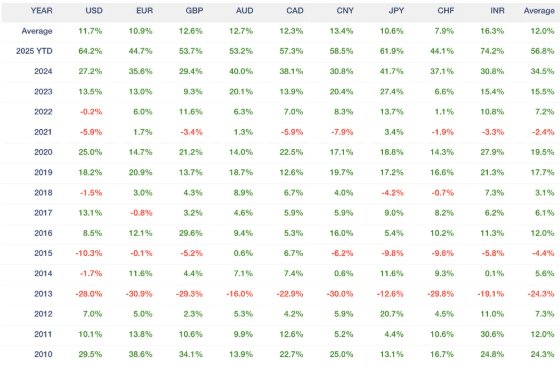

The Price of Gold in Global Currencies: 2025 Year-End Review

Discover how the gold price in global currencies performed in 2025. Compare gold in USD, EUR, GBP, CHF and JPY, and learn how currency movements shape real returns.

Discover how the gold price in global currencies performed in 2025. Compare gold in USD, EUR, GBP, CHF and JPY, and learn how currency movements shape real returns.