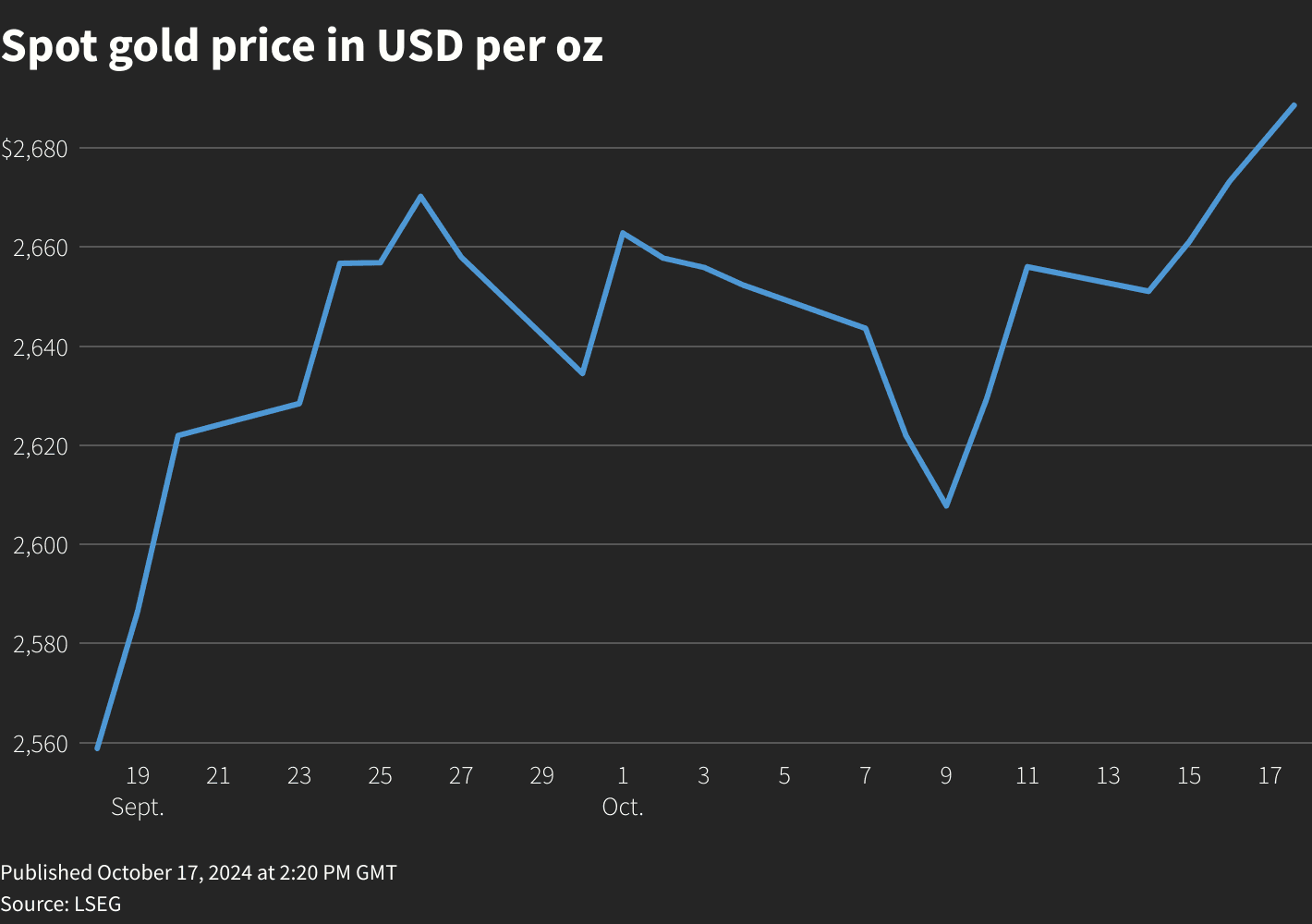

US Presidential Election 2024: How will it affect Gold?

Tic-tac. The race for the U.S. presidency is about to kick off its first round—a major event that could have a direct impact on gold prices.

Tic-tac. The race for the U.S. presidency is about to kick off its first round—a major event that could have a direct impact on gold prices.