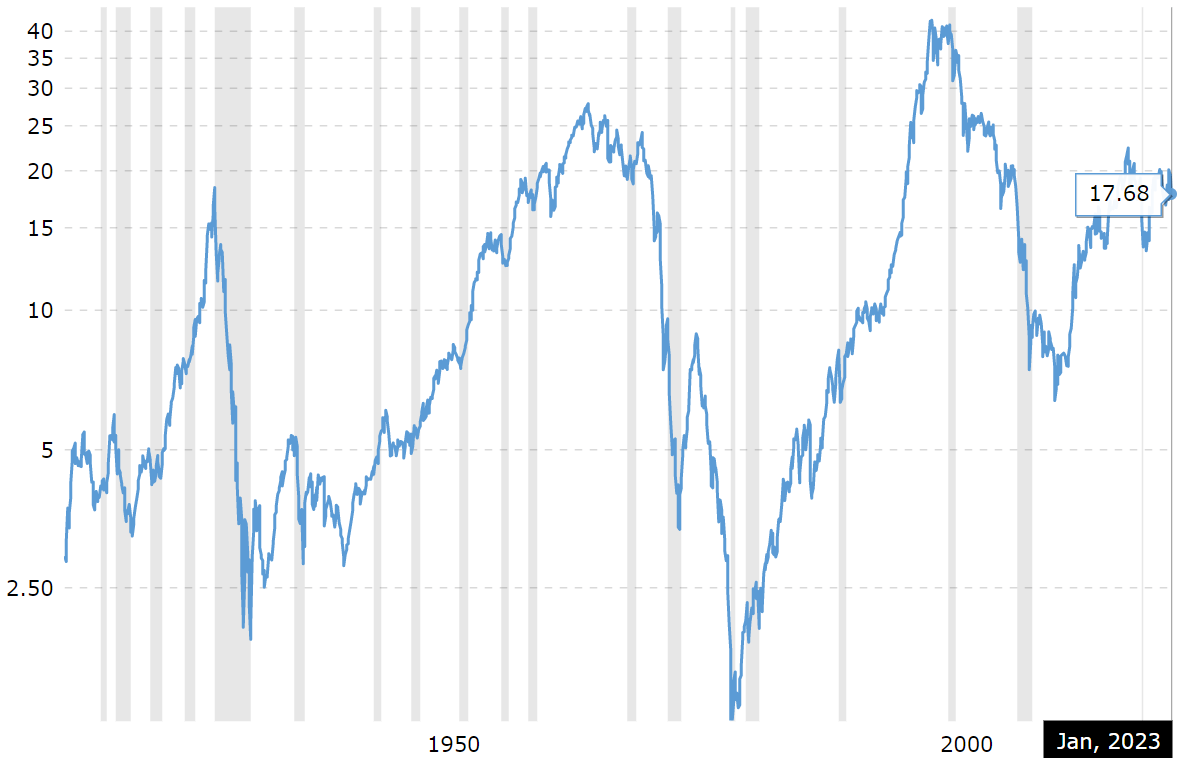

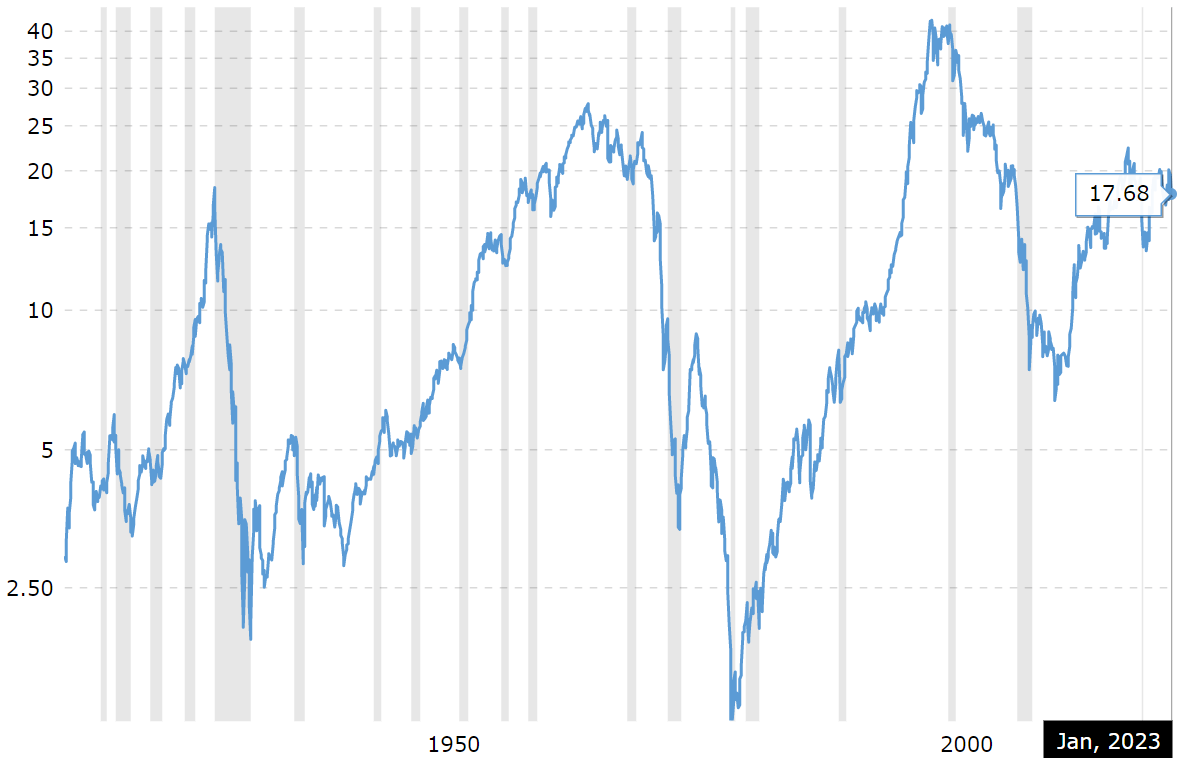

What Can We Learn From the Dow to Gold Ratio?

Savers and investors use this one tool to find the best time to buy and sell gold and stocks. Here's why it's so great.

Savers and investors use this one tool to find the best time to buy and sell gold and stocks. Here's why it's so great.