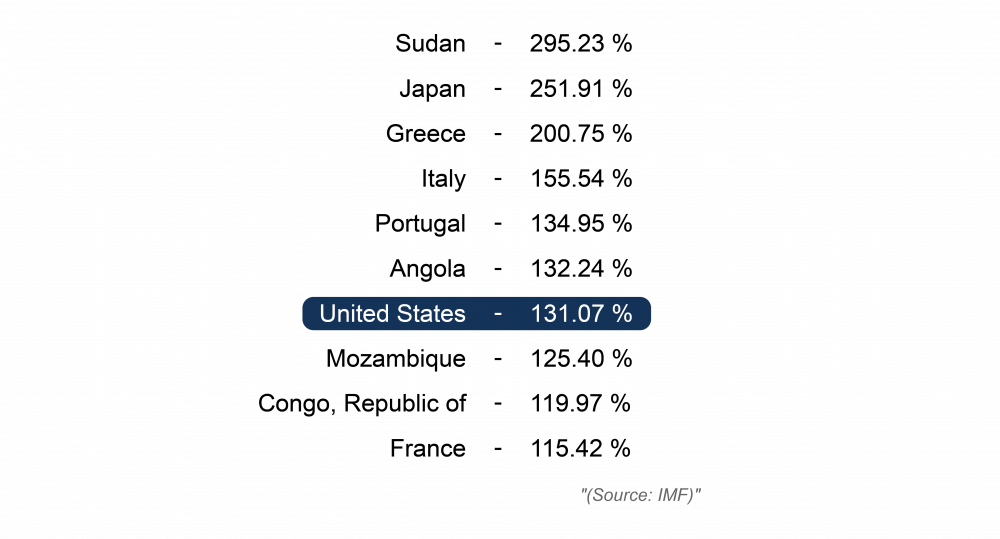

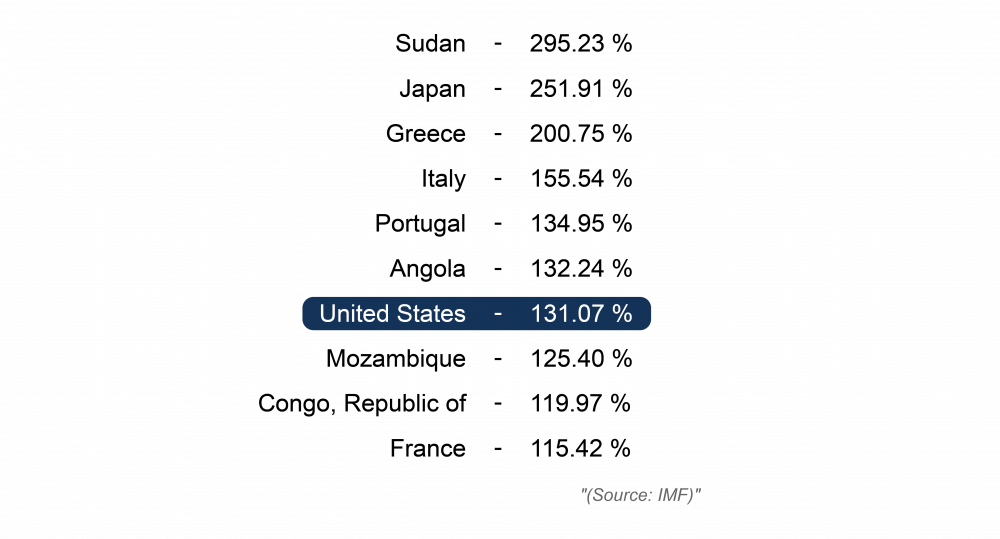

What Comes after a 130% Debt Ratio?

The U.S. debt has just reached 130% of GDP, and famous macro analyst Lyn Alden made a chilling observation about where all this could lead…

The U.S. debt has just reached 130% of GDP, and famous macro analyst Lyn Alden made a chilling observation about where all this could lead…