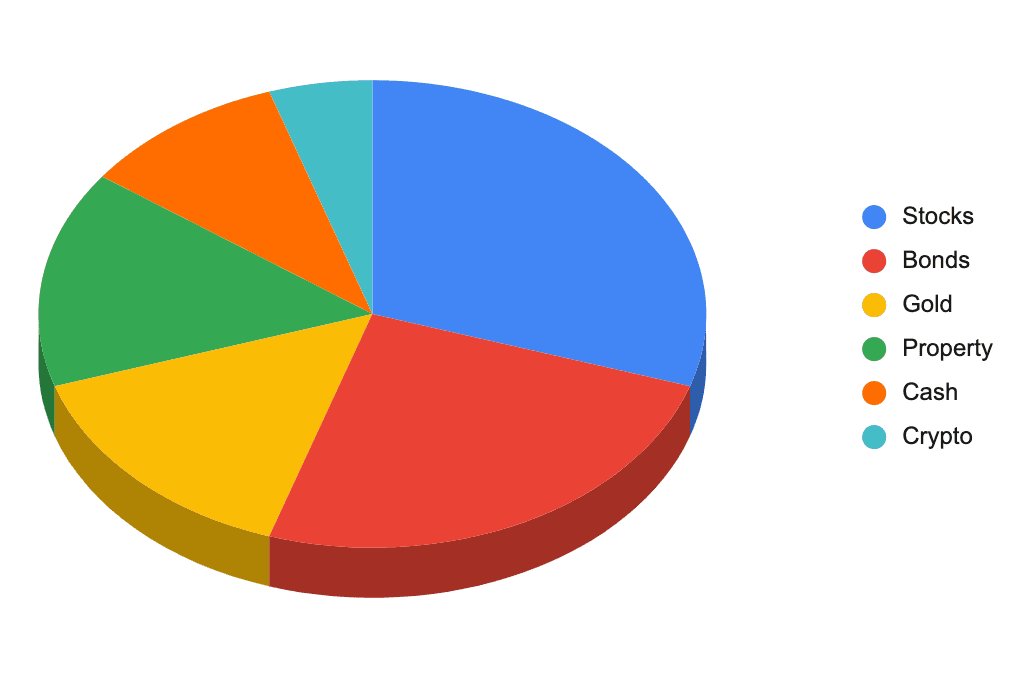

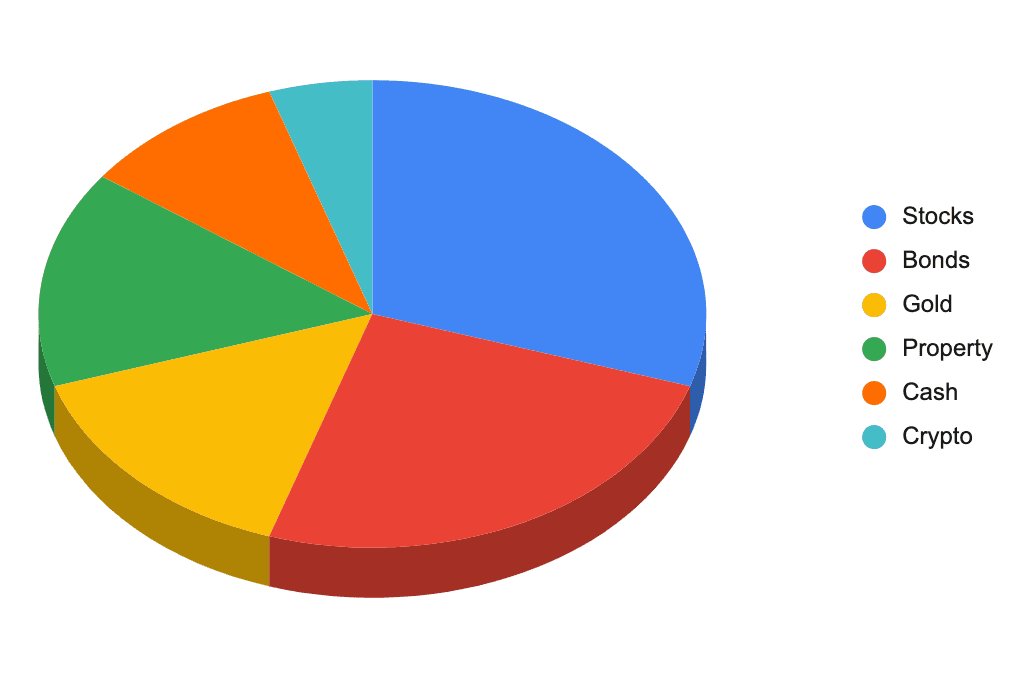

What is a Well-Diversified Portfolio? Tips On Diversifying

A well-diversified portfolio consists of an array of assets, from stocks to property, & precious metals. Here are some tips on diversifying.

A well-diversified portfolio consists of an array of assets, from stocks to property, & precious metals. Here are some tips on diversifying.