Why Are Cryptocurrencies So Volatile?

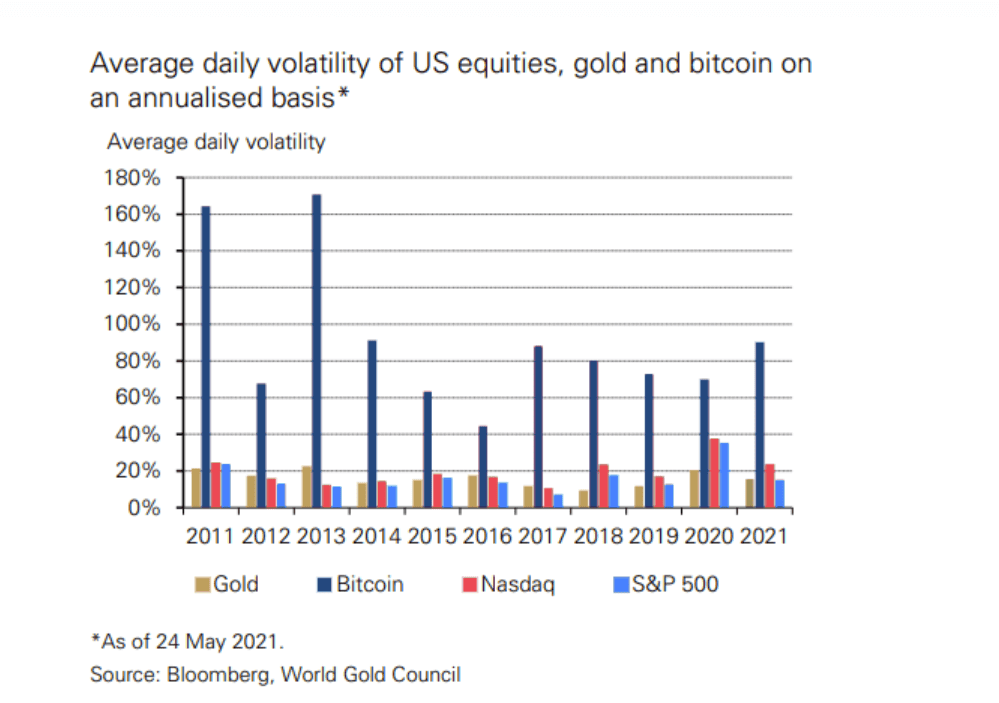

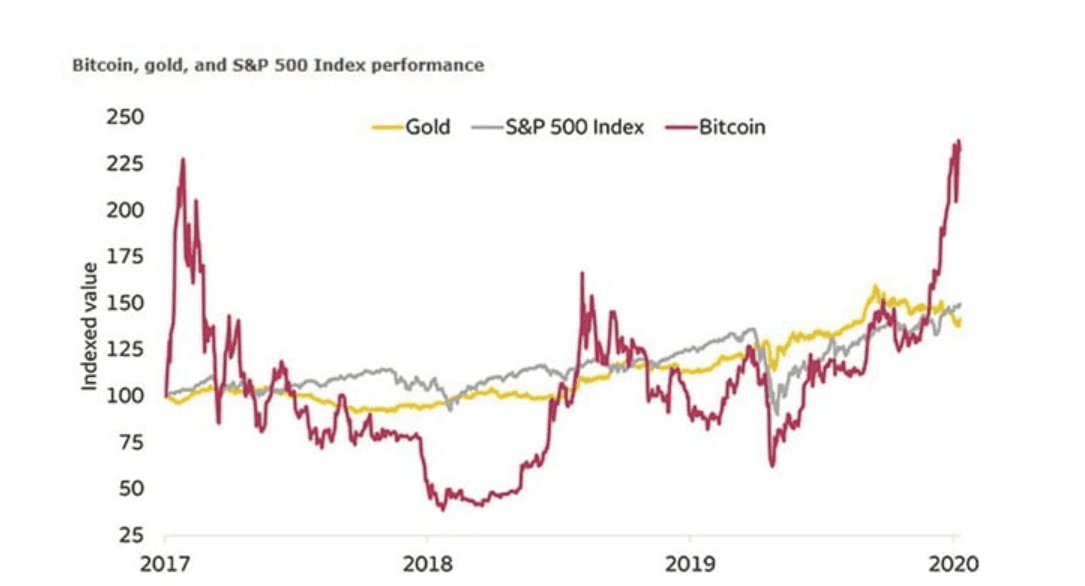

Digital currencies have been on a rollercoaster in 2021, rising and falling sharply throughout the year. In this article, you’ll find out whether it’s safe to put your money in bitcoin and what you can do to protect yourself from crypto volatility.