Why Is Inflation so High in Europe? Here’s What You Need to Know

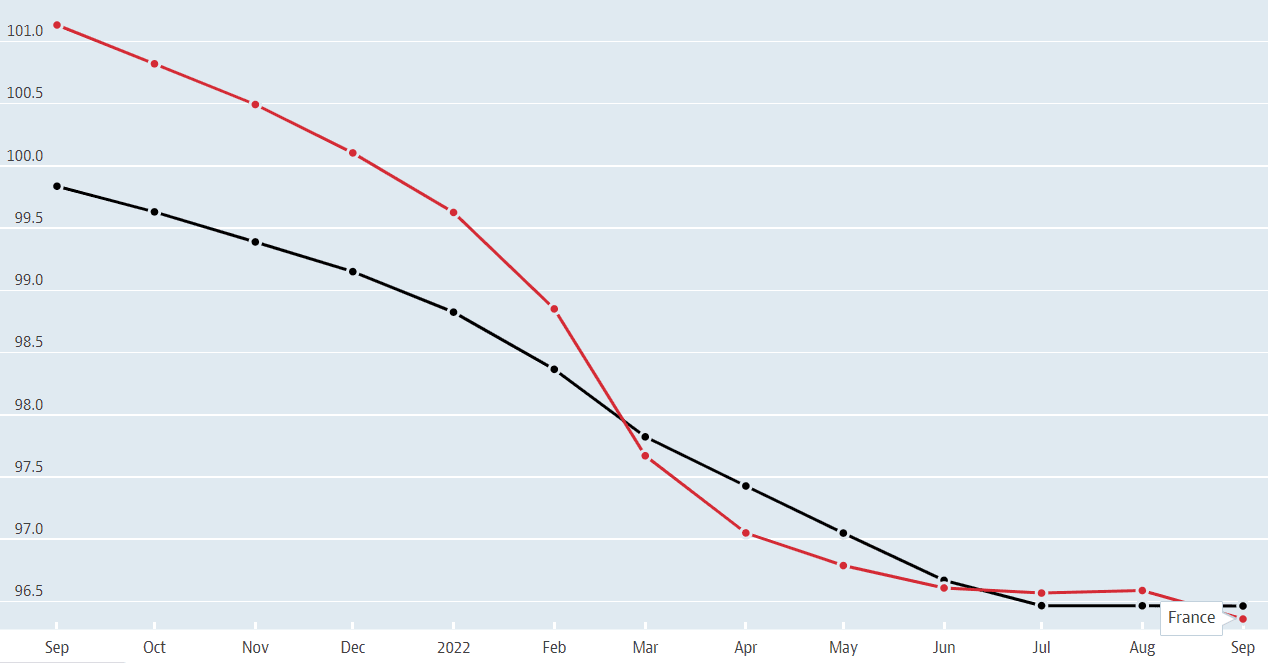

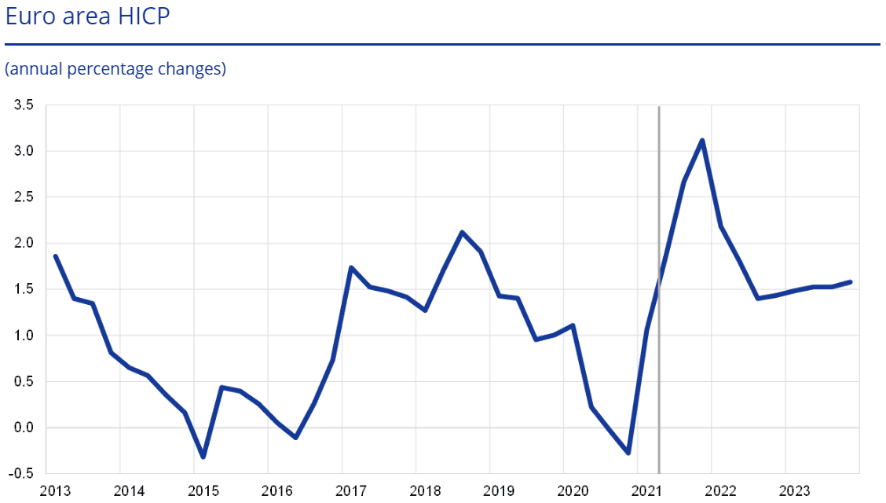

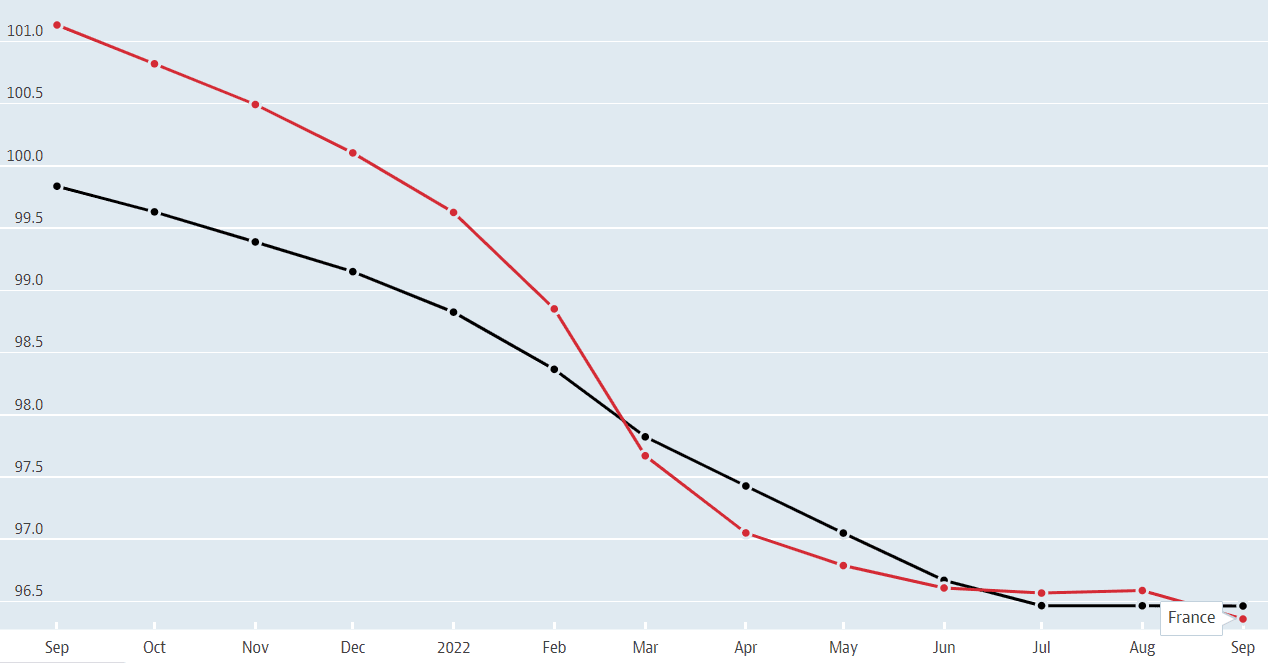

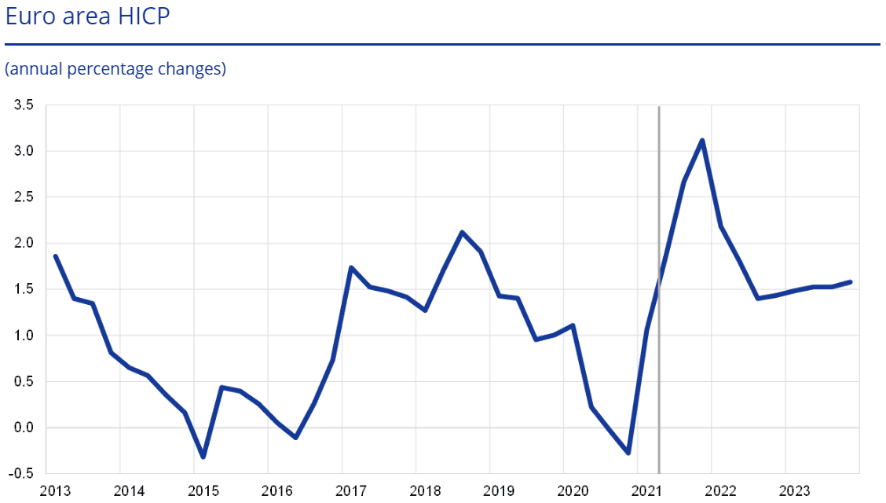

Almost every European economy is now facing eye-watering inflation sparked by rising food and energy prices. And it seems that things will only get worse before they get better.

Almost every European economy is now facing eye-watering inflation sparked by rising food and energy prices. And it seems that things will only get worse before they get better.