The Financial to Hard Assets Rebalancing

With a sharp increase in money supply fueling inflation, a rebalancing of financial asset into hard assets such as gold could occur.

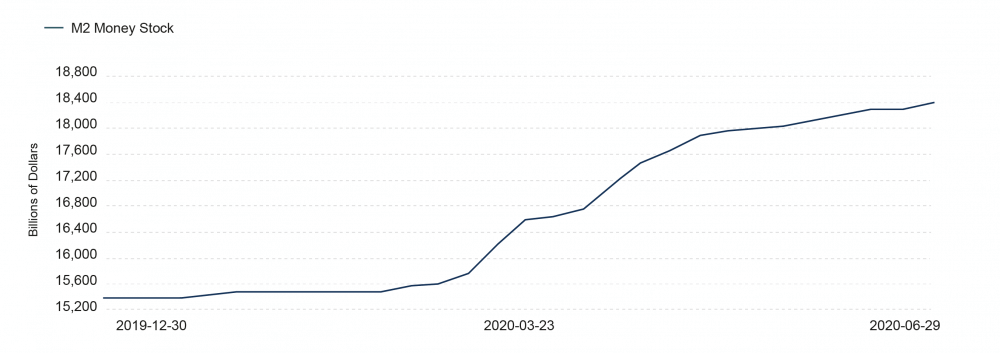

As you can see in the chart below, in 2020 only, the M2* money supply has increased aggressively from 15 to 18.5 trillion dollars, adding a mind-boggling number in circulation: 3.5 trillion dollars. 😲

*M2 is a closely watched measure of the money supply that includes cash, checking deposits, and near money that is easily convertible into cash.

Now, let's consider this:

Although the number is difficult to estimate with accuracy, experts believe that around 350 trillion dollars' worth of global financial assets are directly or indirectly tied to the US dollar.

Meanwhile, the quantity of exchangeable gold and gold-related equities is less than $3 trillion of global financial assets.

And with hard assets such as gold generally used as a hedge against inflation, and increasing money supplies fueling inflation, we can very well imagine that a rebalance from financial assets to hard assets could occur.

This would explain the current strength of the precious metal bull run: if only 1% of the 350 trillion dollars in global financial assets was to rebalance into gold, gold's current value would skyrocket 🚀