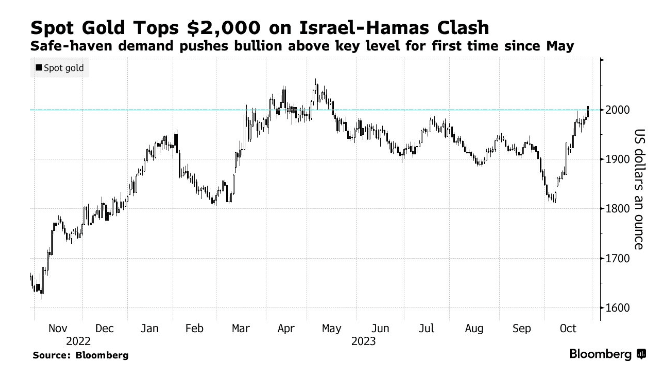

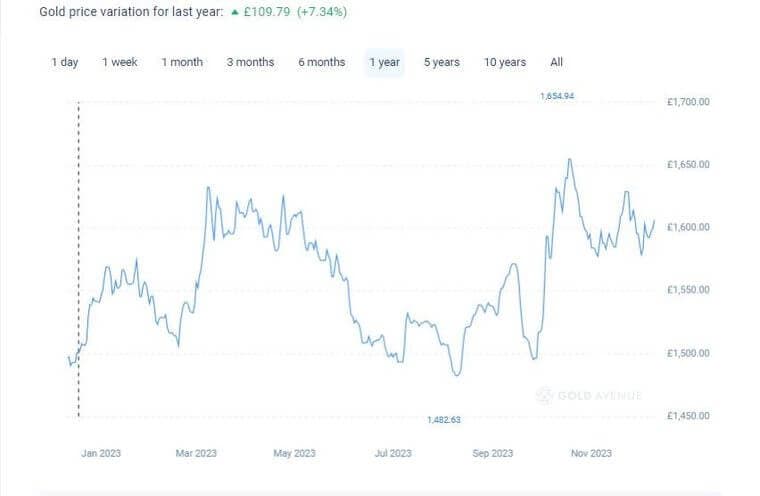

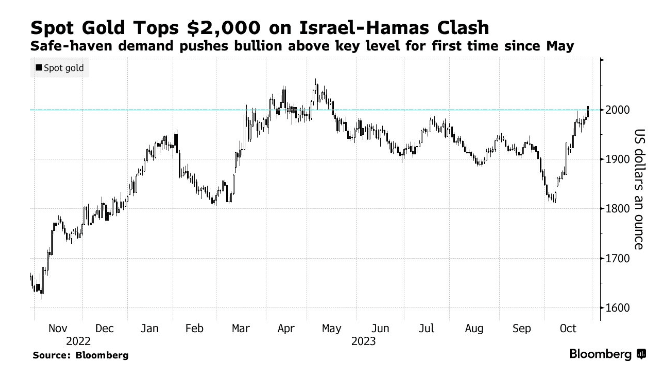

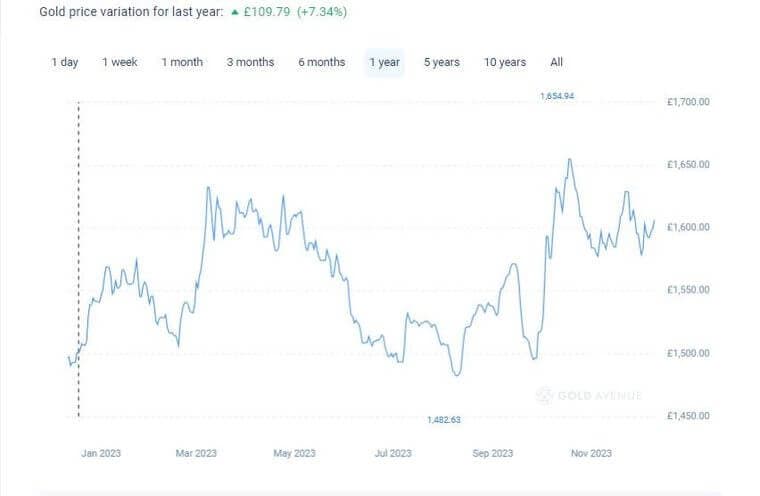

3 Major Events That Moved Gold Prices in 2023

From war to rate hikes, and inflation to banking failures, there were plenty of events that had an impact on gold prices. Let's look back on 2023.

From war to rate hikes, and inflation to banking failures, there were plenty of events that had an impact on gold prices. Let's look back on 2023.