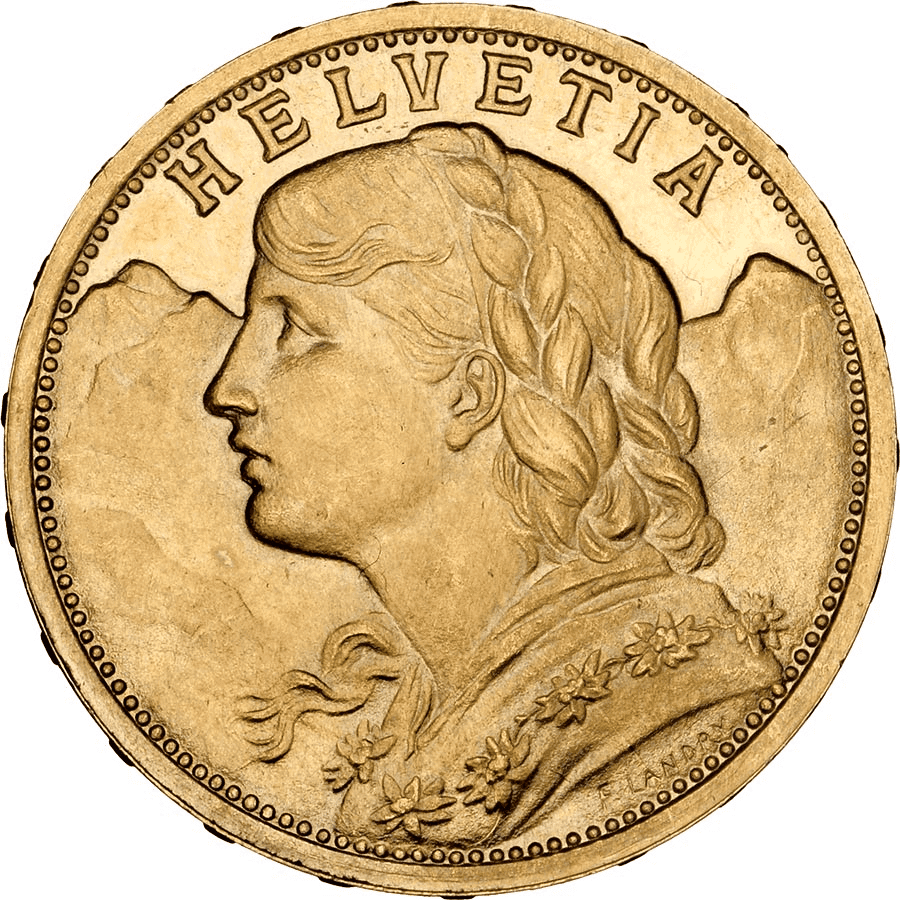

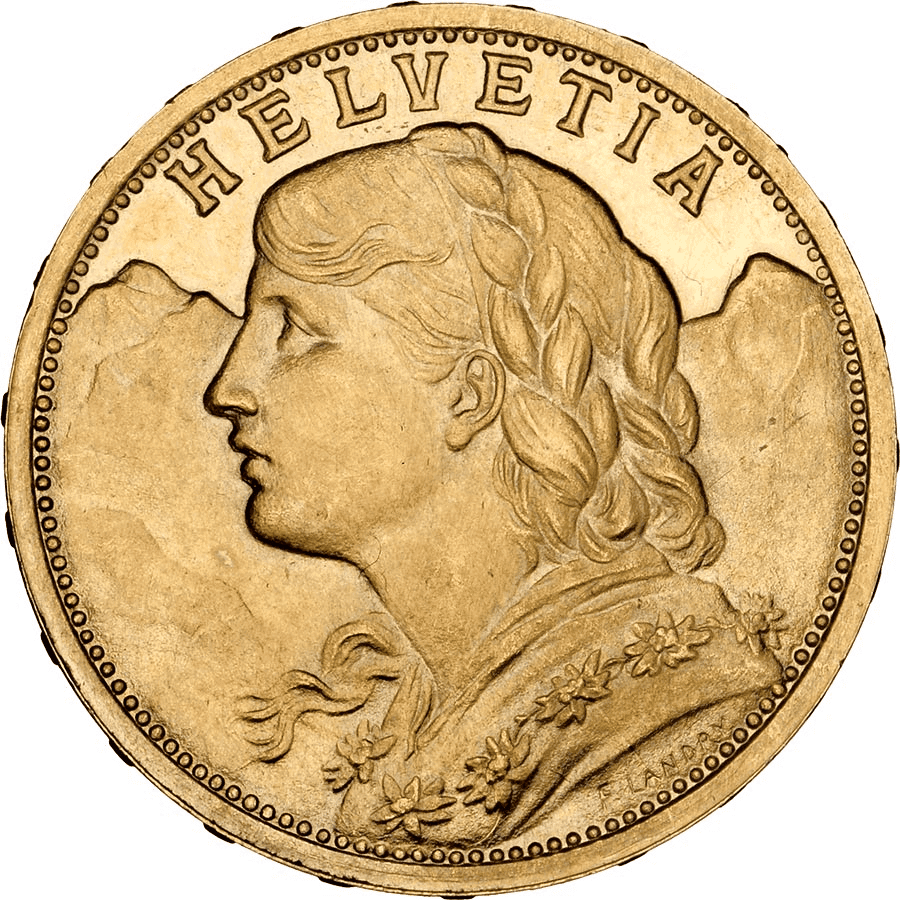

Investing in Gold: A Beginner’s Guide

How to invest in gold? As a precious metals investor, here’s what you need to know about gold, its uses, and its main price drivers when building your gold savings.

How to invest in gold? As a precious metals investor, here’s what you need to know about gold, its uses, and its main price drivers when building your gold savings.