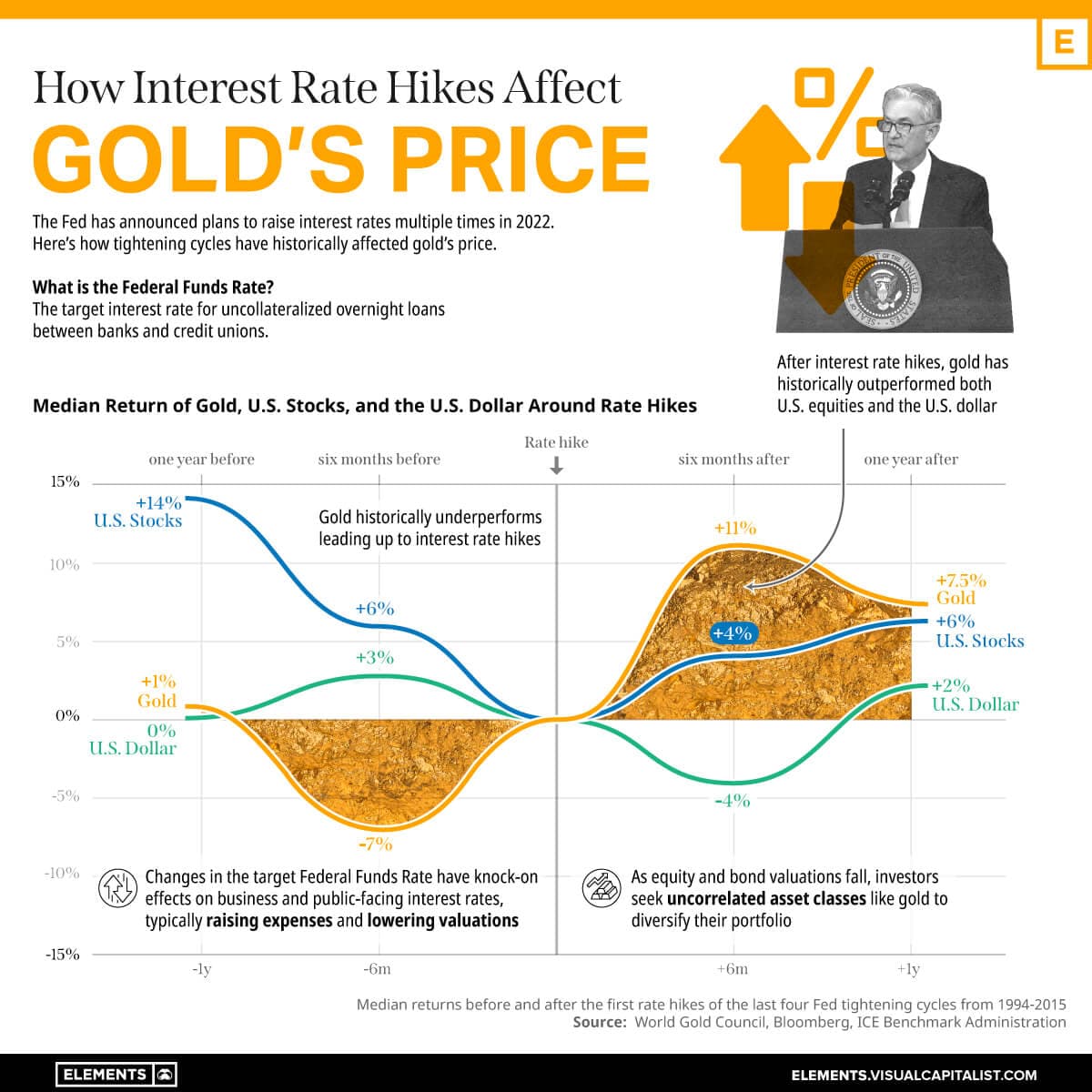

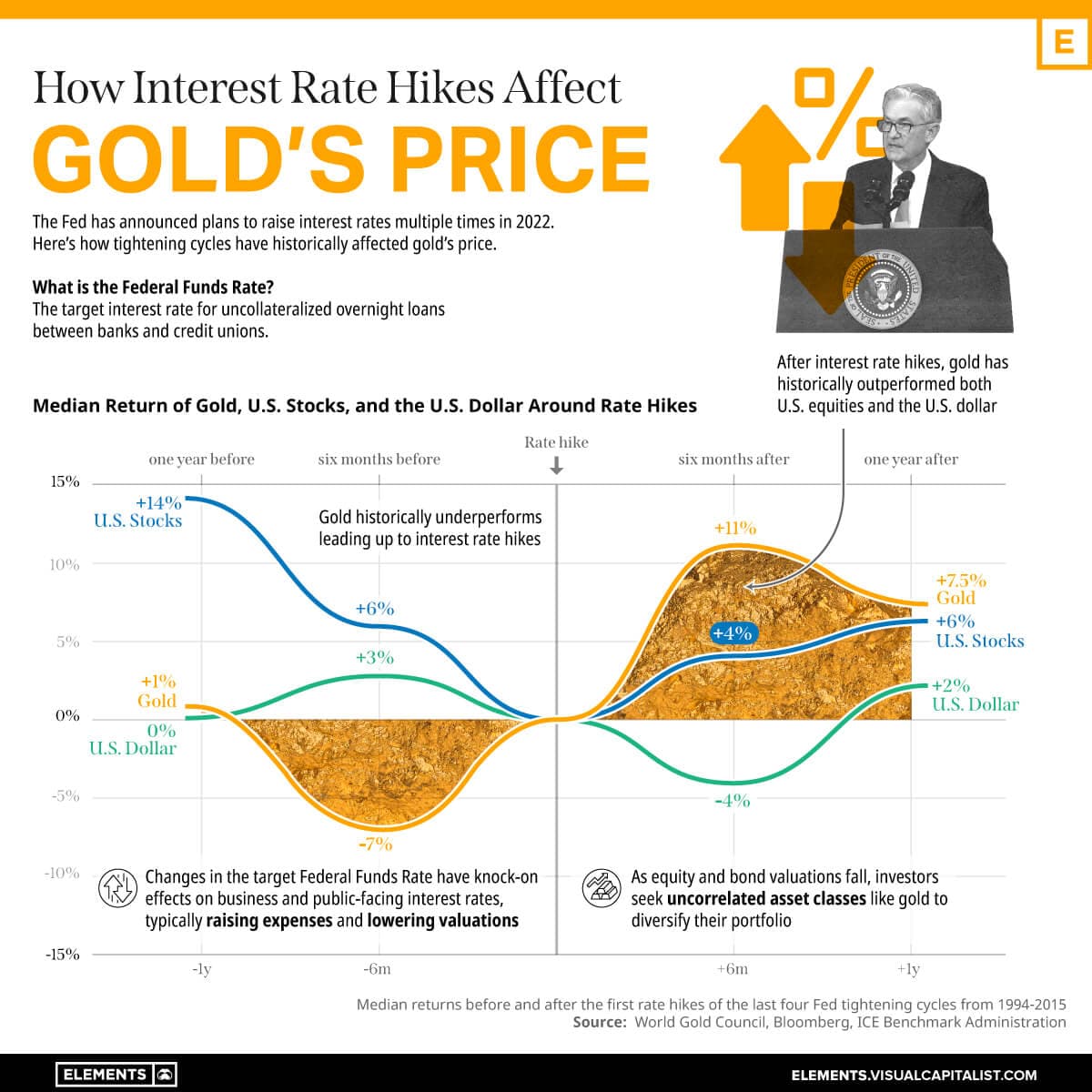

How Interest Rate Hikes Affect the Gold Price

The U.S. Federal Reserve has announced its first interest rate hike since 2018. What could this mean for the gold price? Here’s what you need to know.

The U.S. Federal Reserve has announced its first interest rate hike since 2018. What could this mean for the gold price? Here’s what you need to know.