Investor Gold Demand is Booming Right Now: Here's Why

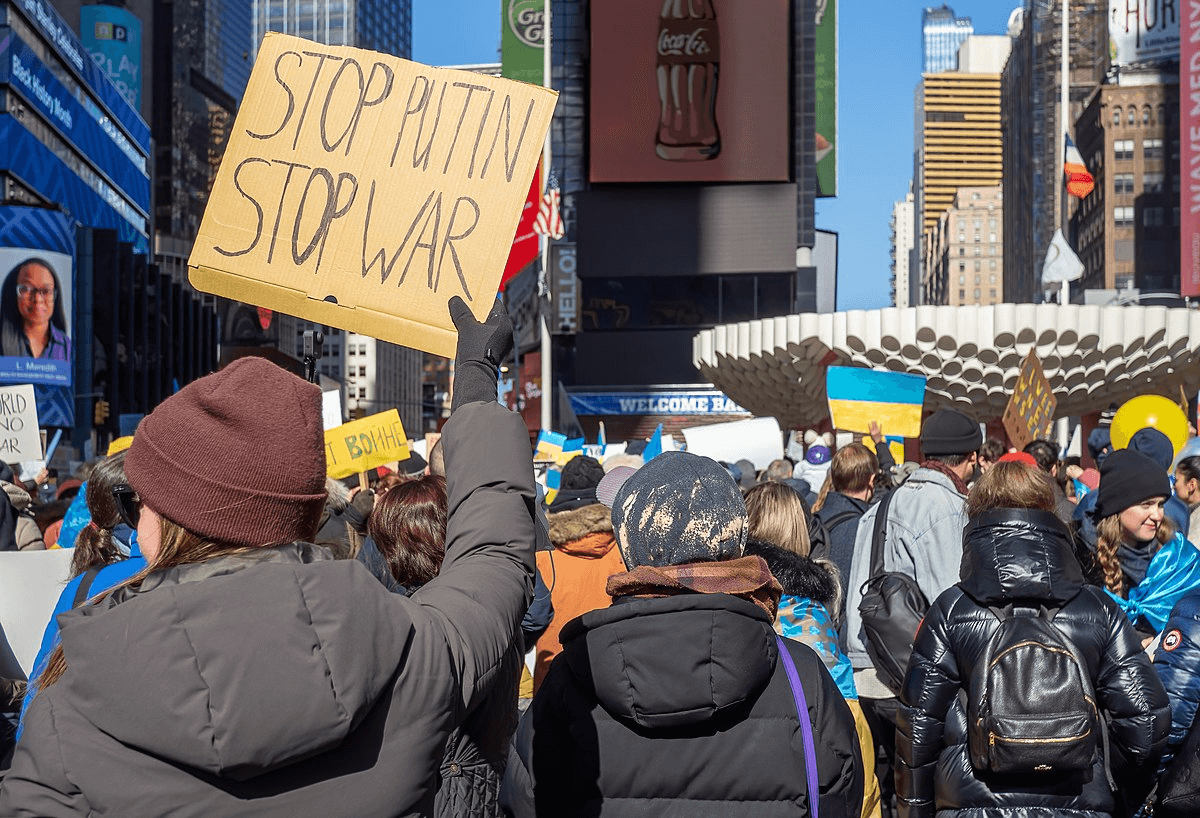

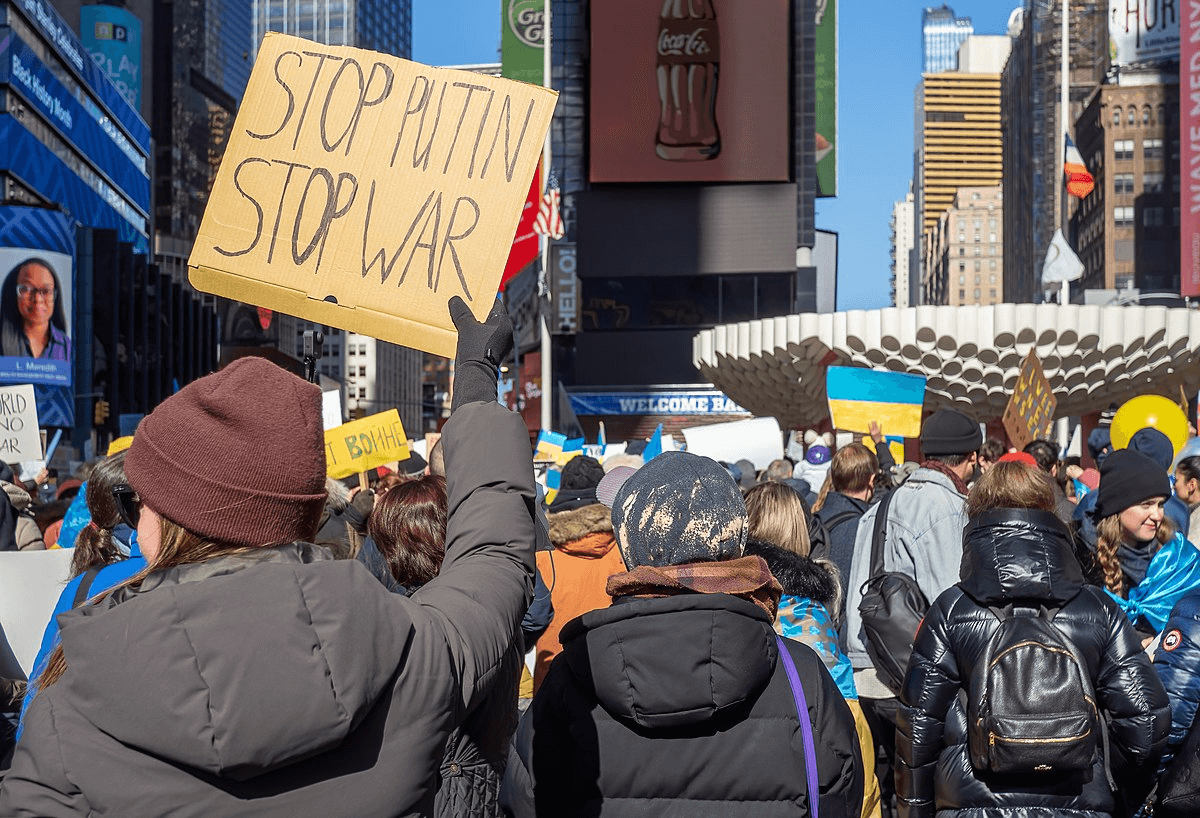

After Russia’s invasion of Ukraine, investors rushed to gold, the world’s oldest safe-haven asset, pushing its price to a new record. Why did this happen? Here’s what you need to know.

After Russia’s invasion of Ukraine, investors rushed to gold, the world’s oldest safe-haven asset, pushing its price to a new record. Why did this happen? Here’s what you need to know.