What Geopolitical Tensions Could Mean for Gold?

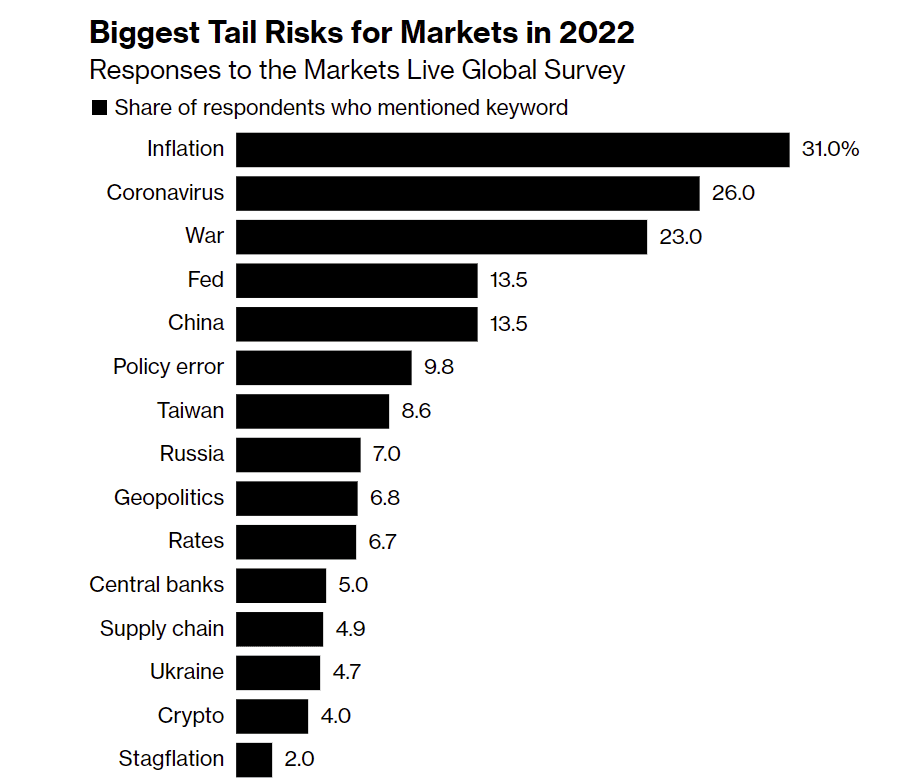

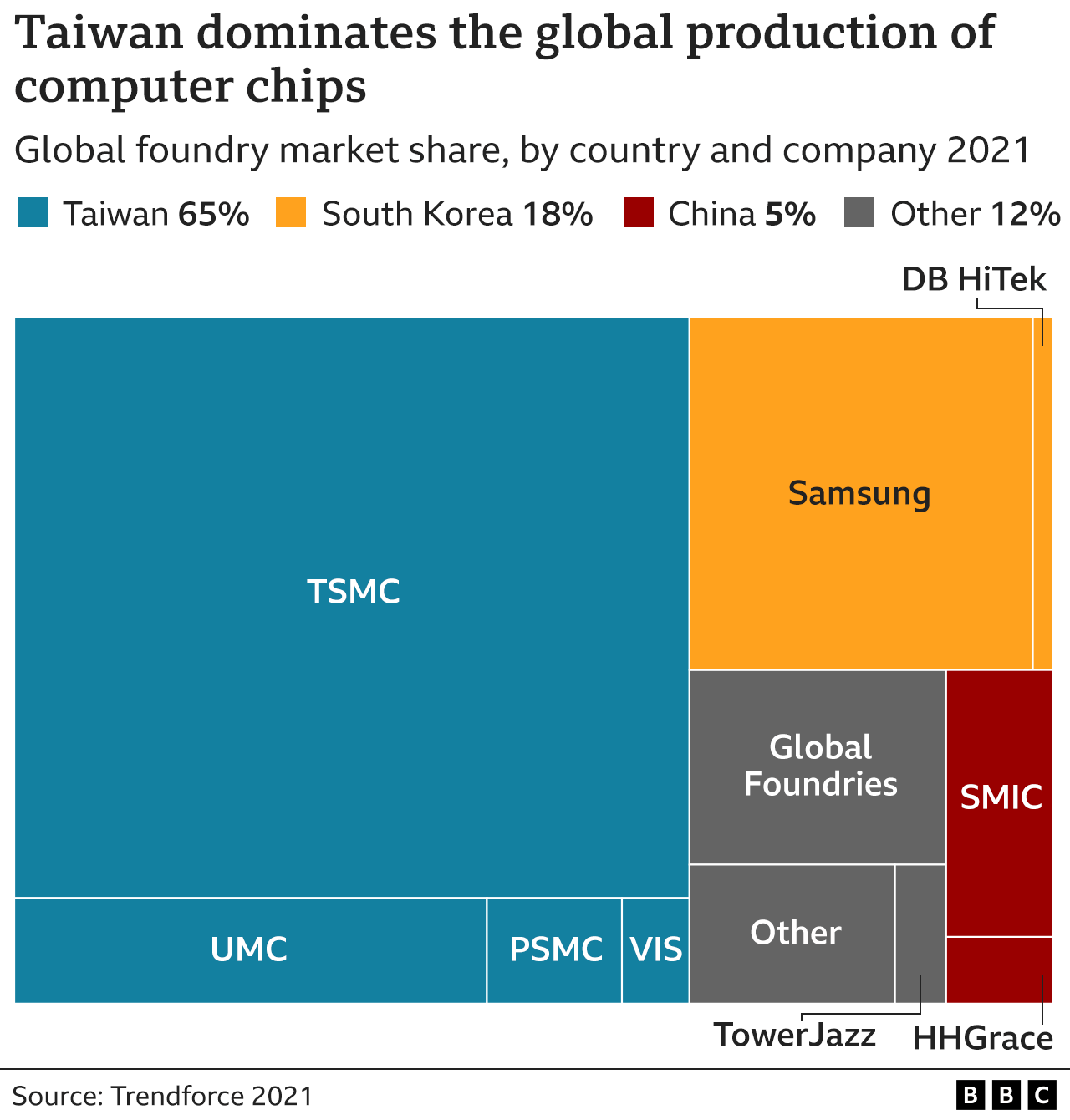

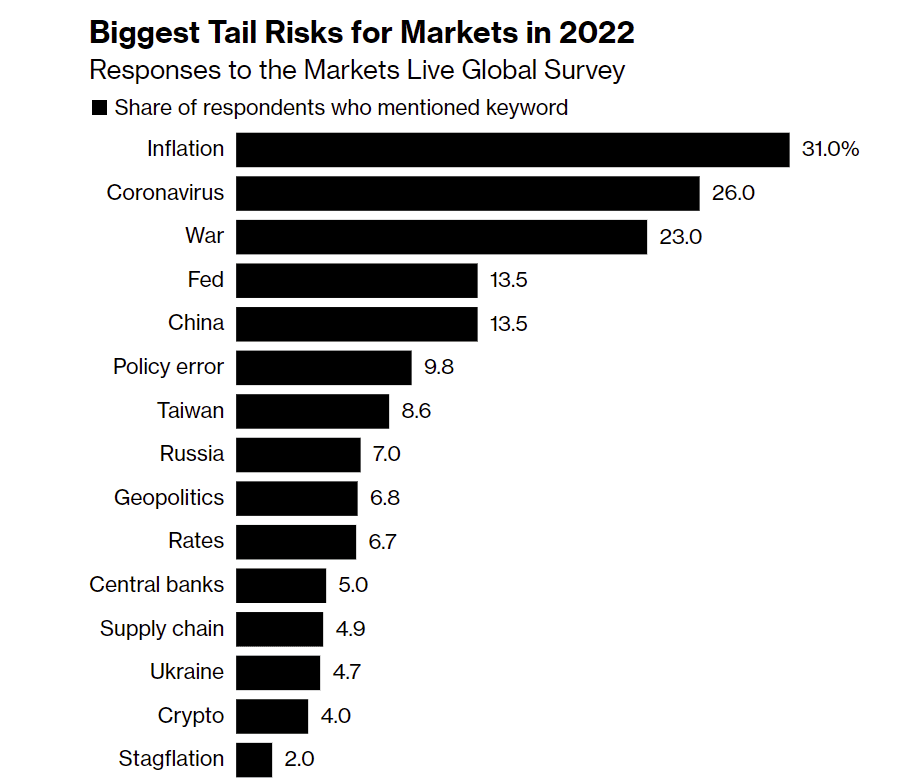

What the ongoing geopolitical tensions between Russia and Ukraine, and China and Taiwan could mean for markets? How could they affect the gold price? Here’s what you need to know.

What the ongoing geopolitical tensions between Russia and Ukraine, and China and Taiwan could mean for markets? How could they affect the gold price? Here’s what you need to know.