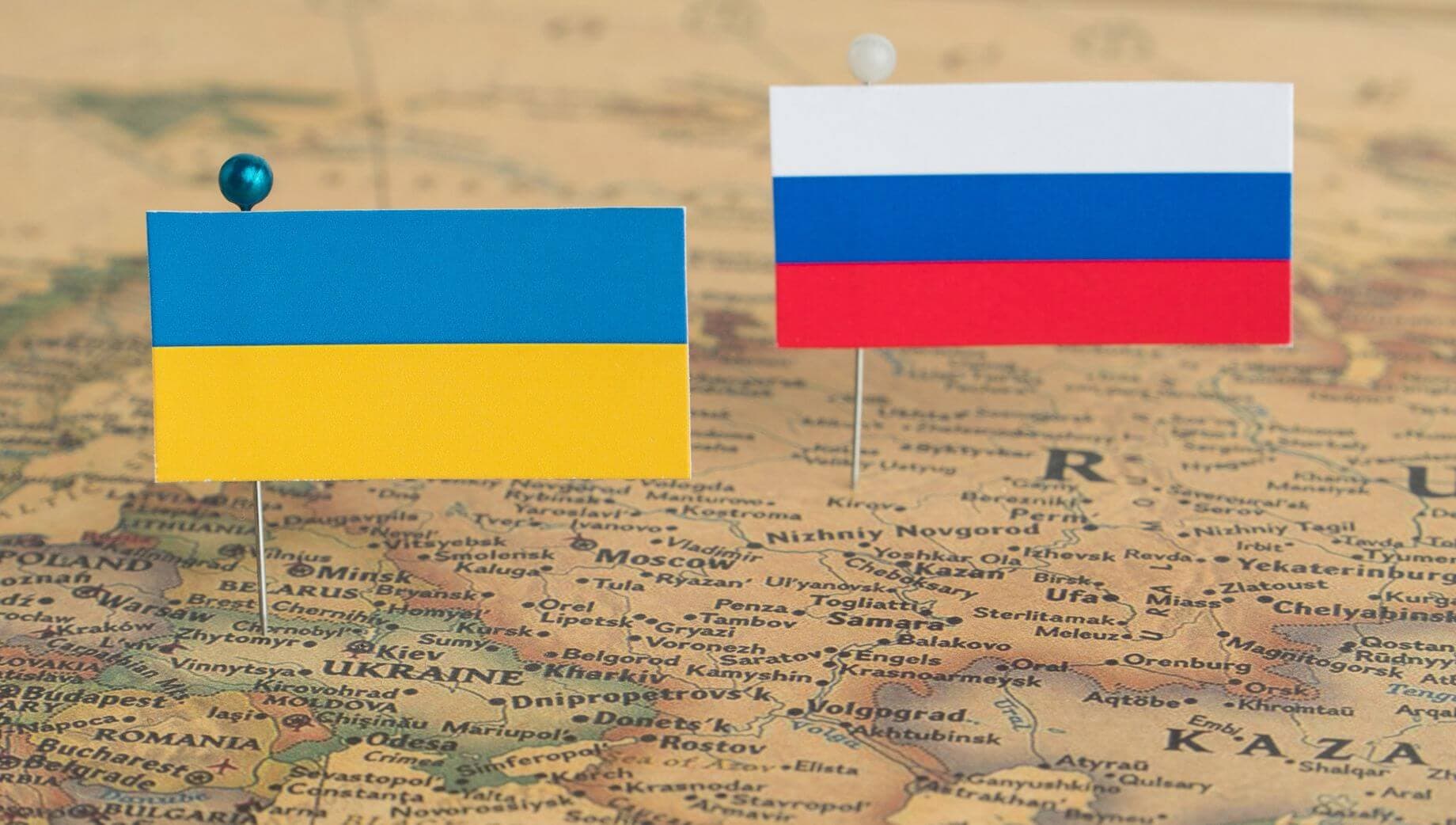

Ukraine-Russia Conflict: What Impact on Your Savings?

World markets have taken a hit as the Russian invasion of Ukraine spooked investors around the globe. Here’s what you can do right now to protect your investment portfolio and gold savings.

World markets have taken a hit as the Russian invasion of Ukraine spooked investors around the globe. Here’s what you can do right now to protect your investment portfolio and gold savings.