Is Gold a Good Investment for 2022?

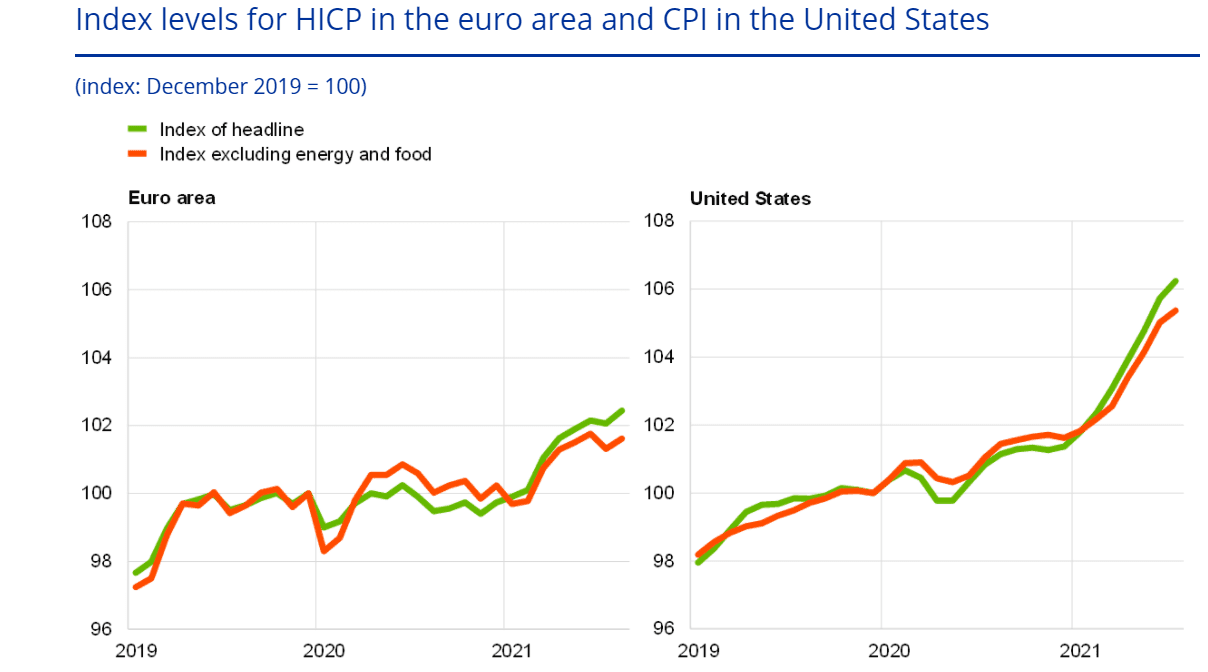

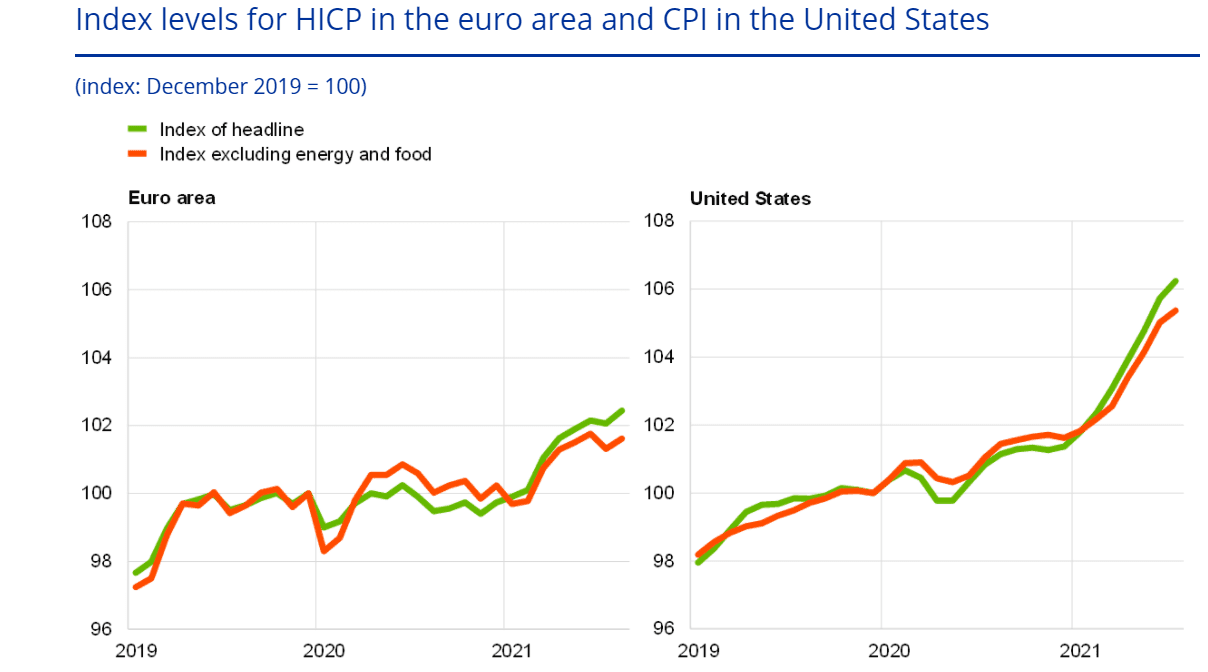

With inflation raging around the world, physical gold is a must-have in your portfolio. If you’re still wondering if the king of metals is a good investment in 2022, here’s what you need to know.

With inflation raging around the world, physical gold is a must-have in your portfolio. If you’re still wondering if the king of metals is a good investment in 2022, here’s what you need to know.