Will the Stock Market Crash in 2022?

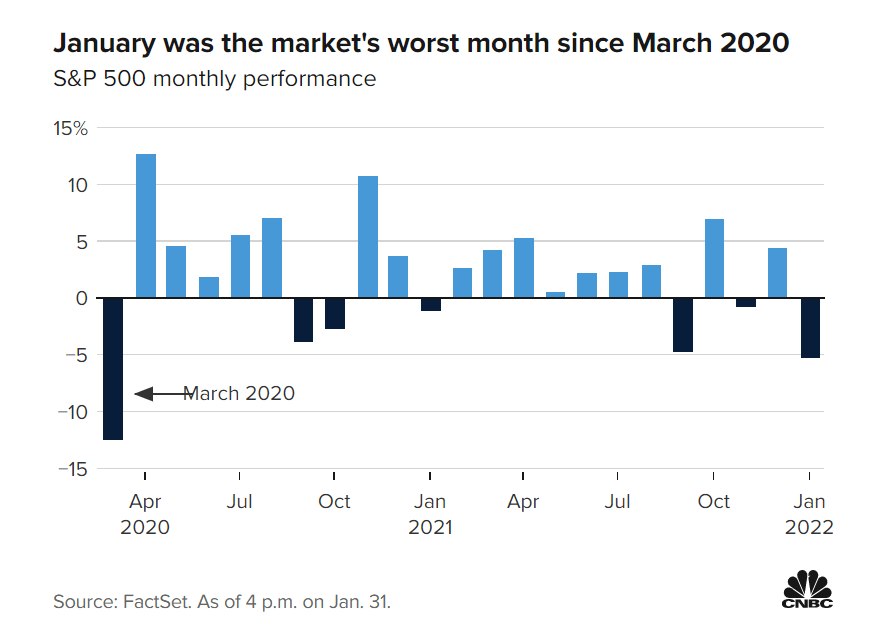

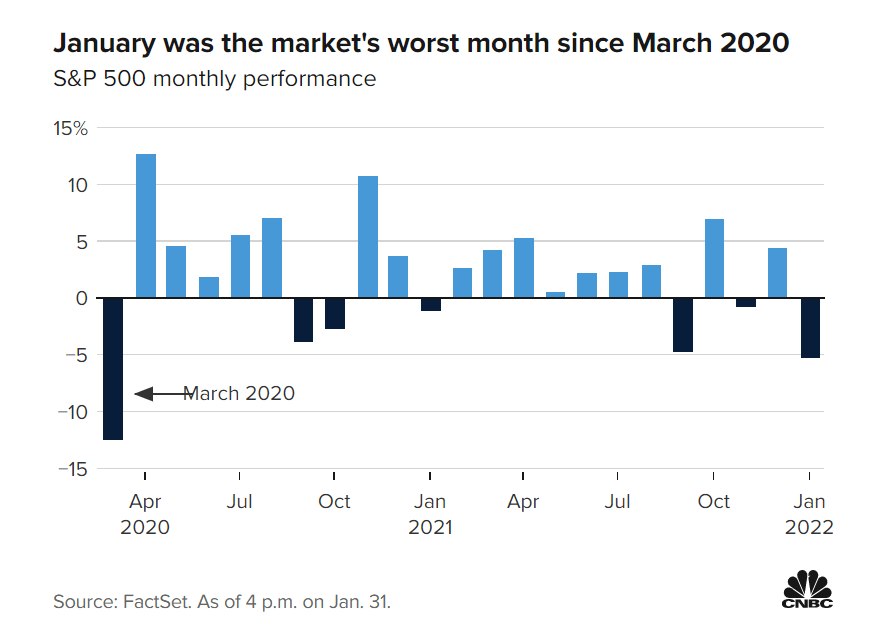

The prospect of aggressive action by the Fed, tensions over Ukraine, and slowing corporate earnings stroke a heavy blow to stock markets in January. Here’s what you need to know about this market turmoil.

The prospect of aggressive action by the Fed, tensions over Ukraine, and slowing corporate earnings stroke a heavy blow to stock markets in January. Here’s what you need to know about this market turmoil.