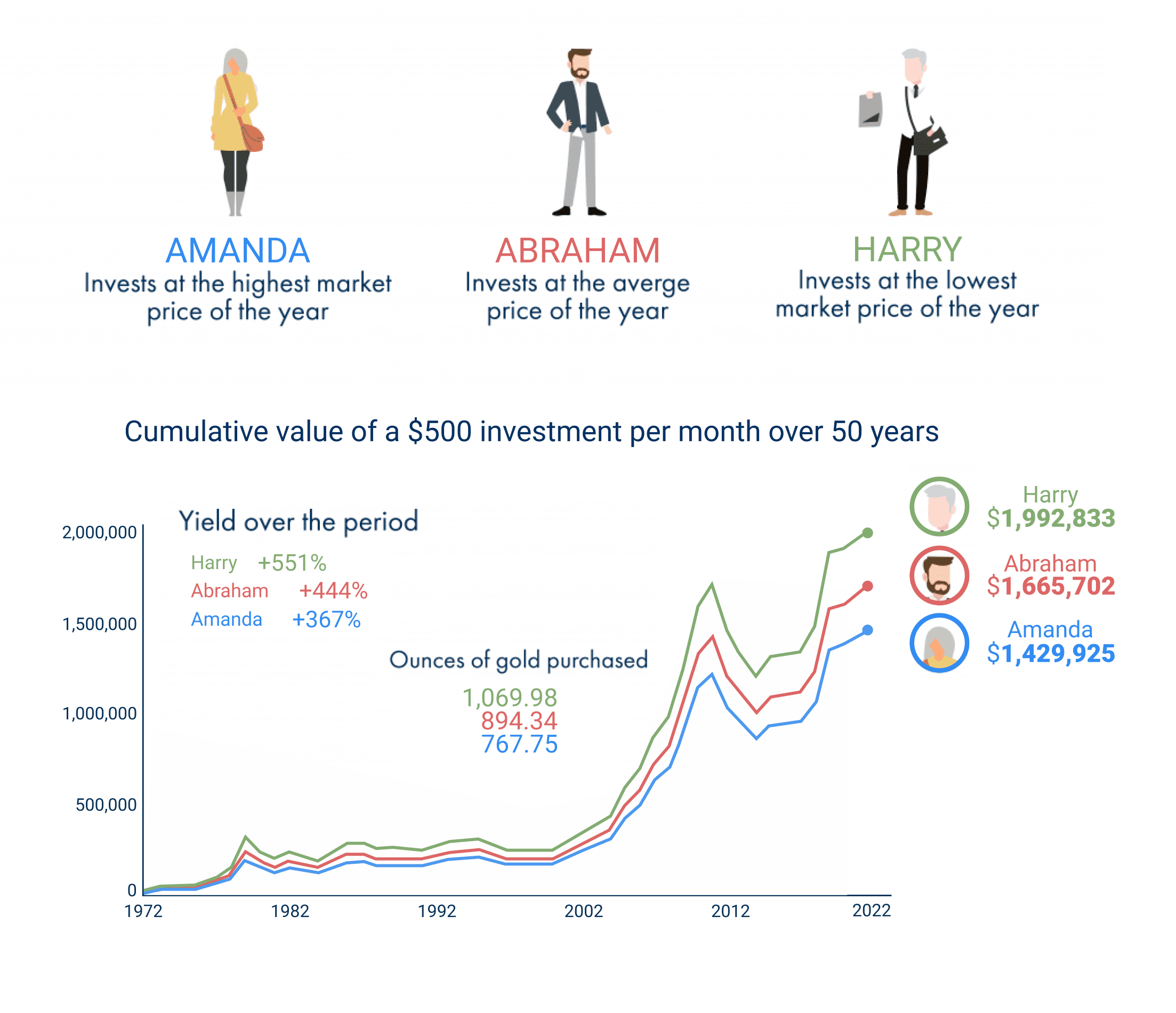

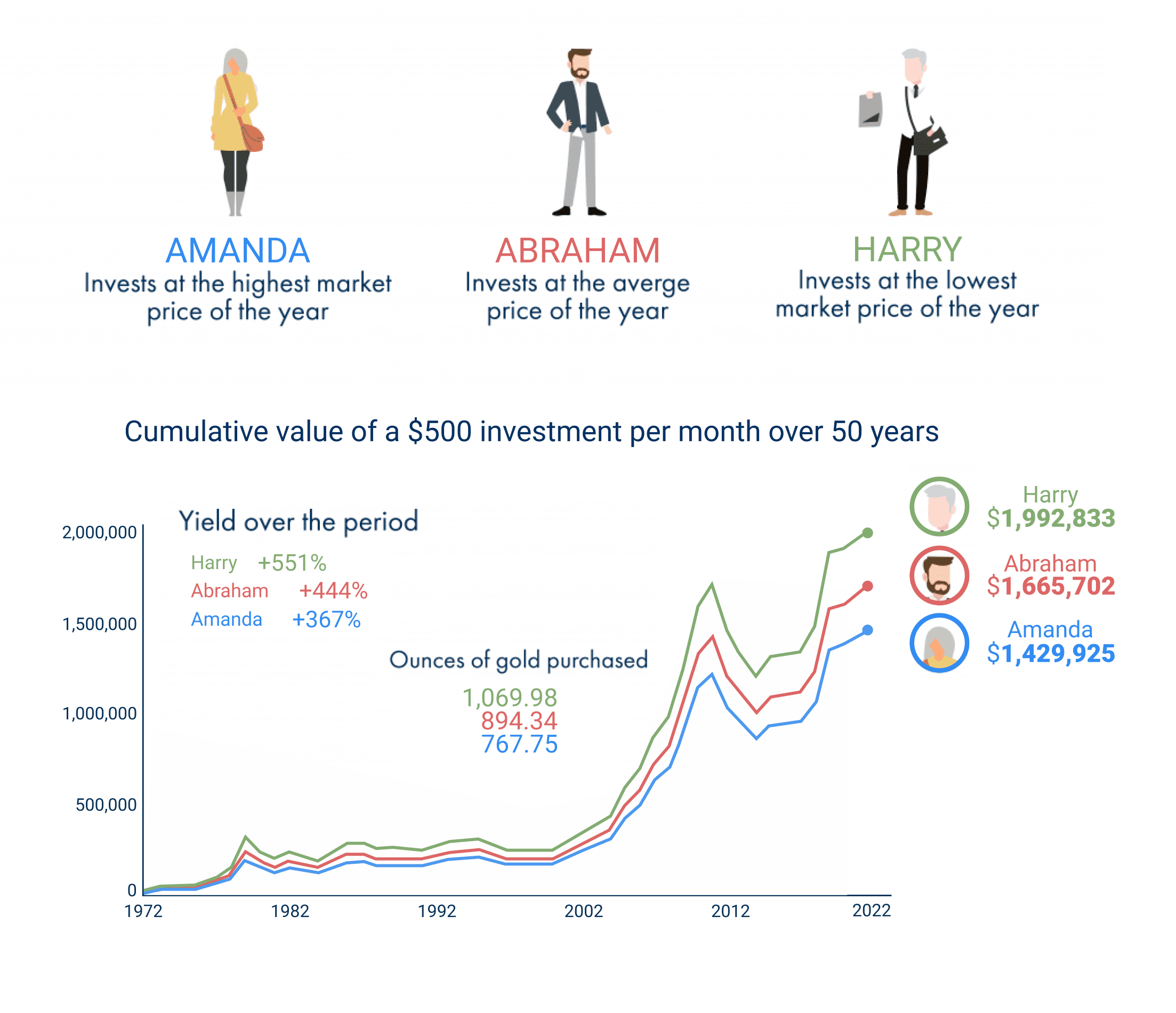

Is It a Good Time to Buy Gold?

If you are a beginner investor, choosing the right time to buy physical gold and silver may not look like an easy task. But in reality, it’s quite simple. Especially if you know the right investment strategy.

If you are a beginner investor, choosing the right time to buy physical gold and silver may not look like an easy task. But in reality, it’s quite simple. Especially if you know the right investment strategy.