How to Buy Gold in Switzerland in 2025: Everything You Need to Know

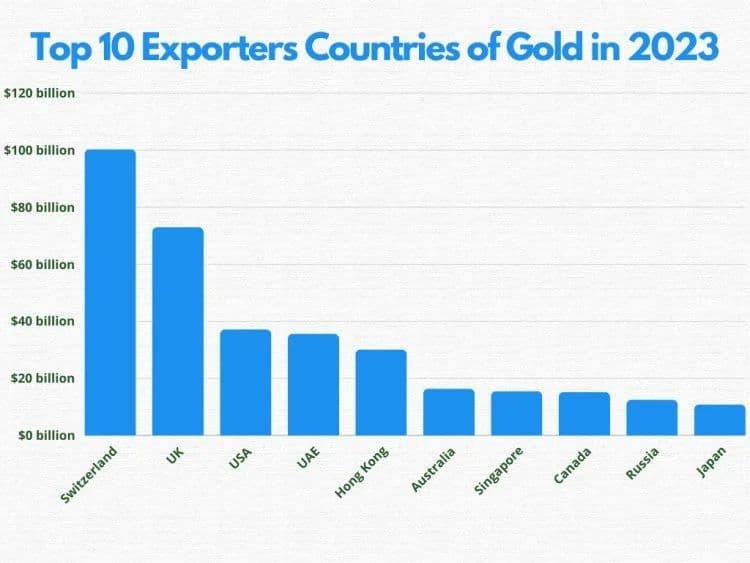

When it comes to secure gold investments, Switzerland sets the global gold standard. Known for its political neutrality, economic stability, and world-class security, it’s no surprise that this alpine nation is a top choice for gold investors around the world. In this guide, we’ll uncover why Switzerland is the go-to destination for precious metal buyers — and break down the key legal and tax insights you need to know before adding Swiss gold to your portfolio.

Shop our categories

cgtfreeproducts