Europe’s Energy Crisis: How to Prepare for Winter?

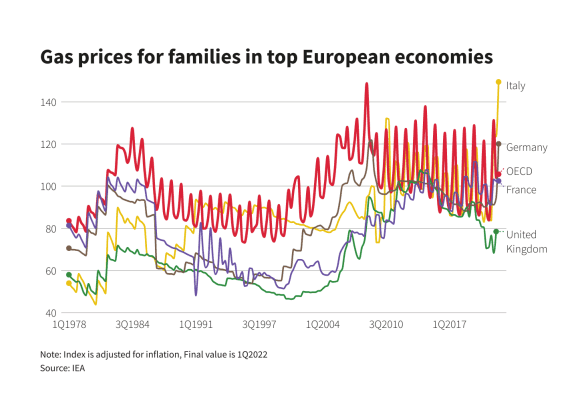

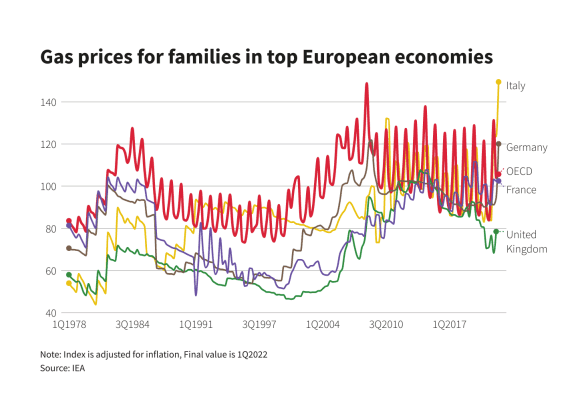

Europe is experiencing its worst energy crisis in 50 years. Rising energy prices are fueling already high inflation that could seriously affect your savings. Here's how to protect yourself.

Europe is experiencing its worst energy crisis in 50 years. Rising energy prices are fueling already high inflation that could seriously affect your savings. Here's how to protect yourself.