Gold Demand in Europe: What Are The Trends?

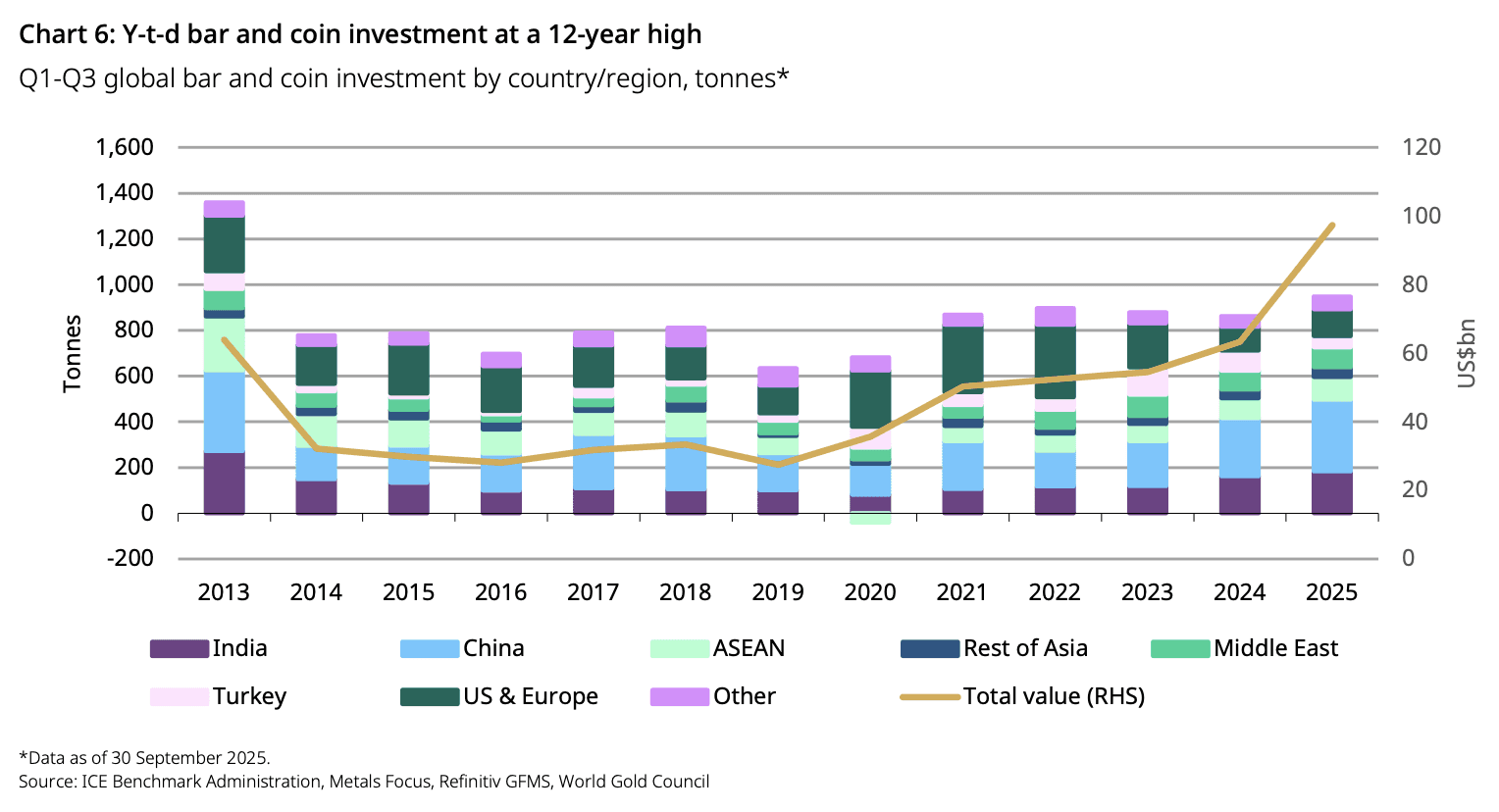

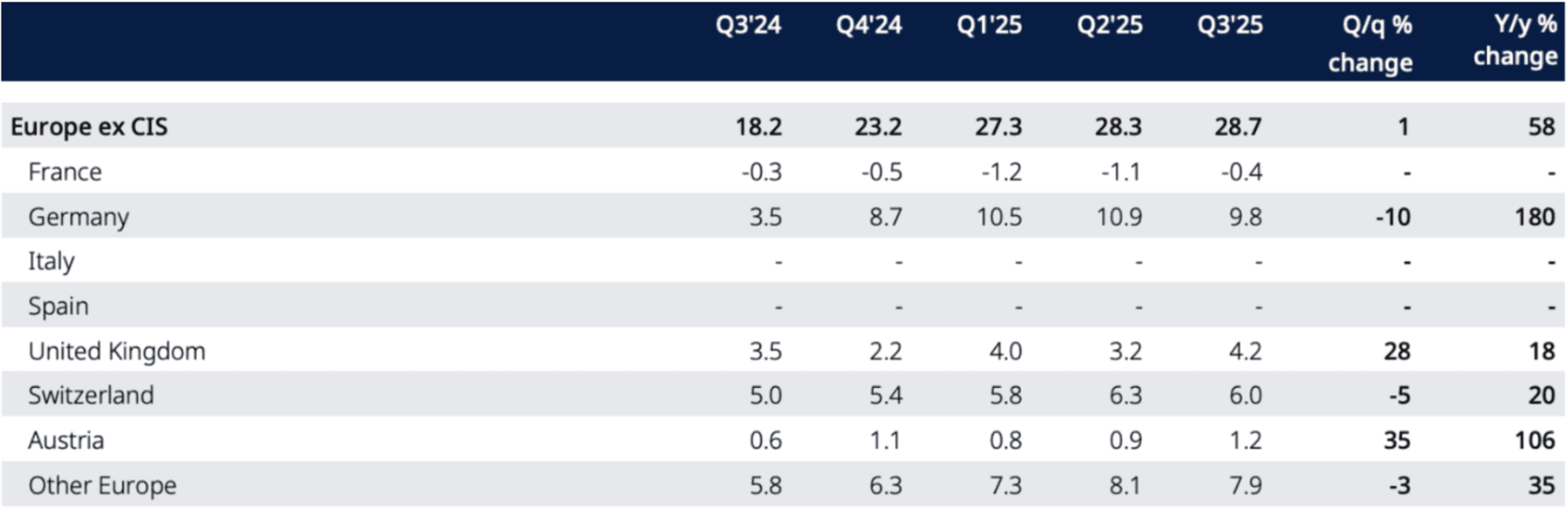

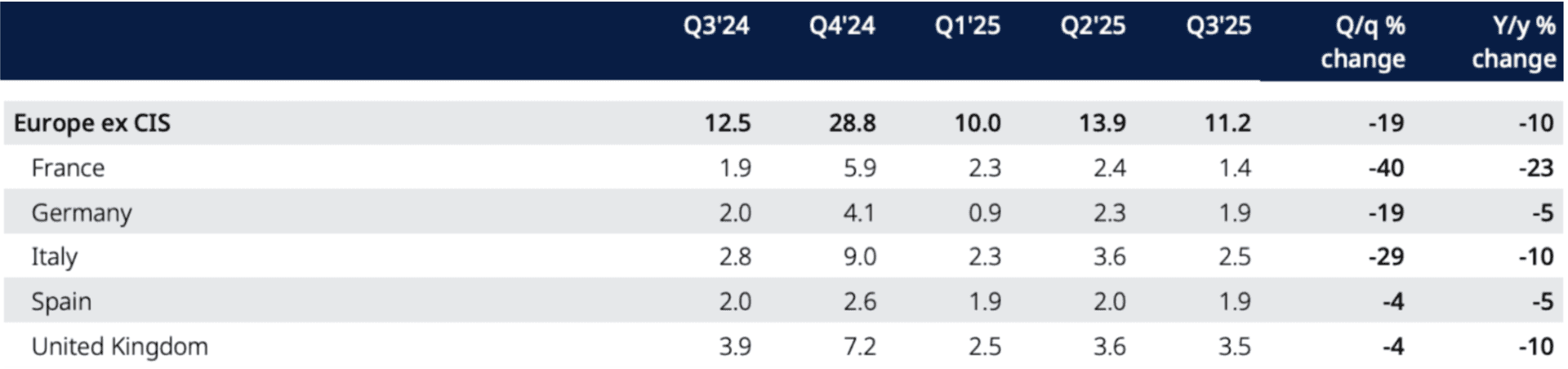

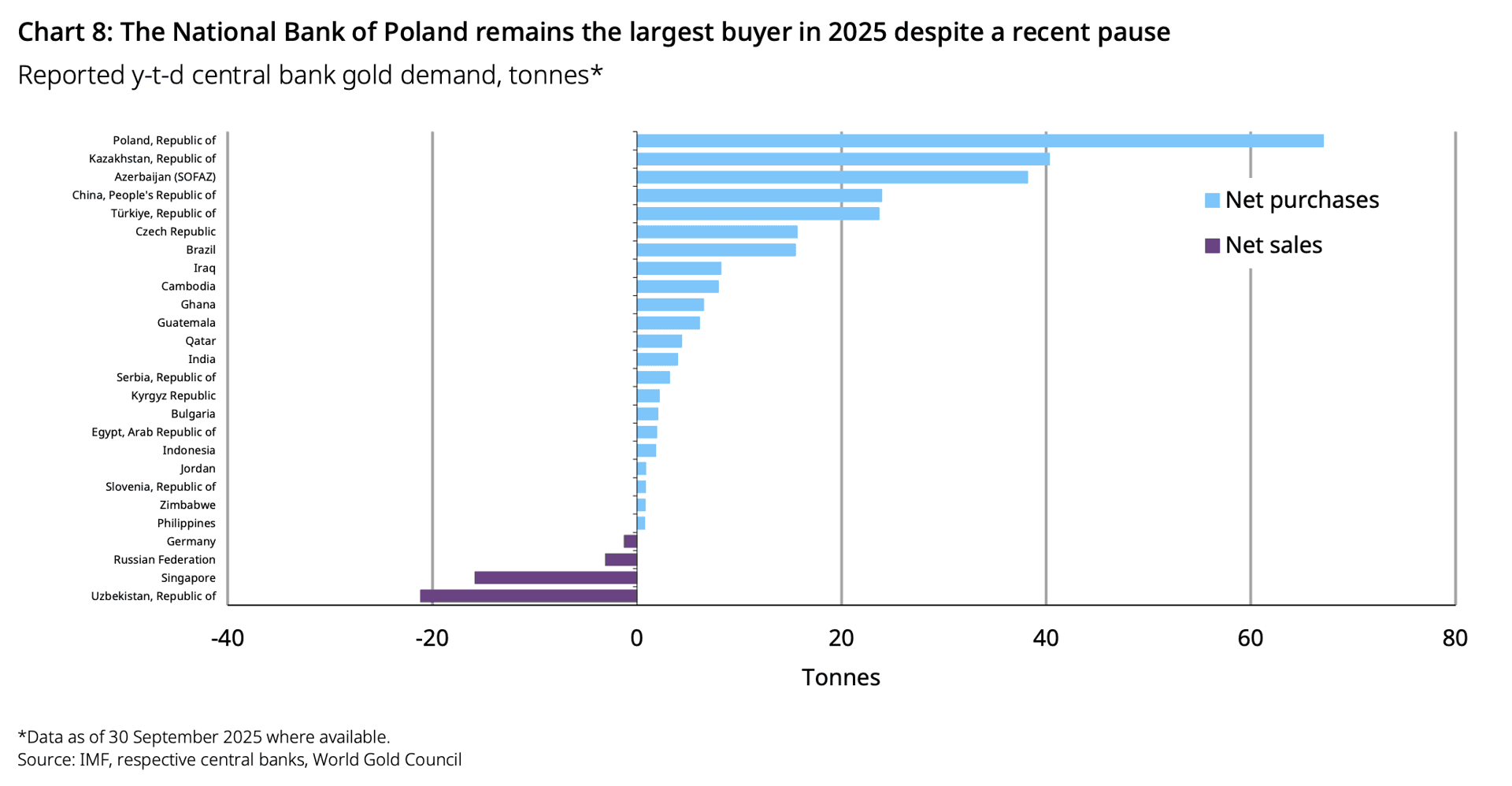

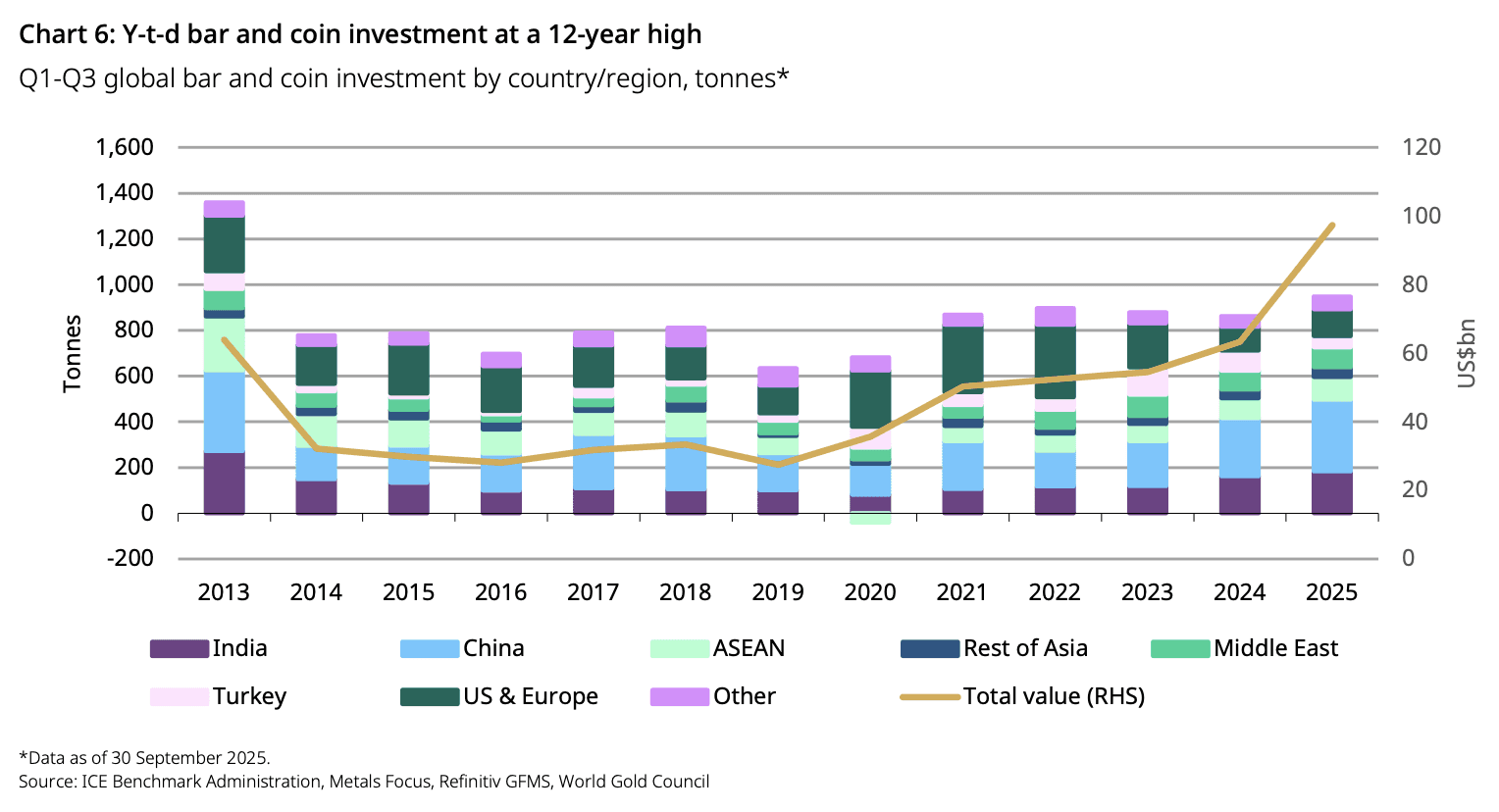

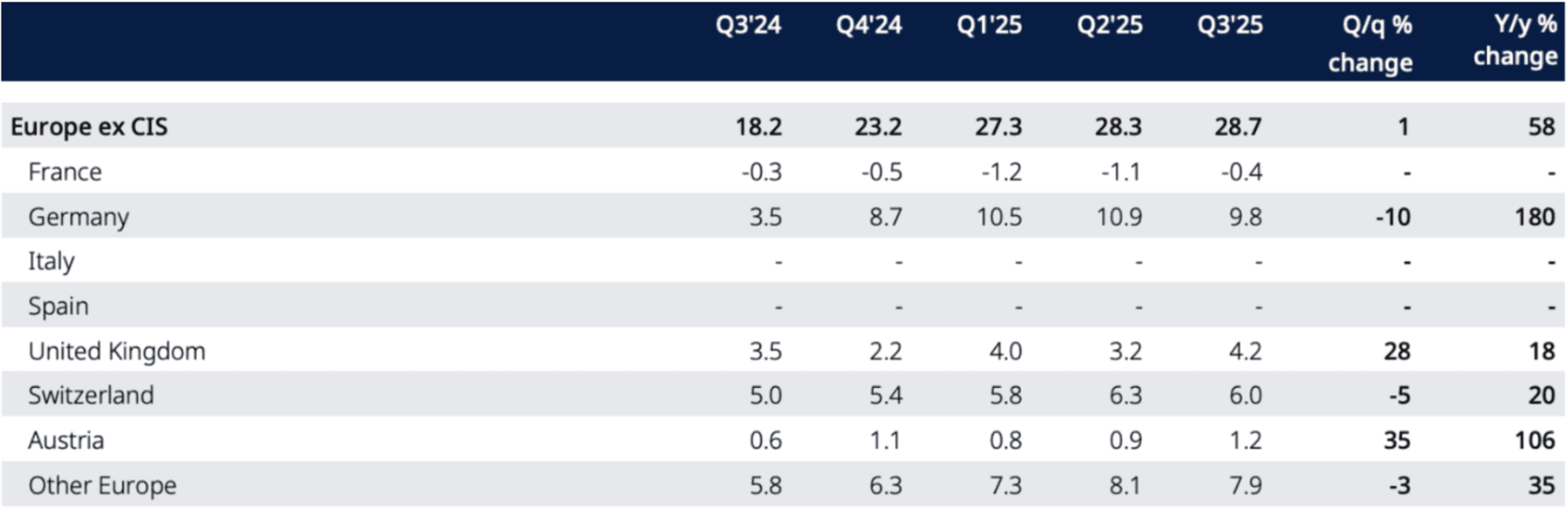

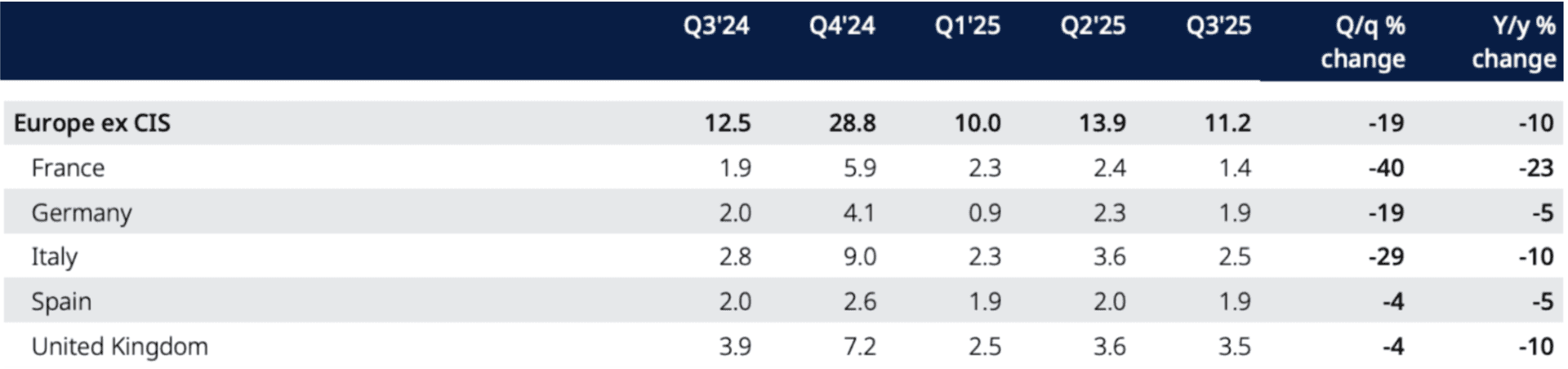

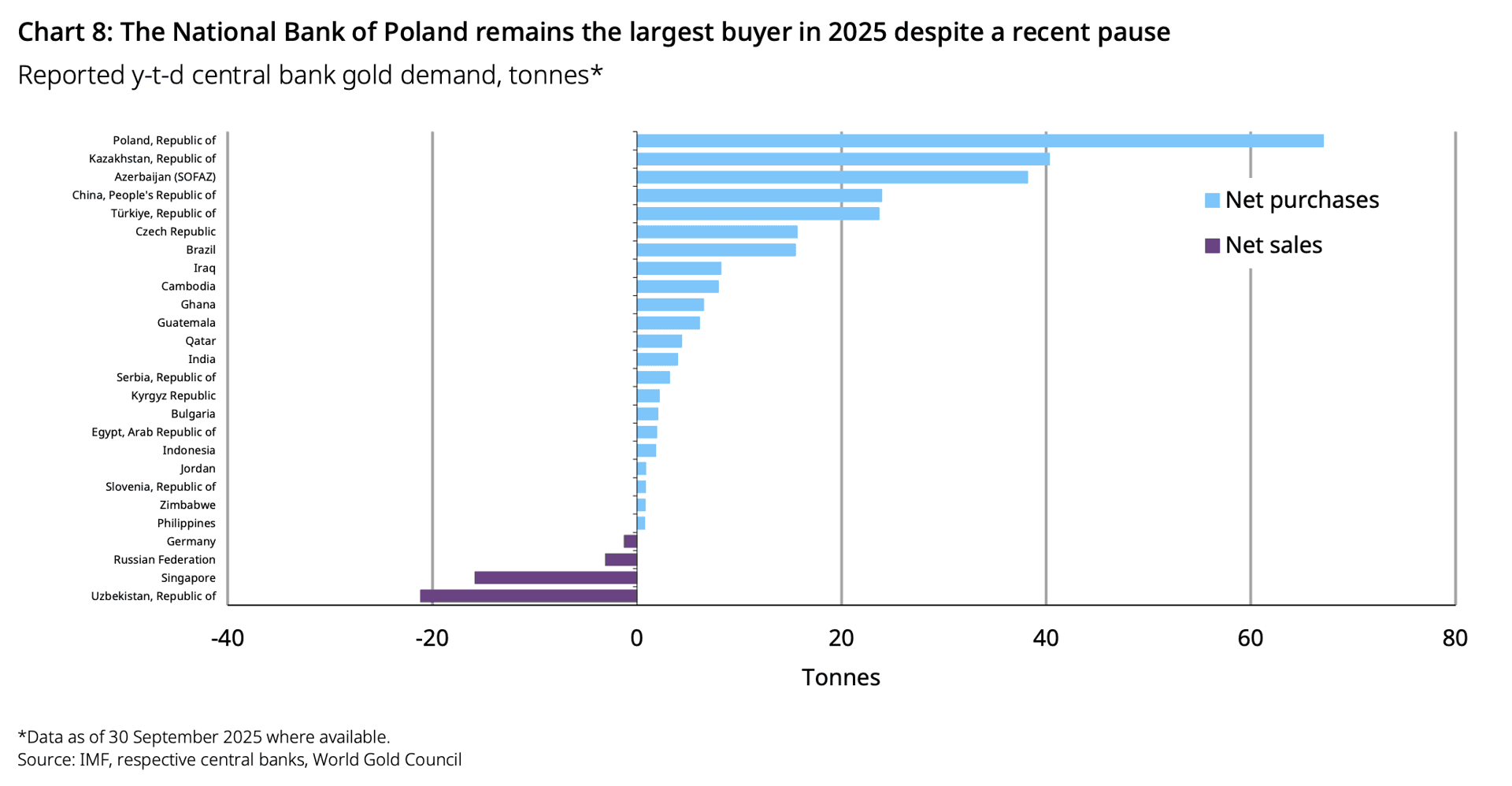

Discover how and why gold demand surged across Europe in 2025 as investors sought safe-haven assets amid eurozone uncertainty and record-high prices.

Discover how and why gold demand surged across Europe in 2025 as investors sought safe-haven assets amid eurozone uncertainty and record-high prices.