How to fight inflation?

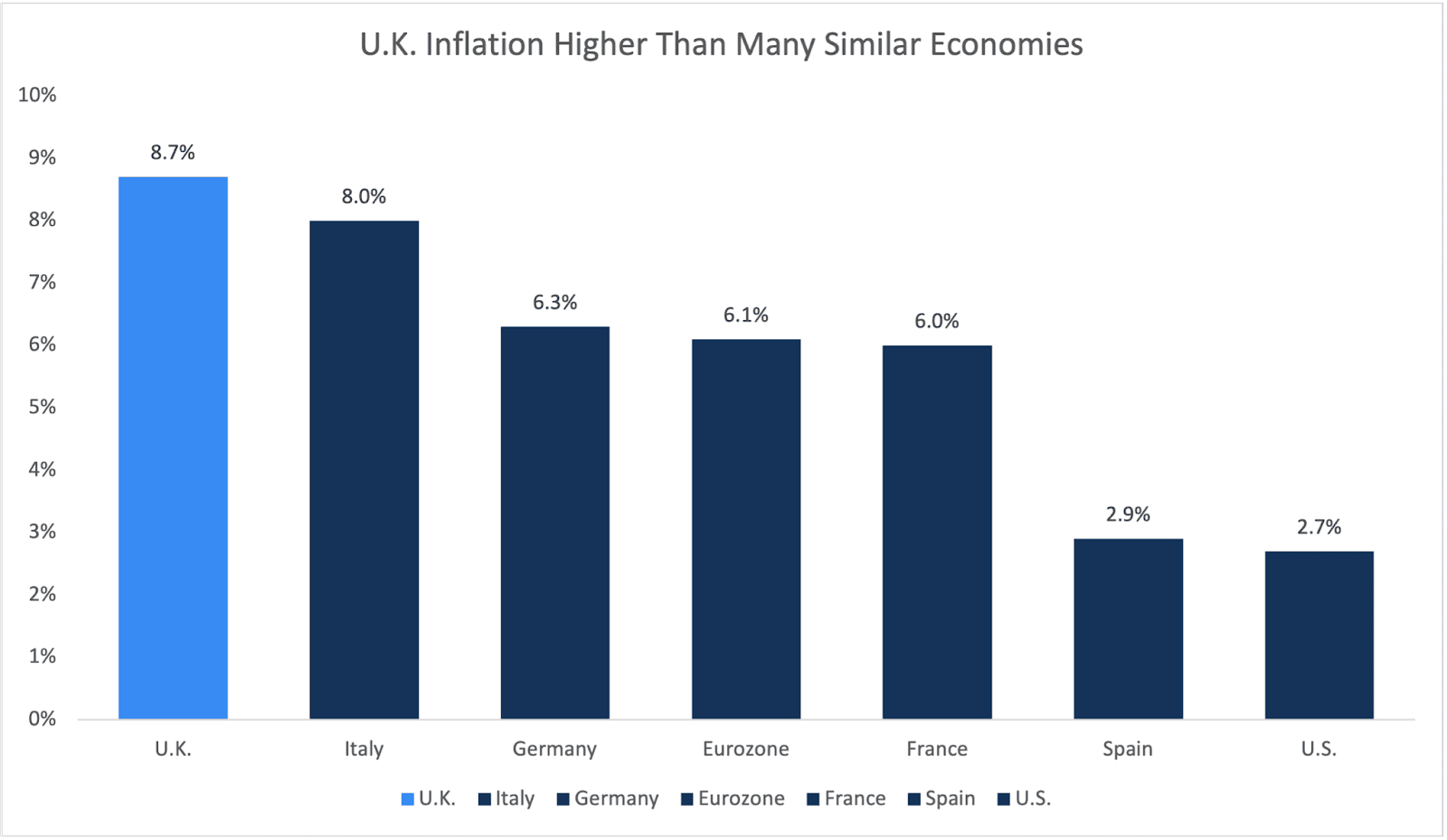

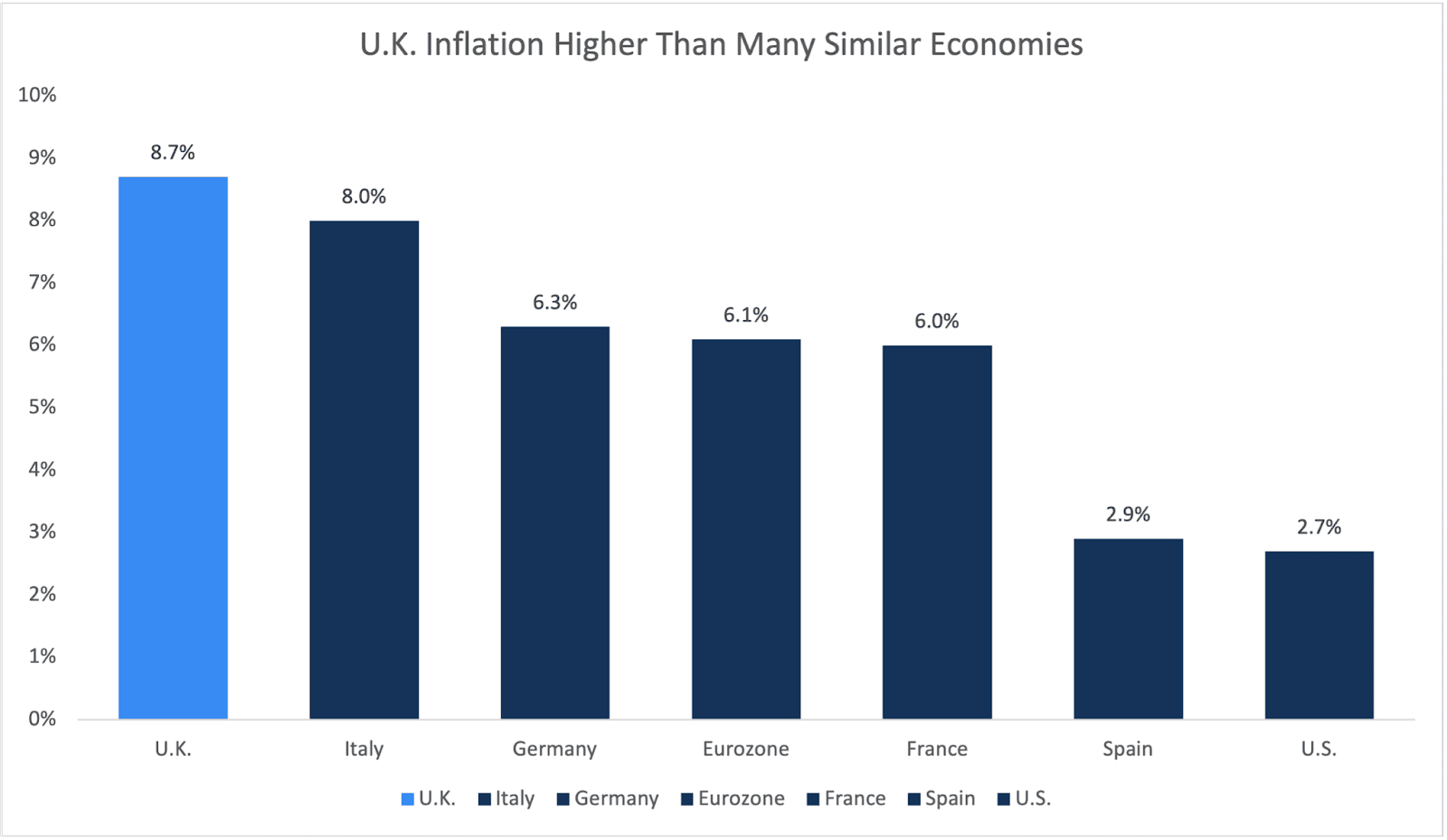

With inflation moving down at a slow pace and the possibility of stagnation looming in the U.K., let’s explore some practical tips on how you can protect against inflation.

With inflation moving down at a slow pace and the possibility of stagnation looming in the U.K., let’s explore some practical tips on how you can protect against inflation.