How To Avoid Capital Gains Tax on Gold Investments in the UK

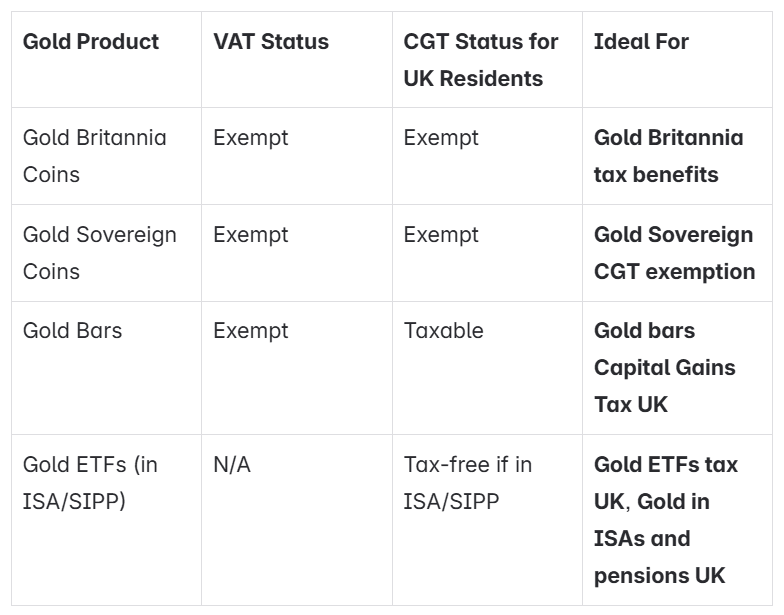

Is gold investment tax-free in the UK and how can I avoid paying capital gains tax on gold in the UK? These are the two questions we get asked again and again, so we thought it would be helpful to detail in this updated guide for 2025, exactly what the tax implications of buying gold in the UK are, so that you can maximise your profits and make the best investment decisions.

cgtfreeproducts