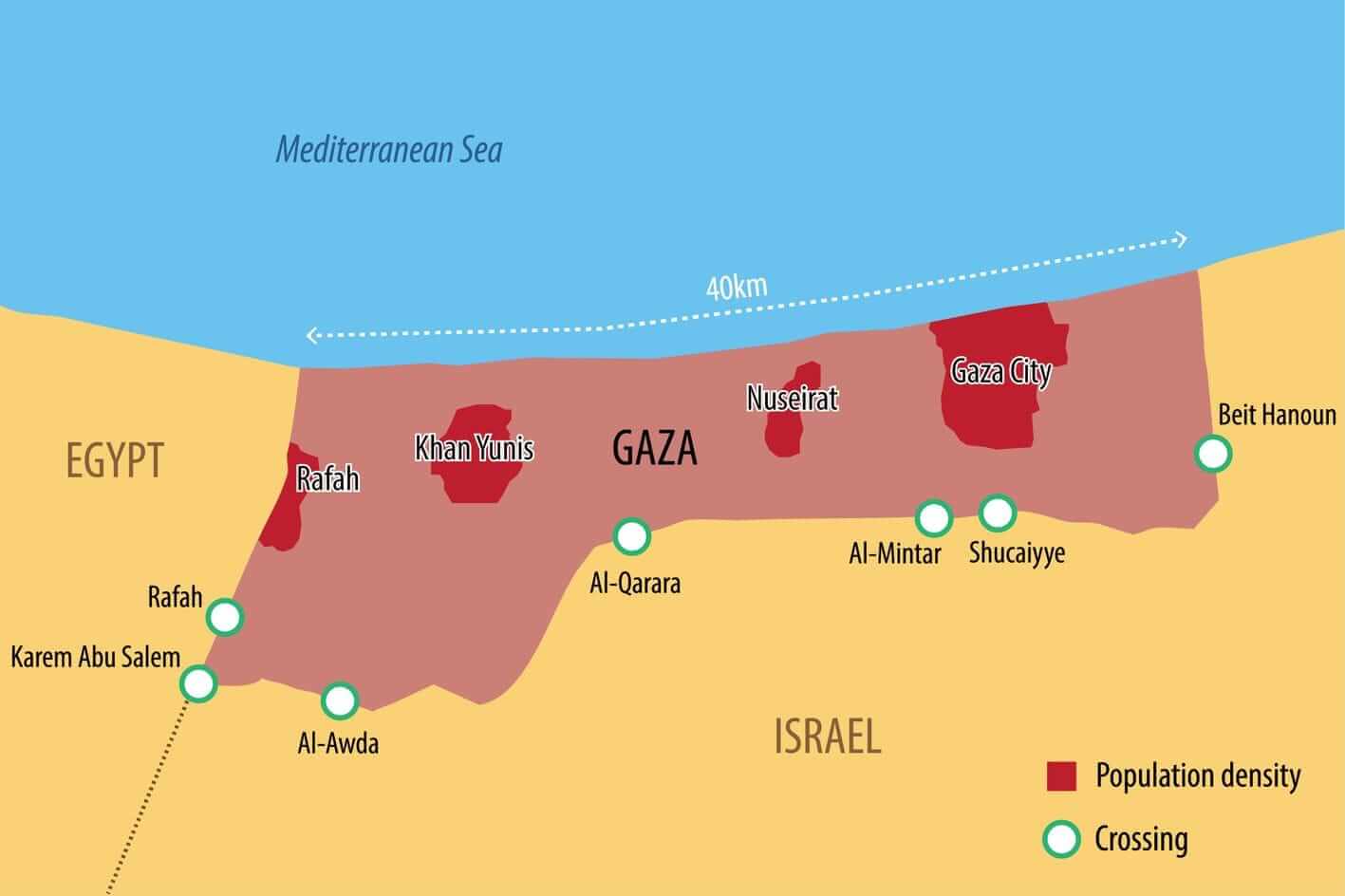

Israel-Hamas War and the Price of Gold: the Possible Scenarios That Could Impact the Global Economy

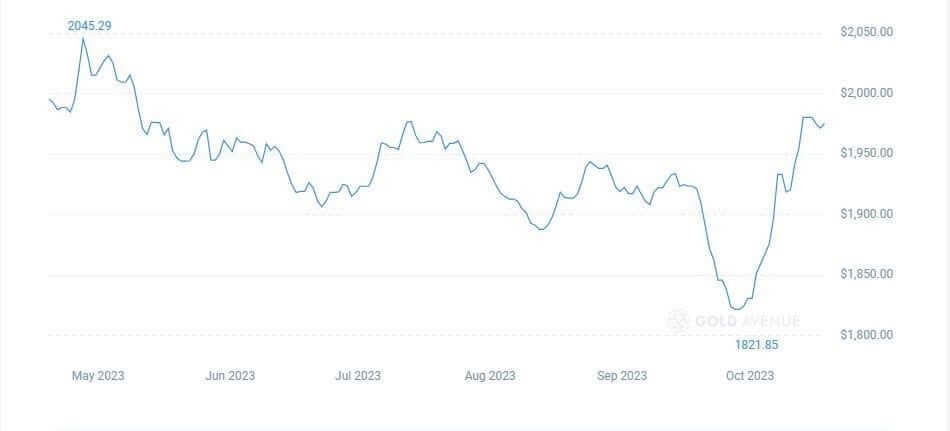

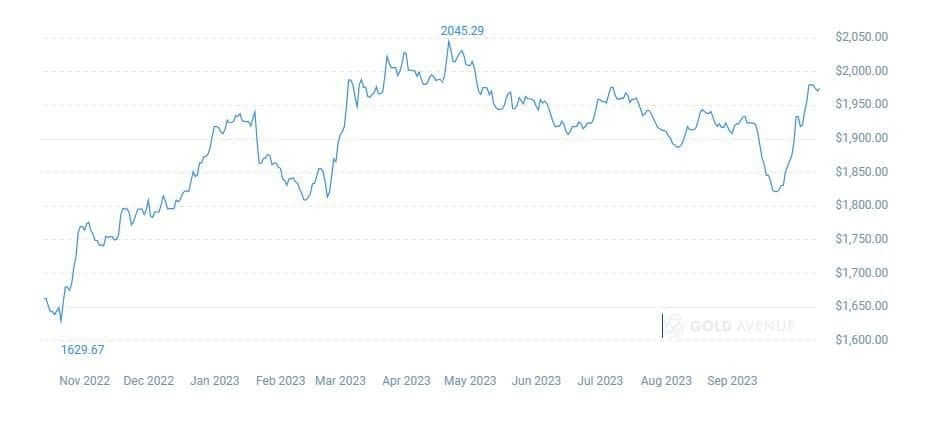

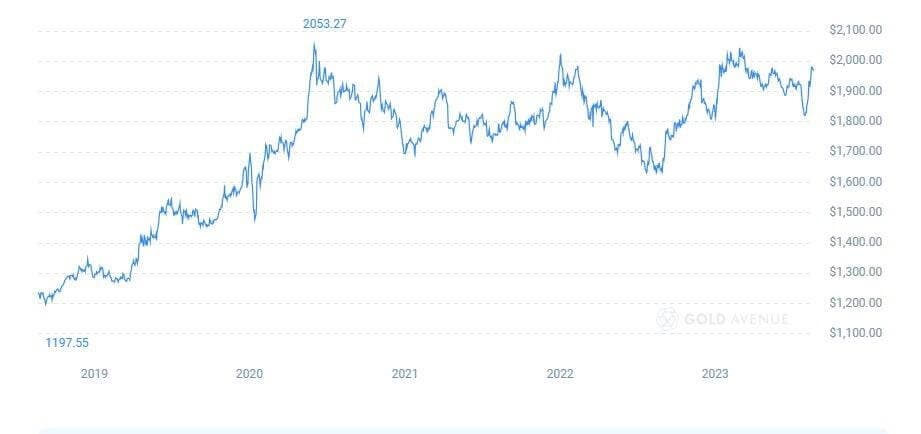

Gold is often seen as a safe-haven asset during geopolitical turmoil. So as tensions rise between Israel and Hamas, how will the conflict impact gold and the world economy?