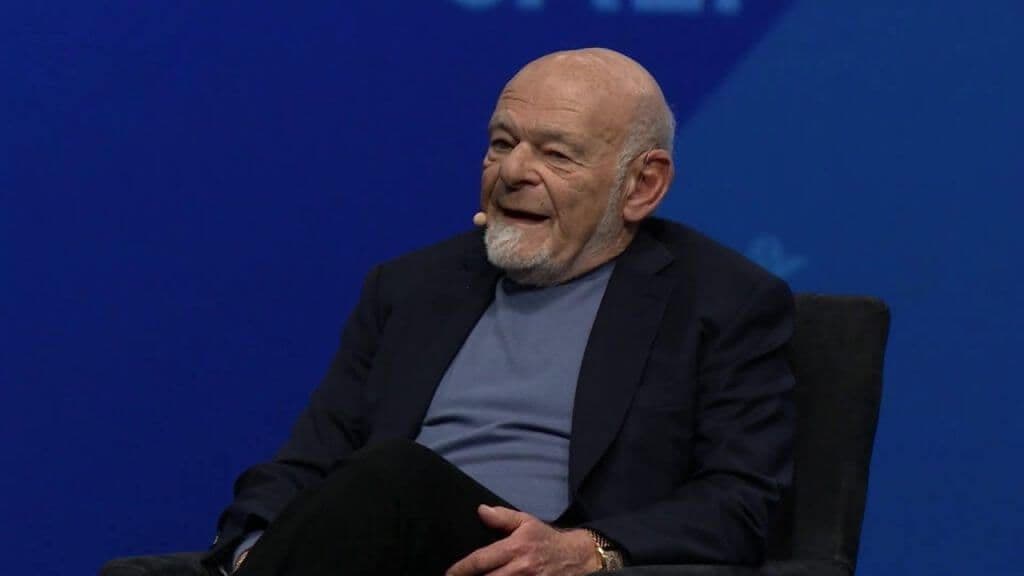

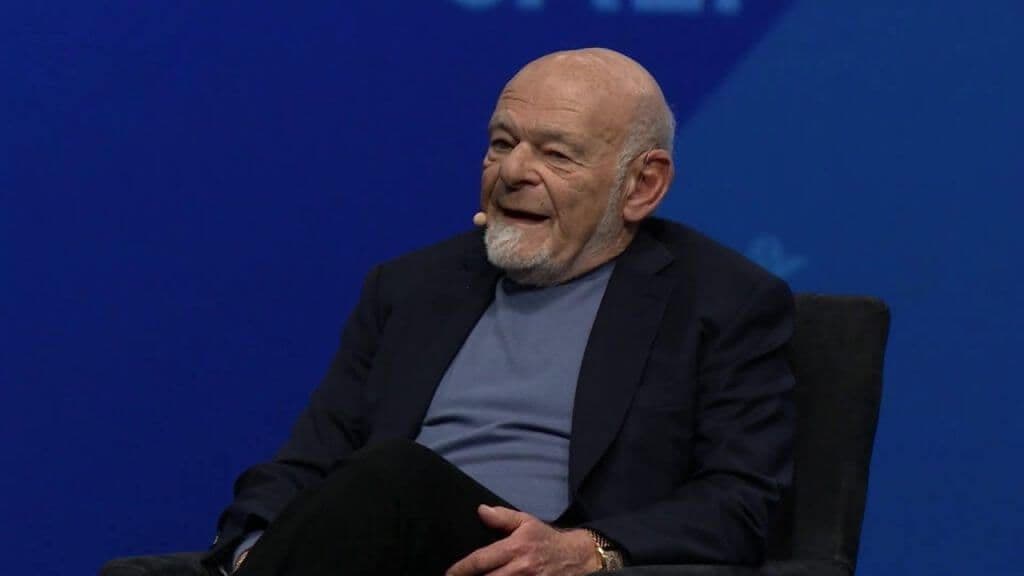

Lifelong Gold Skeptic Makes Major U-Turn

Famous precious metal skeptic buys gold as a hedge against accelerating inflation which he says is “reminiscent of the 1970s”.

Famous precious metal skeptic buys gold as a hedge against accelerating inflation which he says is “reminiscent of the 1970s”.