Should You Invest in Real Estate in 2023?

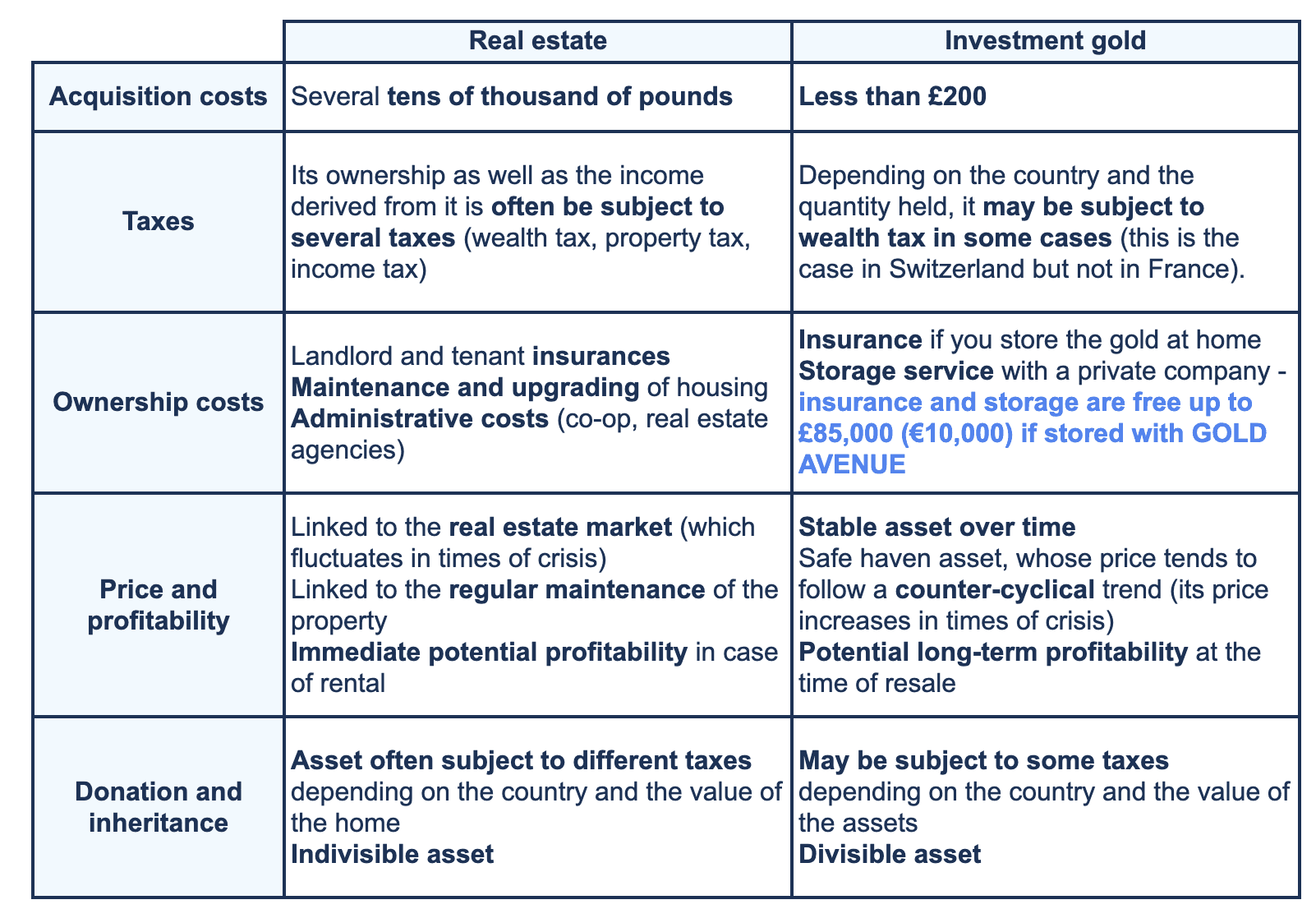

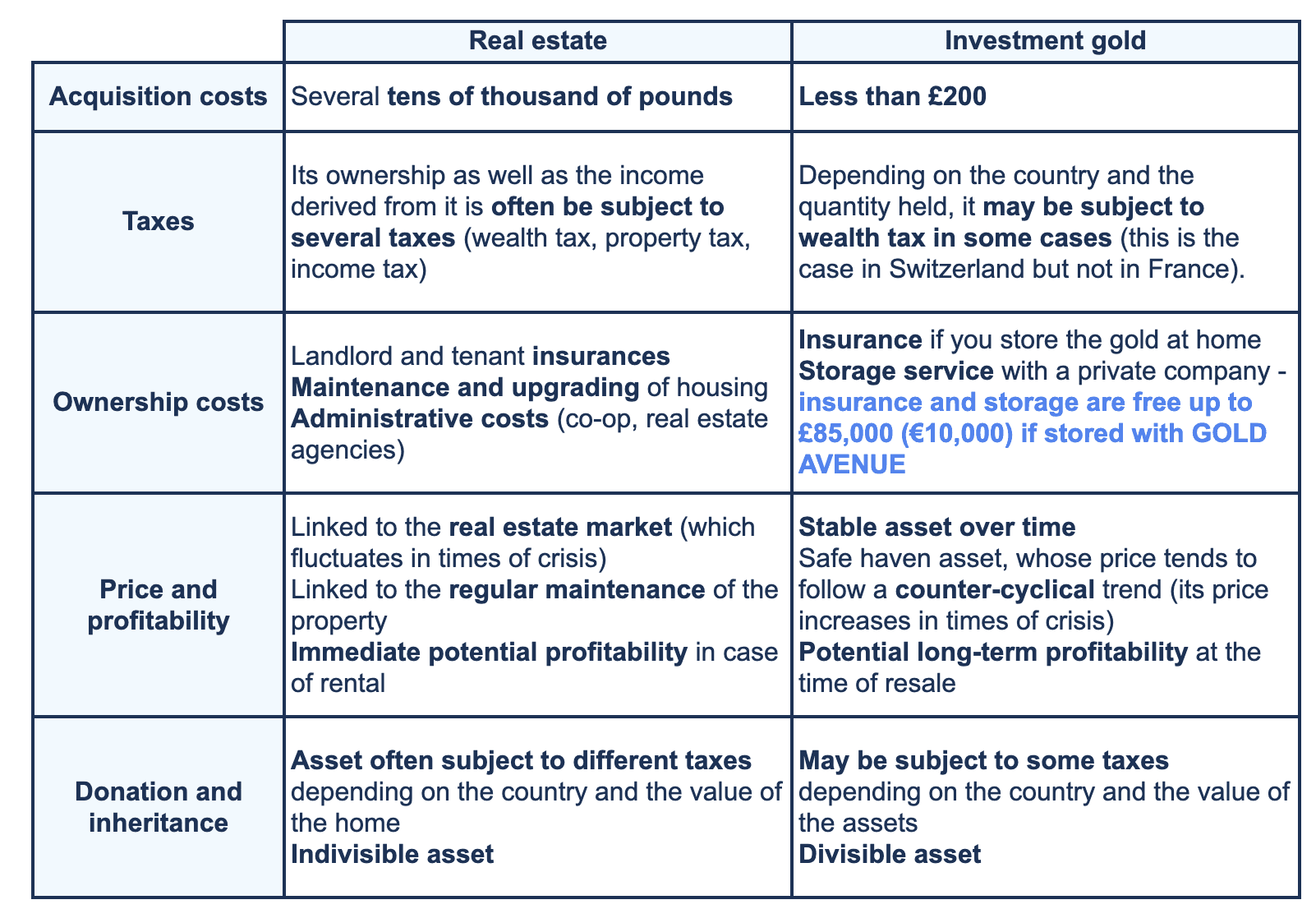

Is it a good idea to invest in real estate in 2023? Maybe...but this year, gold and precious metals can be just as interesting.

Is it a good idea to invest in real estate in 2023? Maybe...but this year, gold and precious metals can be just as interesting.