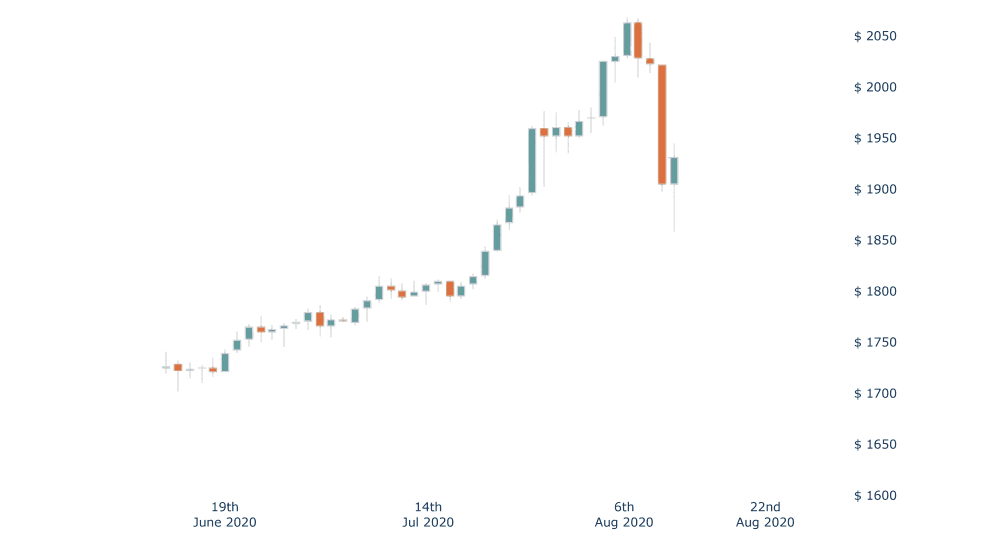

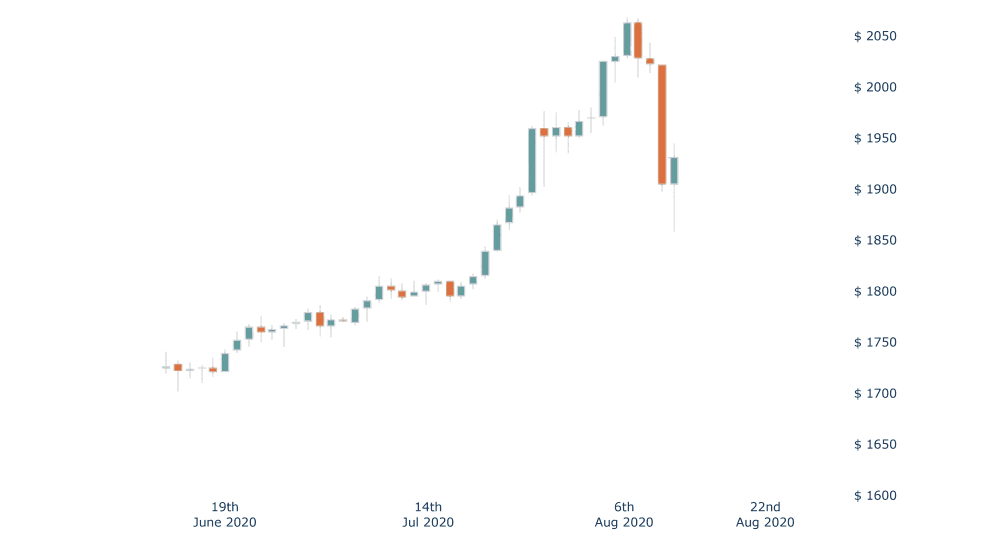

The biggest drop in a day for gold in 7 years!

A large drop in gold prices due to recent news could be a good entry point for potential gold buyers.

A large drop in gold prices due to recent news could be a good entry point for potential gold buyers.