What the K-Shaped Recovery Means for Gold

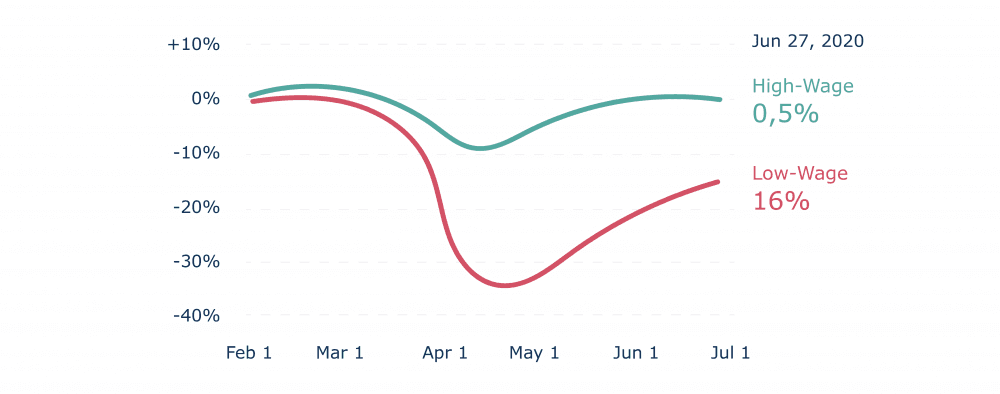

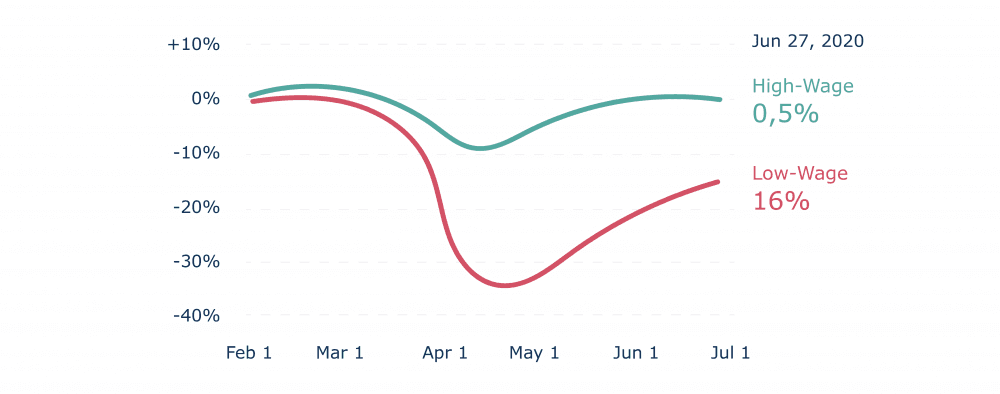

You probably noticed certain industries and communities aren’t bouncing back as quickly as others during times of recession or economic crisis. That’s what the K-shaped recovery is all about.

You probably noticed certain industries and communities aren’t bouncing back as quickly as others during times of recession or economic crisis. That’s what the K-shaped recovery is all about.