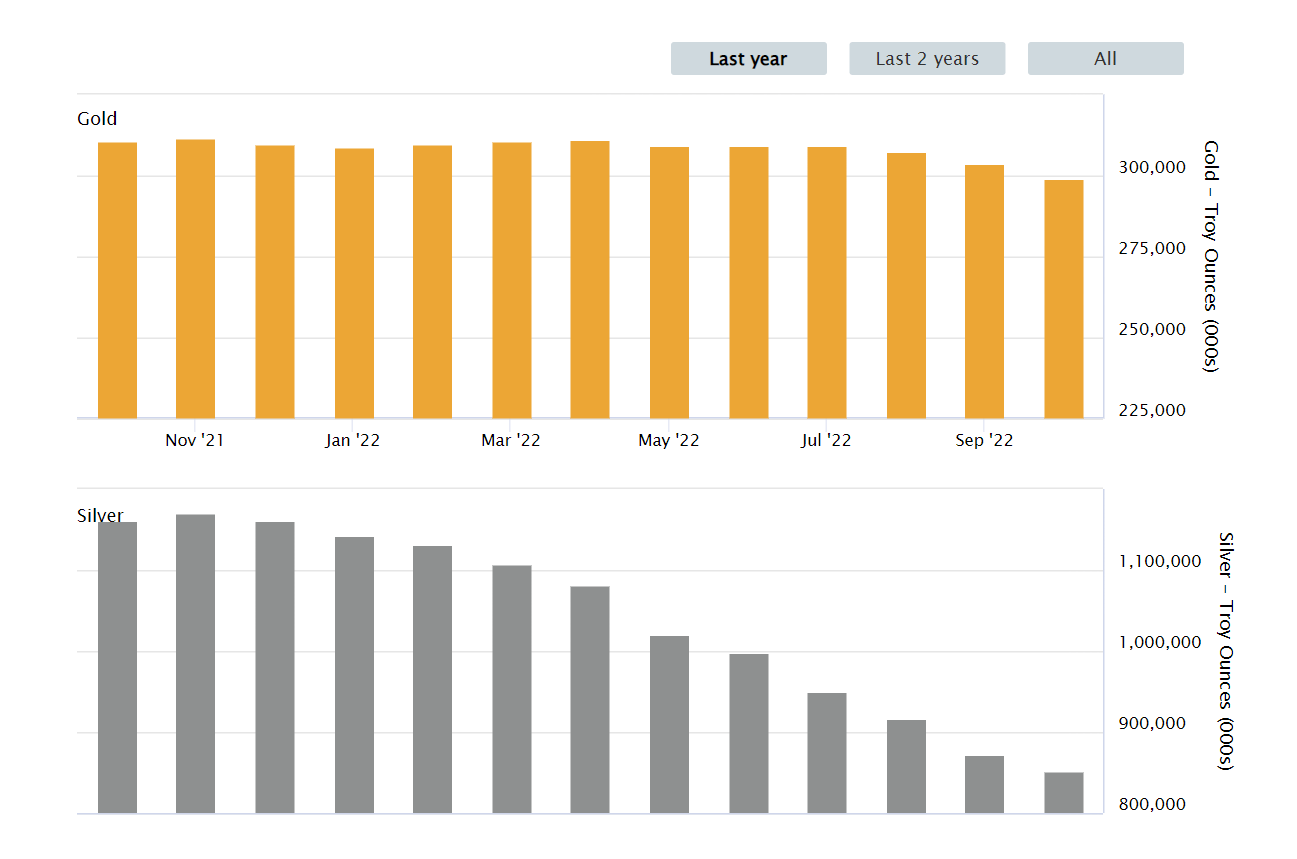

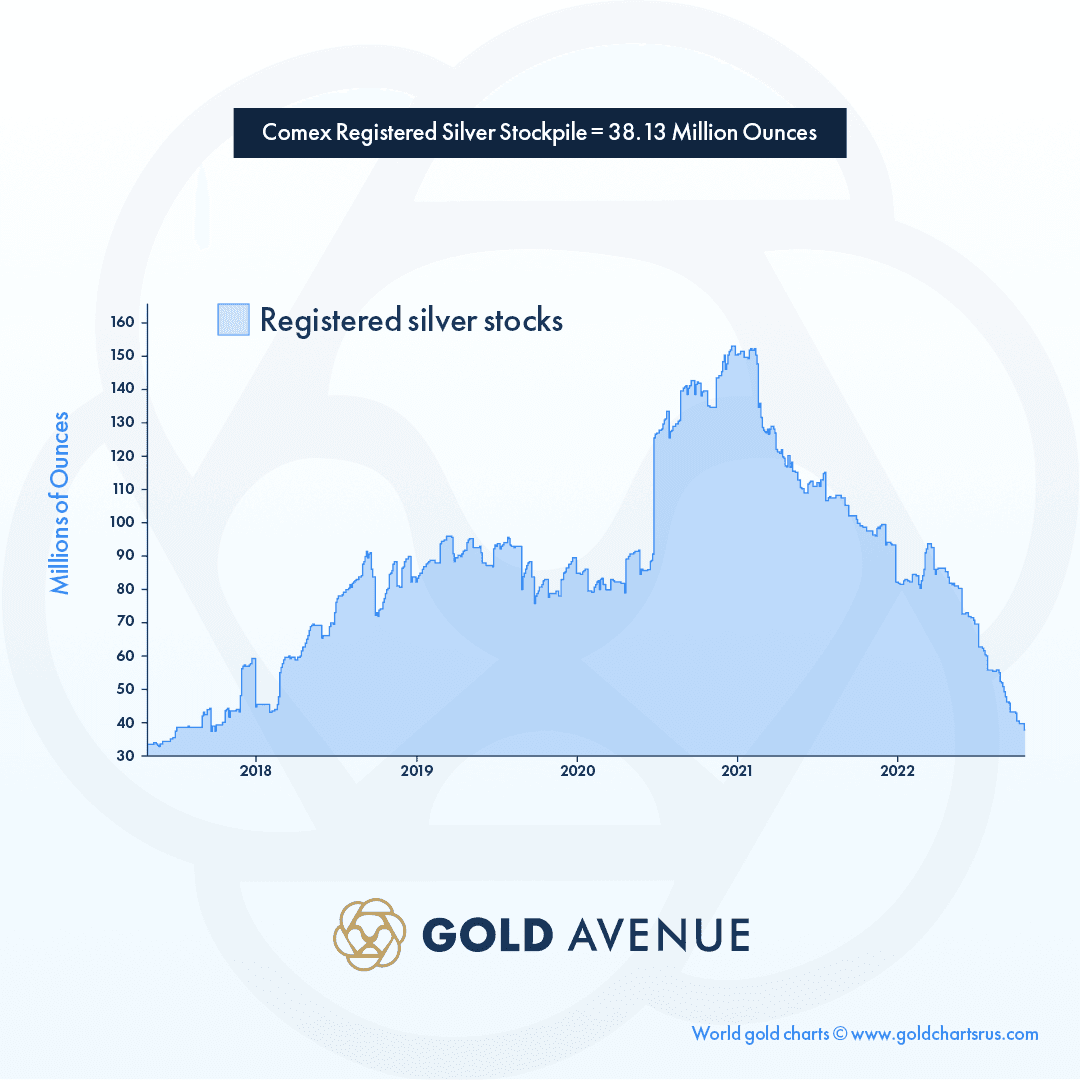

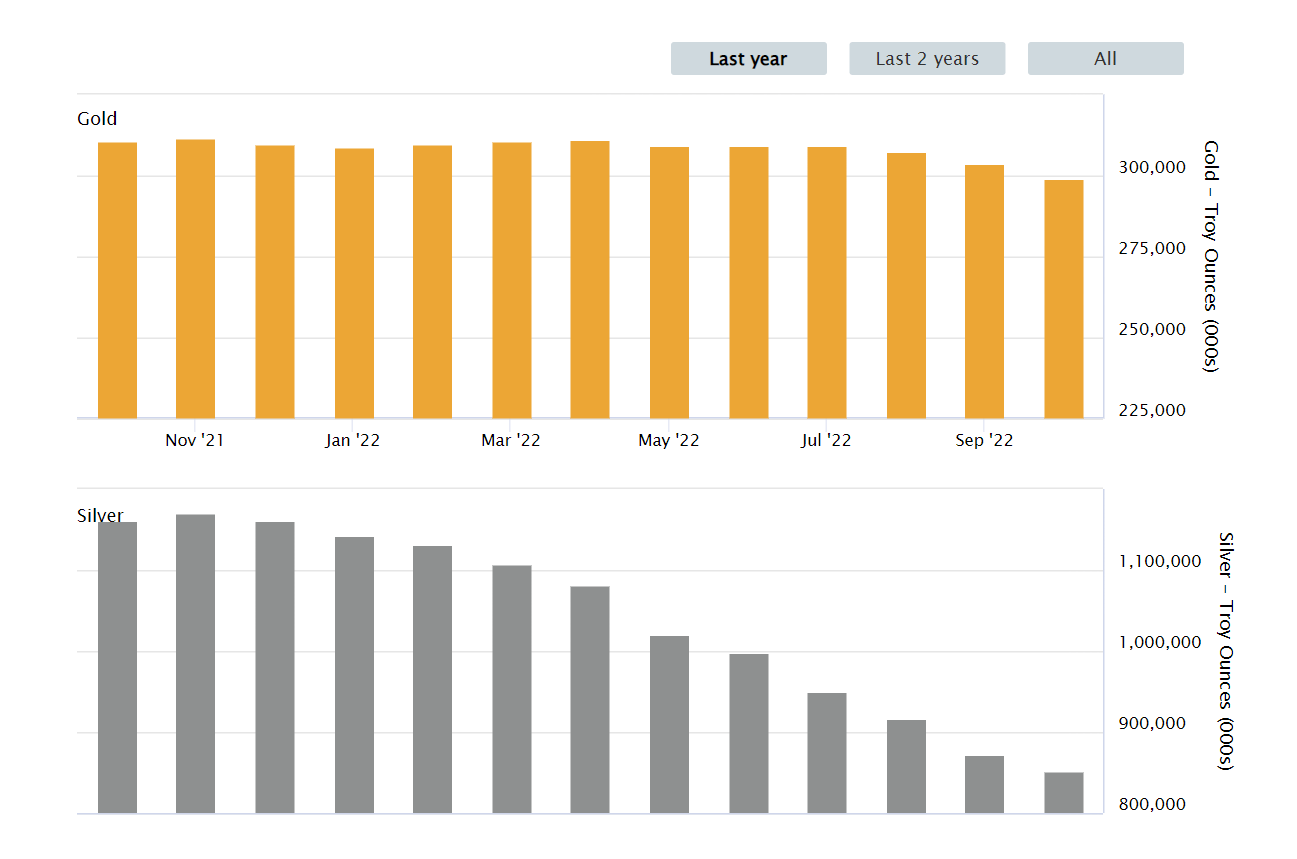

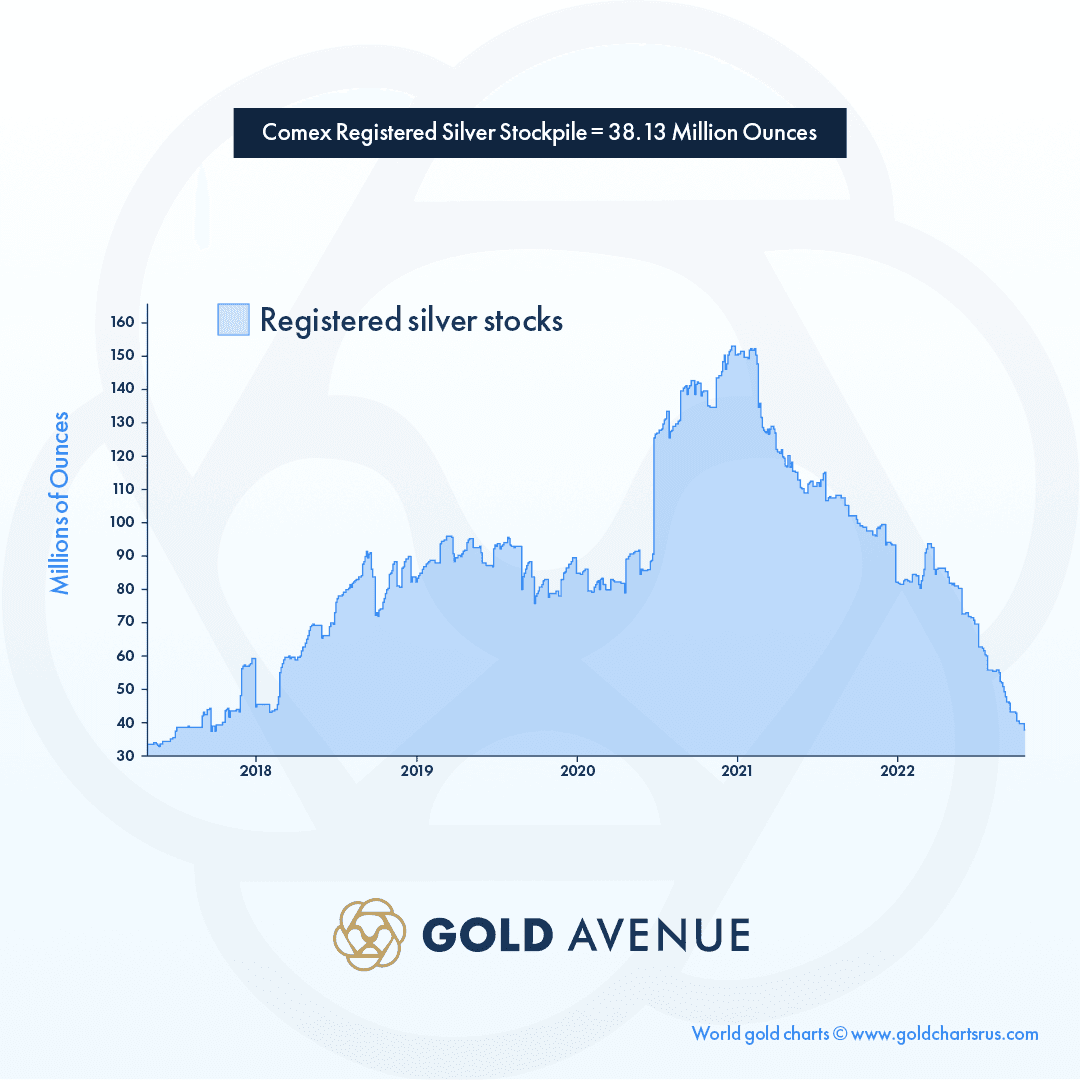

Why Are Physical Silver Reserves Suddenly Dropping?

There has been a mysterious drop in silver stocks on major international trading platforms that created quite a buzz. Could it make the silver price surge next year? Here’s what you need to know.

There has been a mysterious drop in silver stocks on major international trading platforms that created quite a buzz. Could it make the silver price surge next year? Here’s what you need to know.