How to Prepare Your Budget for a Big Life Project

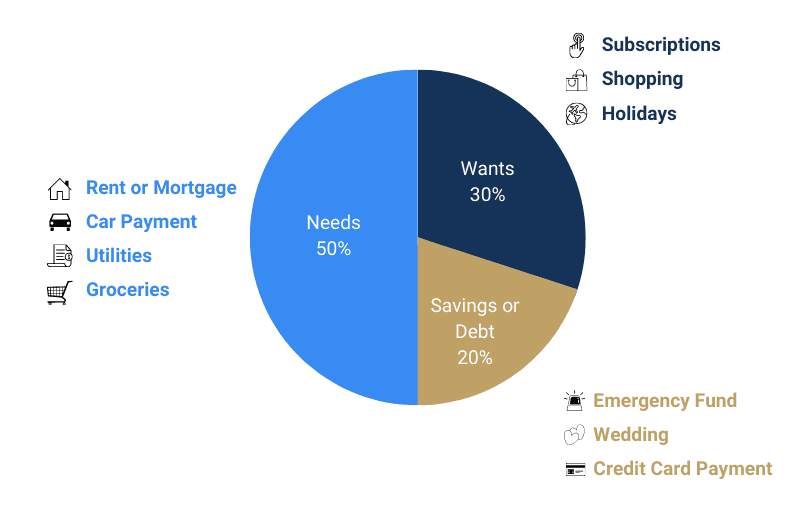

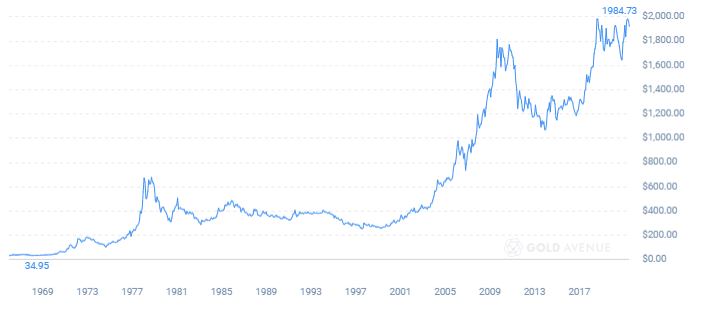

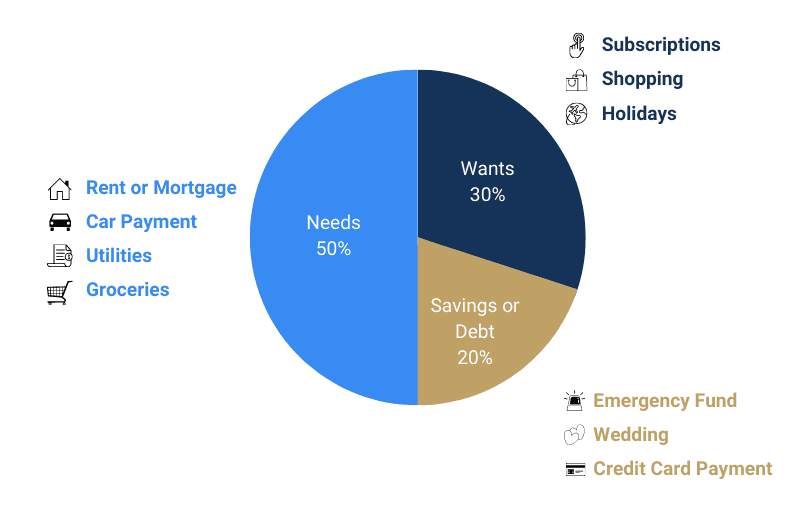

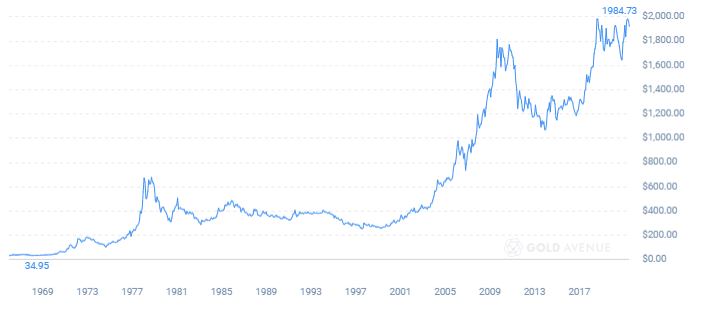

Unlock the secrets to achieving your budgeting for life's major milestones in our comprehensive guide and explore the power of gold savings in your financial journey.

Unlock the secrets to achieving your budgeting for life's major milestones in our comprehensive guide and explore the power of gold savings in your financial journey.