Bitcoin, stocks, gold: What is the best investment today?

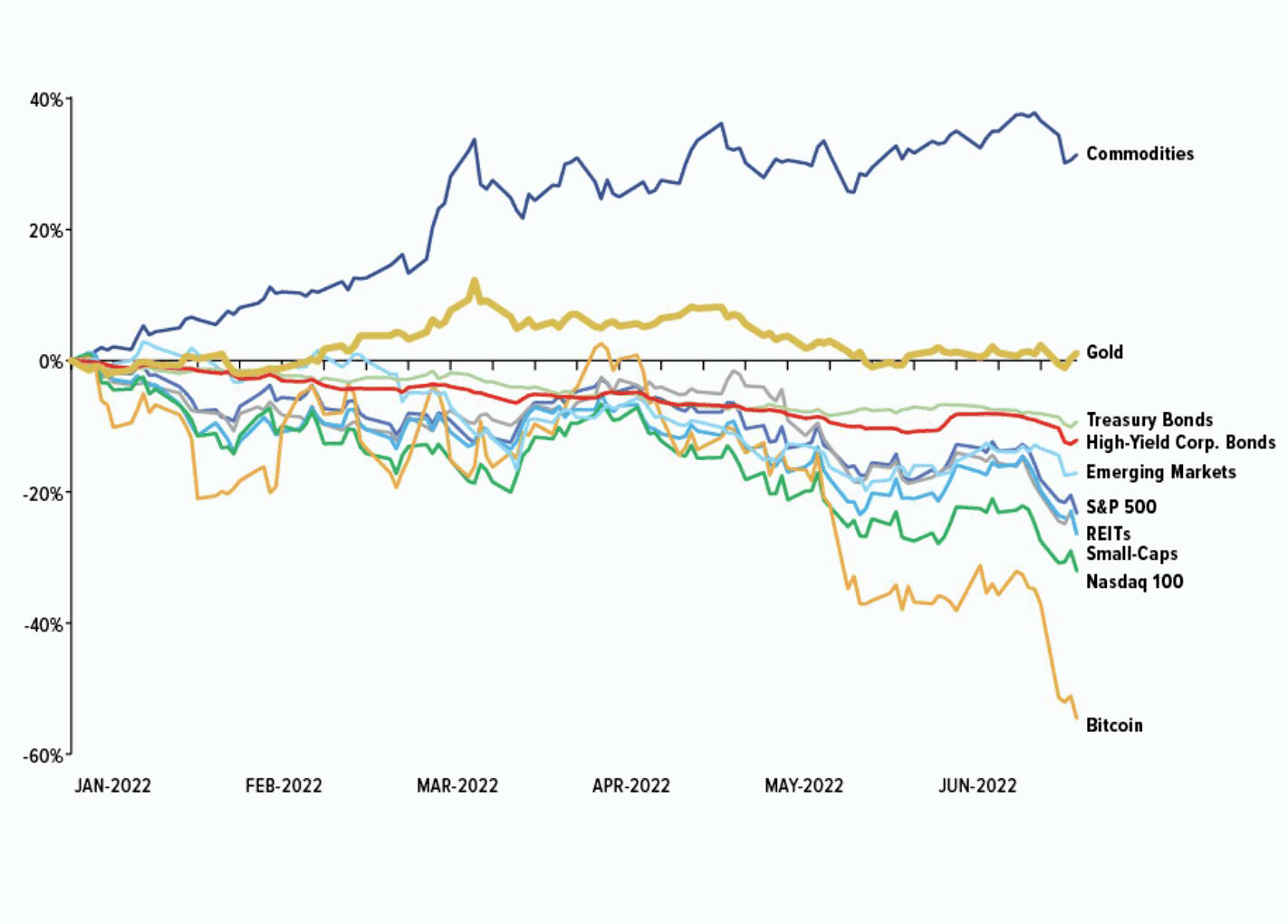

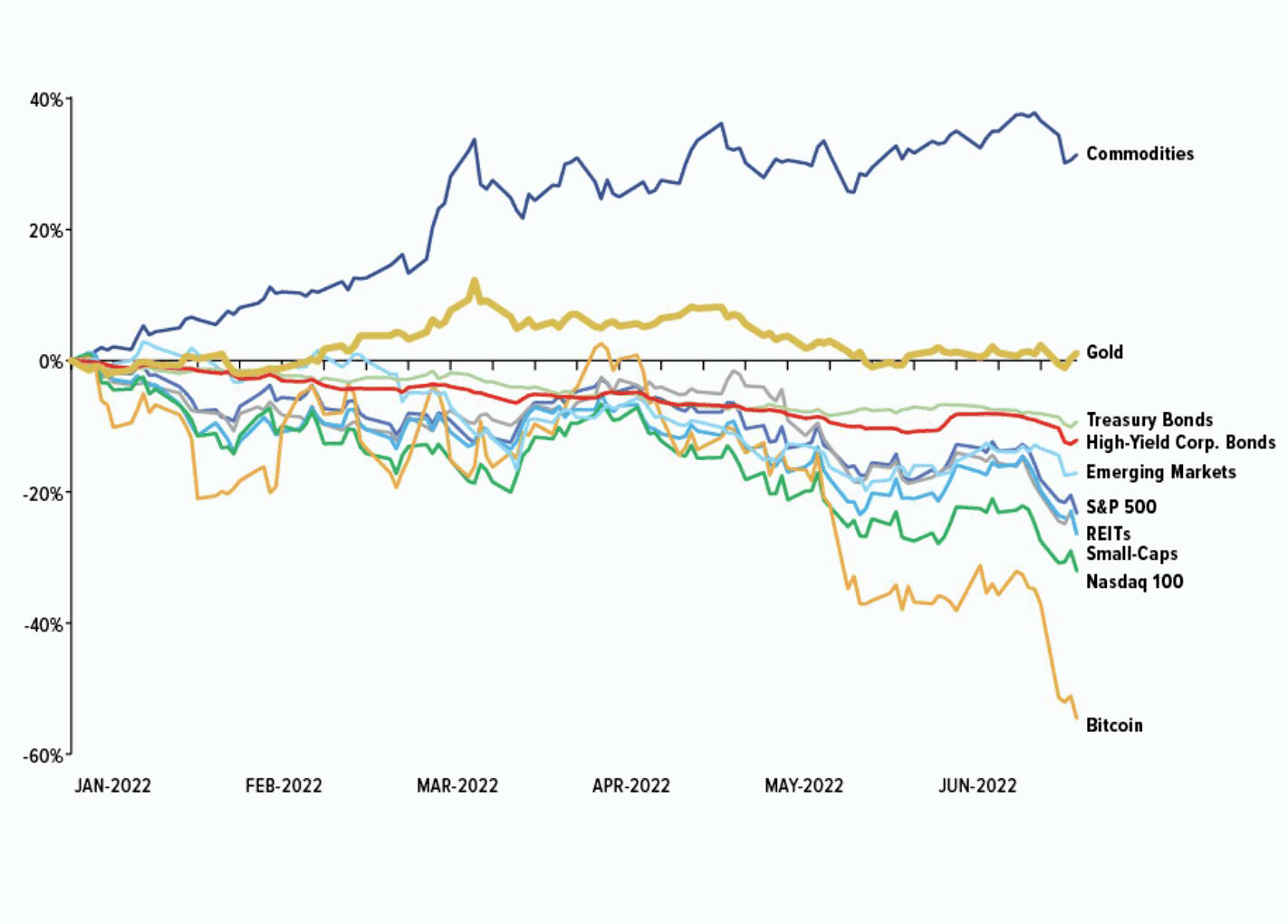

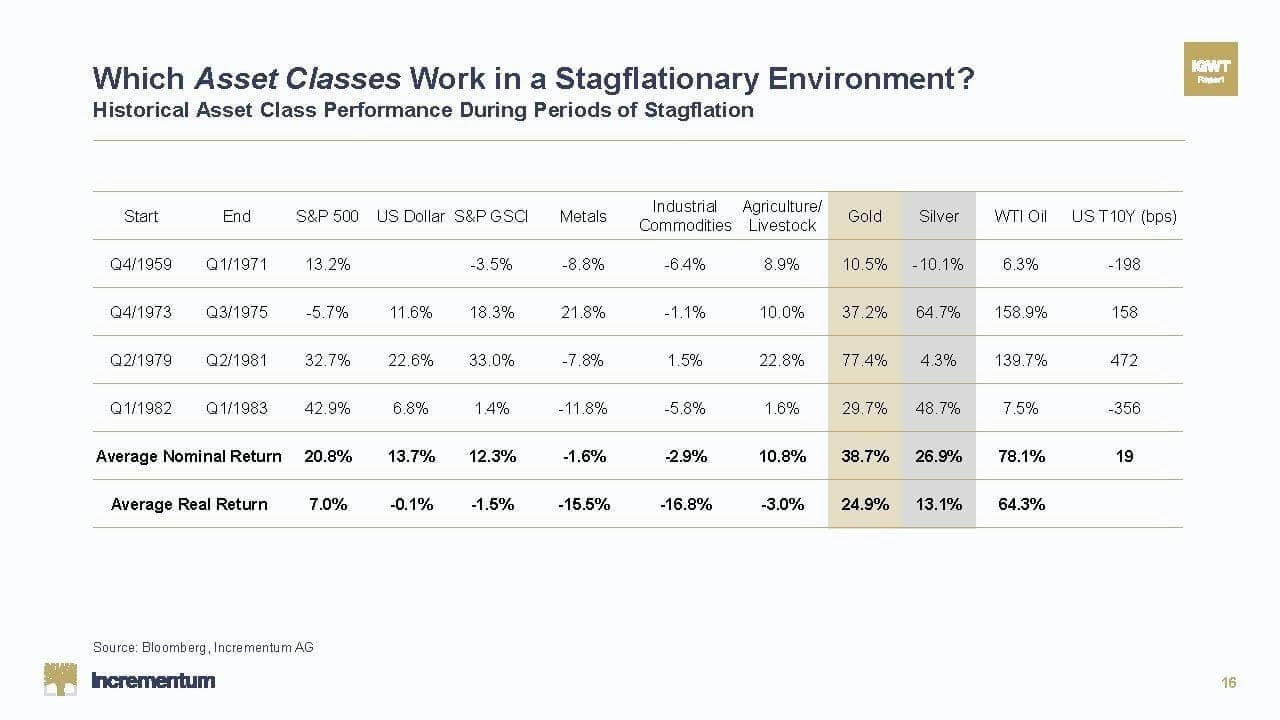

While stocks and bitcoin went down sharply due to rising inflation and uncertain economic outlook, gold has retained its value, exactly when investors and savers needed it.

While stocks and bitcoin went down sharply due to rising inflation and uncertain economic outlook, gold has retained its value, exactly when investors and savers needed it.