Has Inflation Peaked? Here's What You Need to Know to Understand Inflation

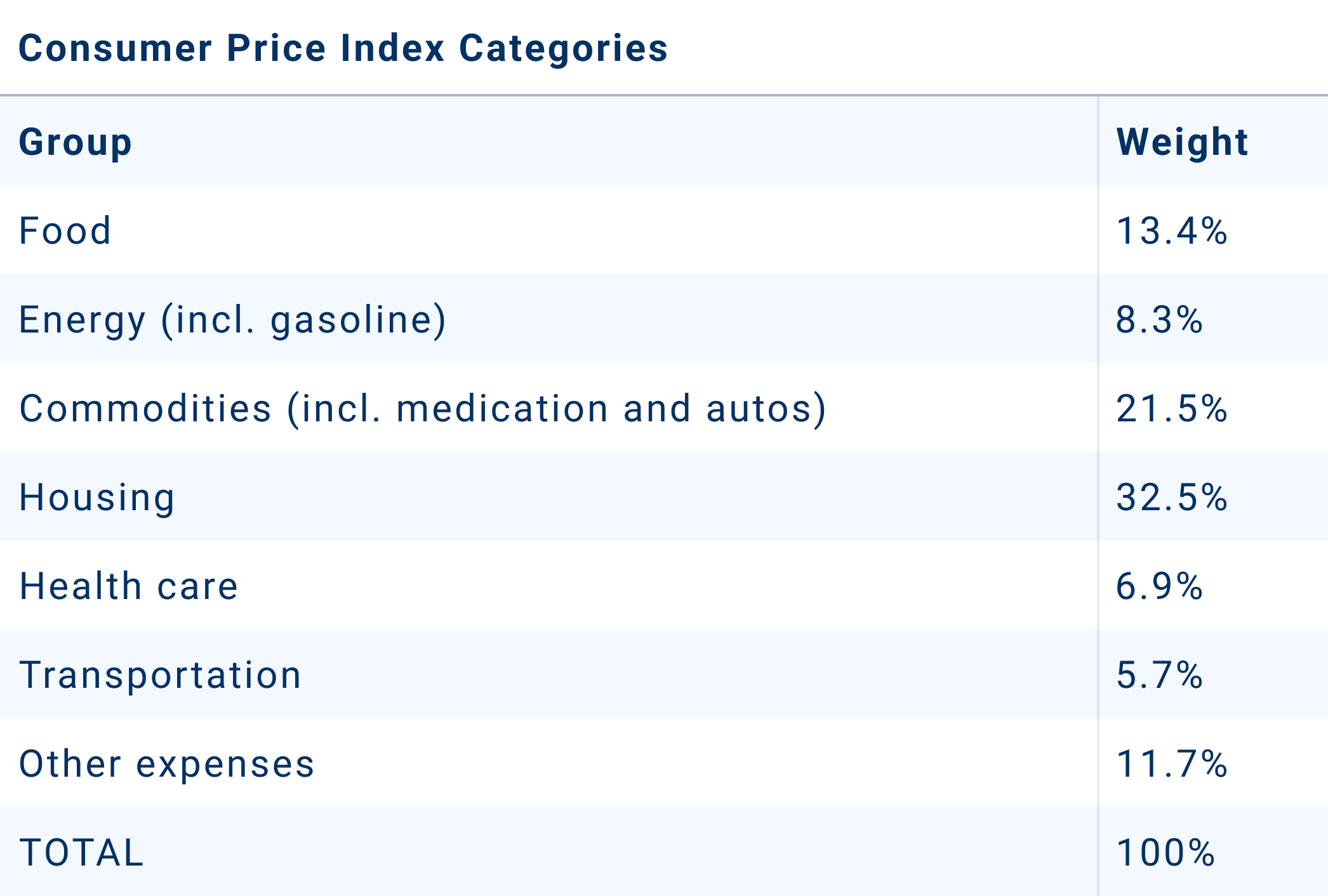

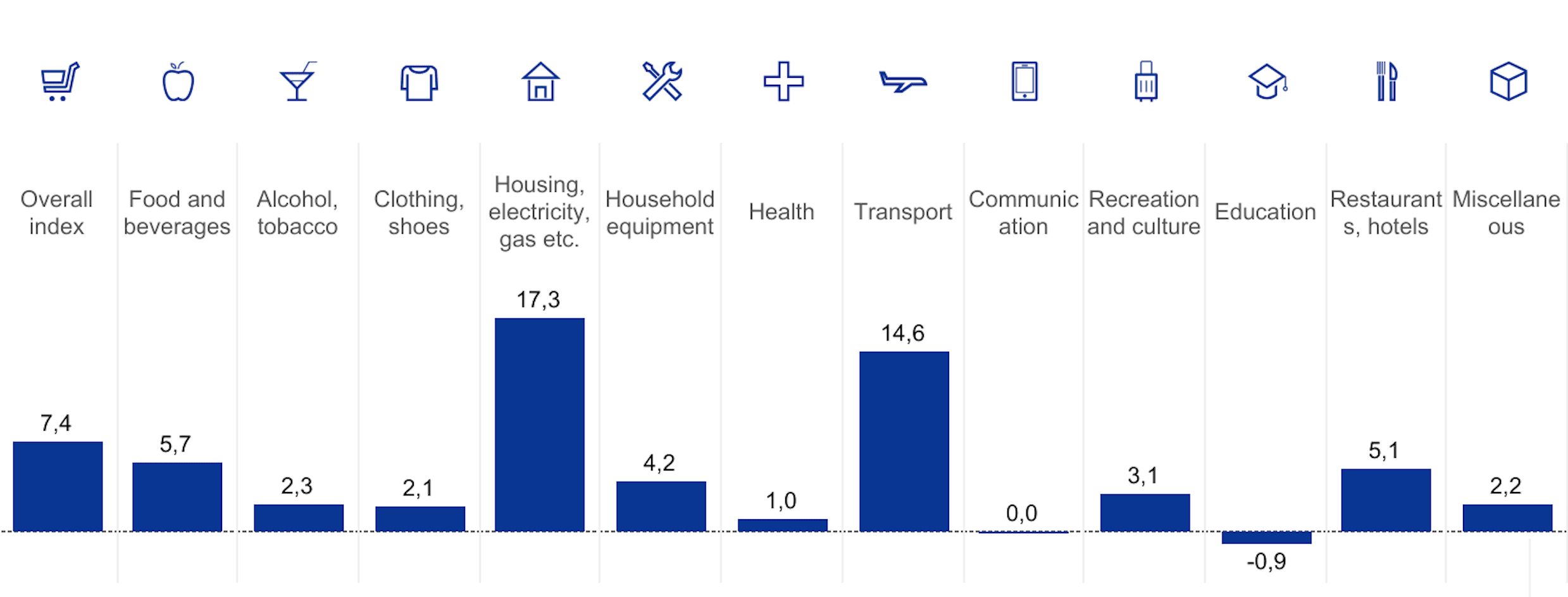

You read in the press that persistently high inflation has finally peaked and should be going down soon. But the latest CPI numbers show it might not be entirely true. Here’s why.