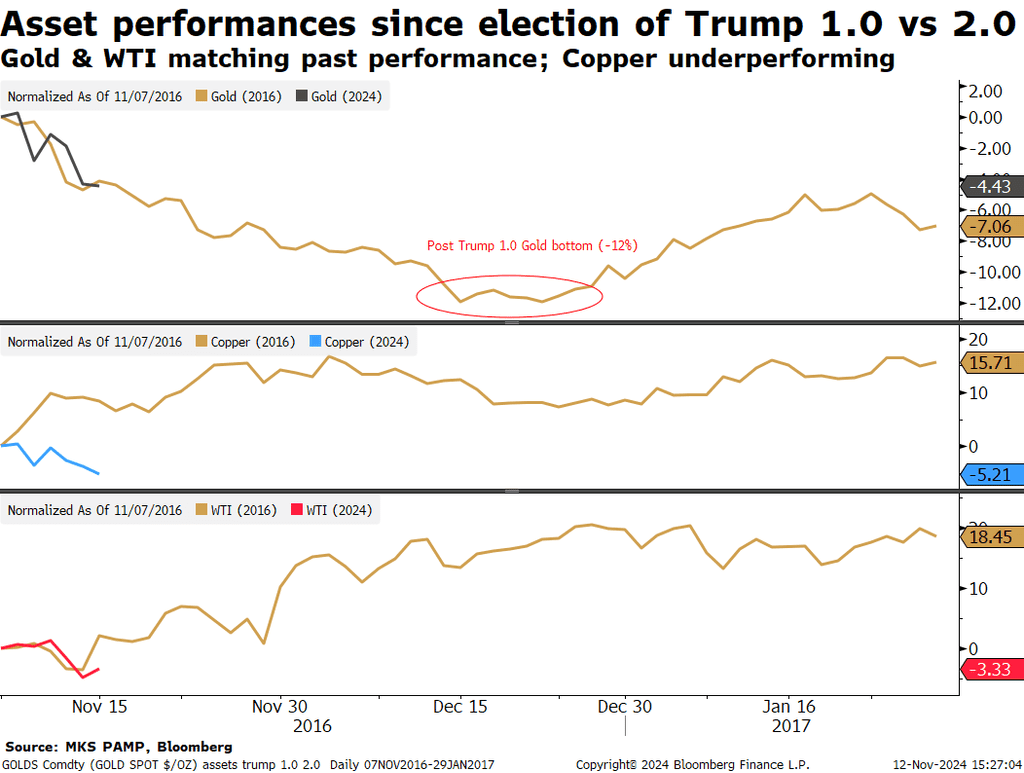

US Election: How Will Trump's Win Affect the Price of Gold?

America has chosen its next leader and former President Donald Trump will once again reside in the White House for the next four years. Below, we explore how this could affect the price of gold.