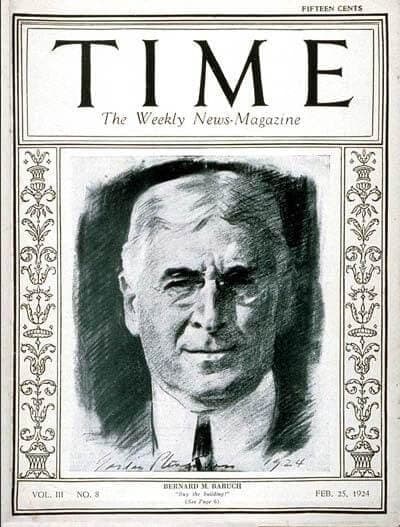

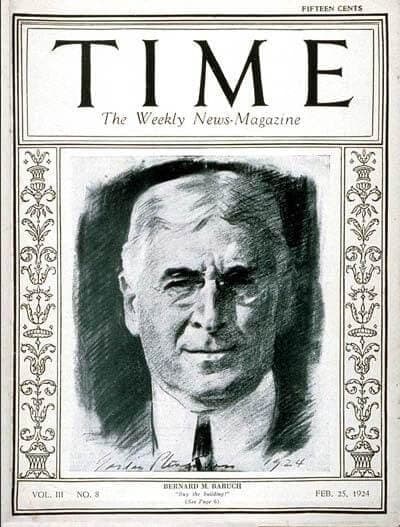

Who was America’s First Bullionaire?

The story of Bernard Baruch, the first Wall Street broker to become a Bullionaire before the government took almost all his gold away.

The story of Bernard Baruch, the first Wall Street broker to become a Bullionaire before the government took almost all his gold away.