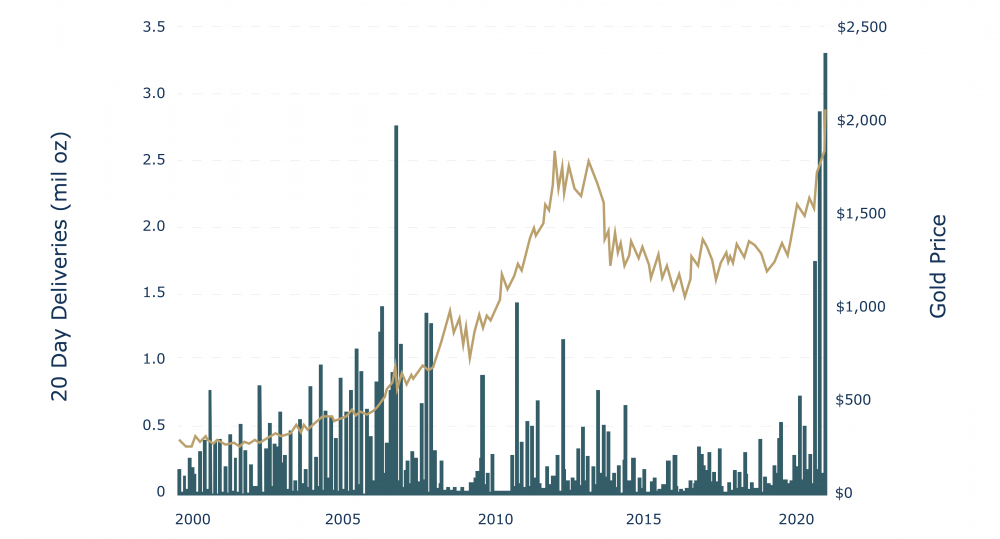

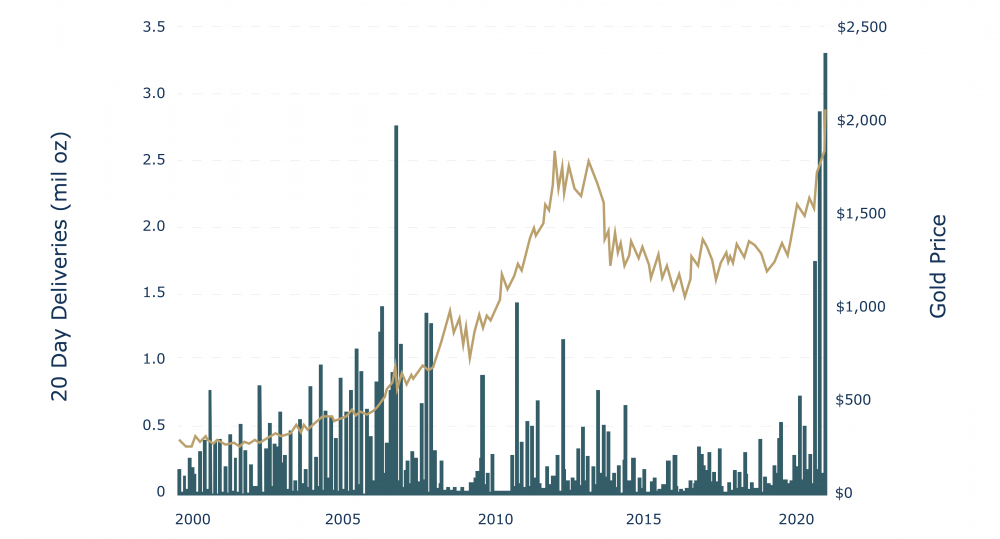

Why Are Gold Deliveries at an All-time High?

A recent spike in deliveries of physical gold on the COMEX is a signal of rising concerns over the financial system that make market participants drop paper contracts for physical products.

A recent spike in deliveries of physical gold on the COMEX is a signal of rising concerns over the financial system that make market participants drop paper contracts for physical products.