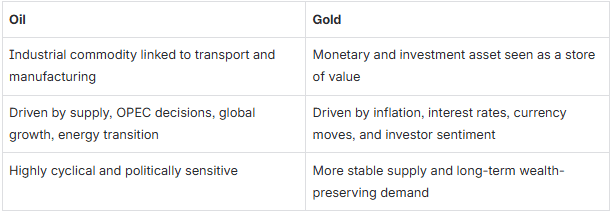

Gold and Oil: Myths, Numbers, and What Really Matters

Gold and crude oil are natural resources with intrinsic value. But is there a real link between these two asset classes? Let’s find out!

Gold and crude oil are natural resources with intrinsic value. But is there a real link between these two asset classes? Let’s find out!