Is a Recession Coming in 2022?

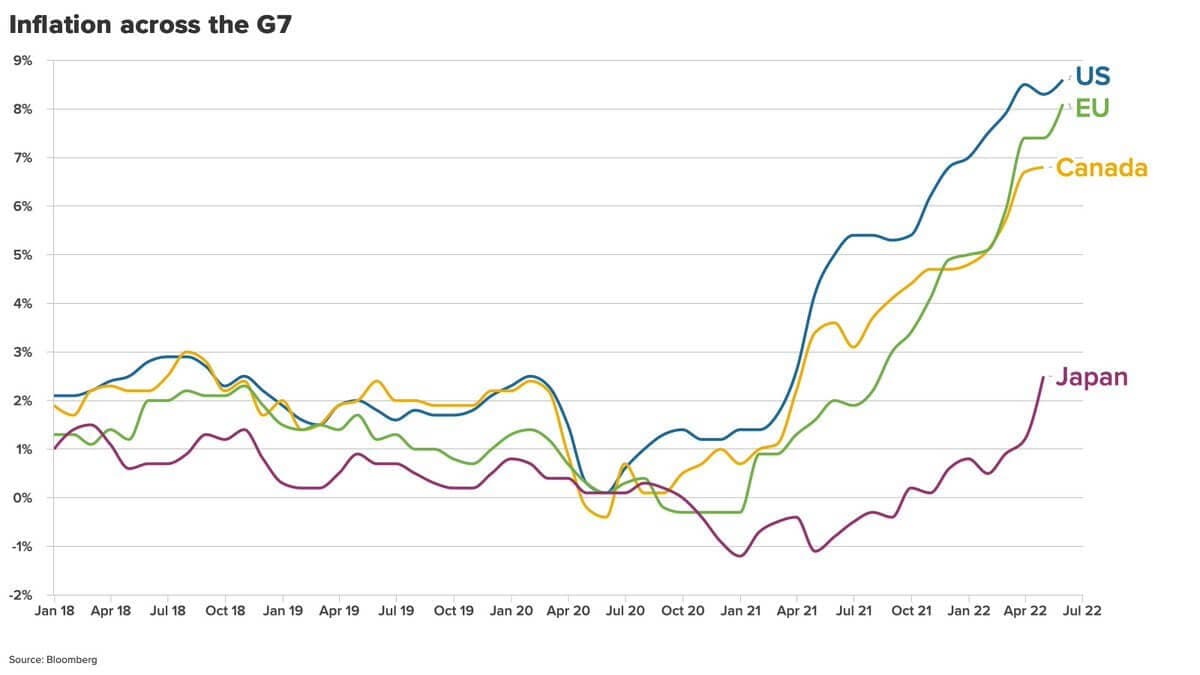

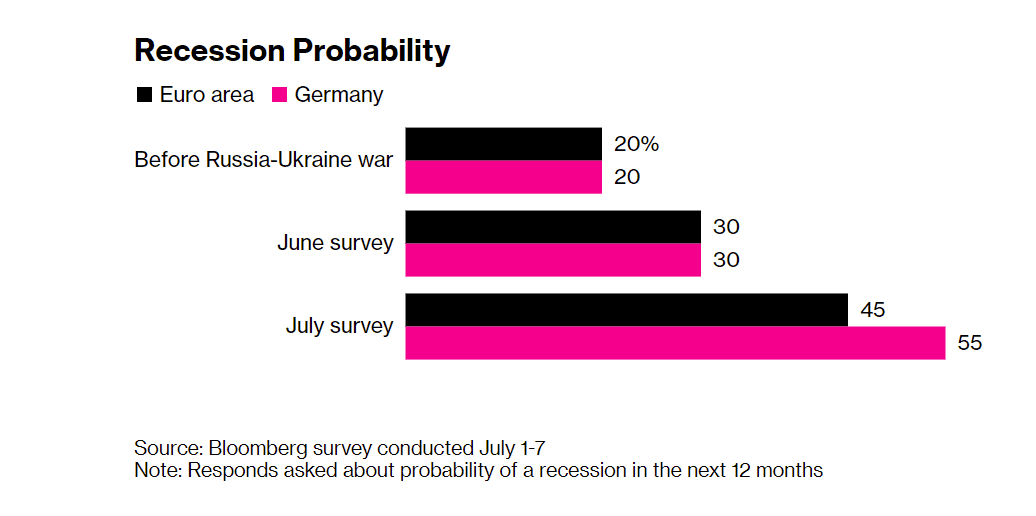

As the Fed raises interest rates and Russia squeezes gas supplies to Europe, it looks like the global economy is slowly but surely drifting into a recession. Will it happen by the end of 2022, and what does it mean for gold?