New BRICS Currency: What Impact on Gold and the Dollar?

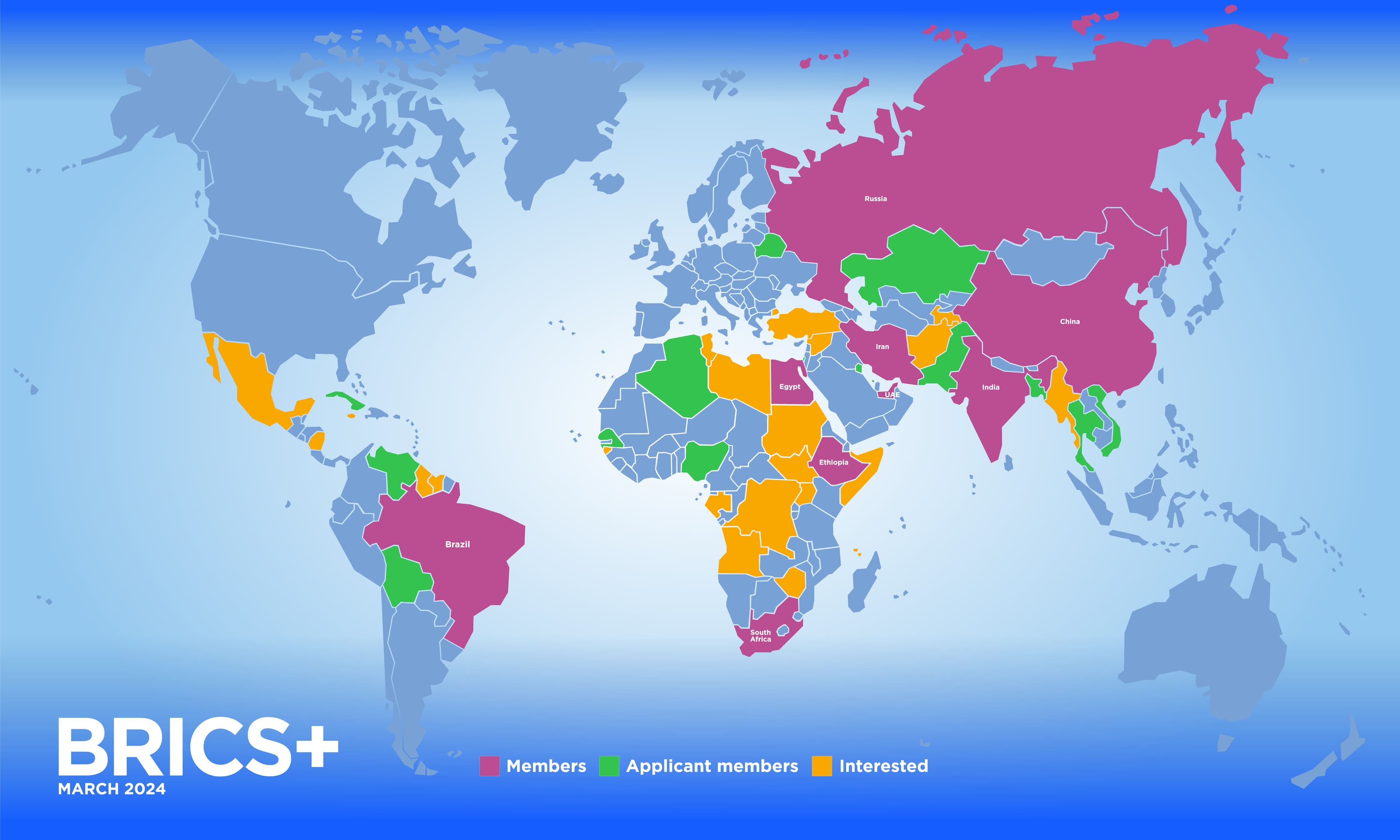

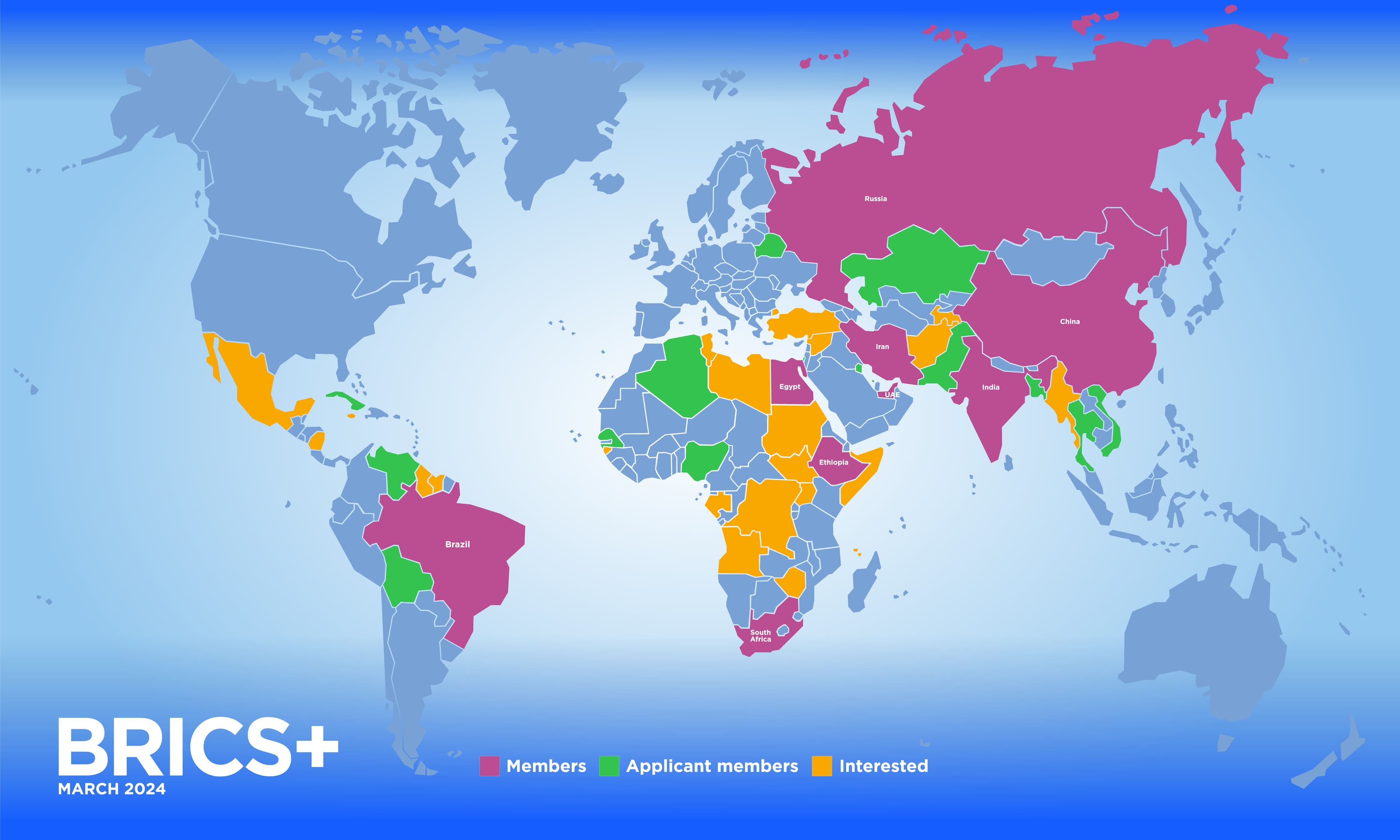

The intention to create a new currency within the BRICS is no longer just a rumor. What effects could this new currency have on geopolitics and gold?

The intention to create a new currency within the BRICS is no longer just a rumor. What effects could this new currency have on geopolitics and gold?