Central Bank Gold Buying Explained

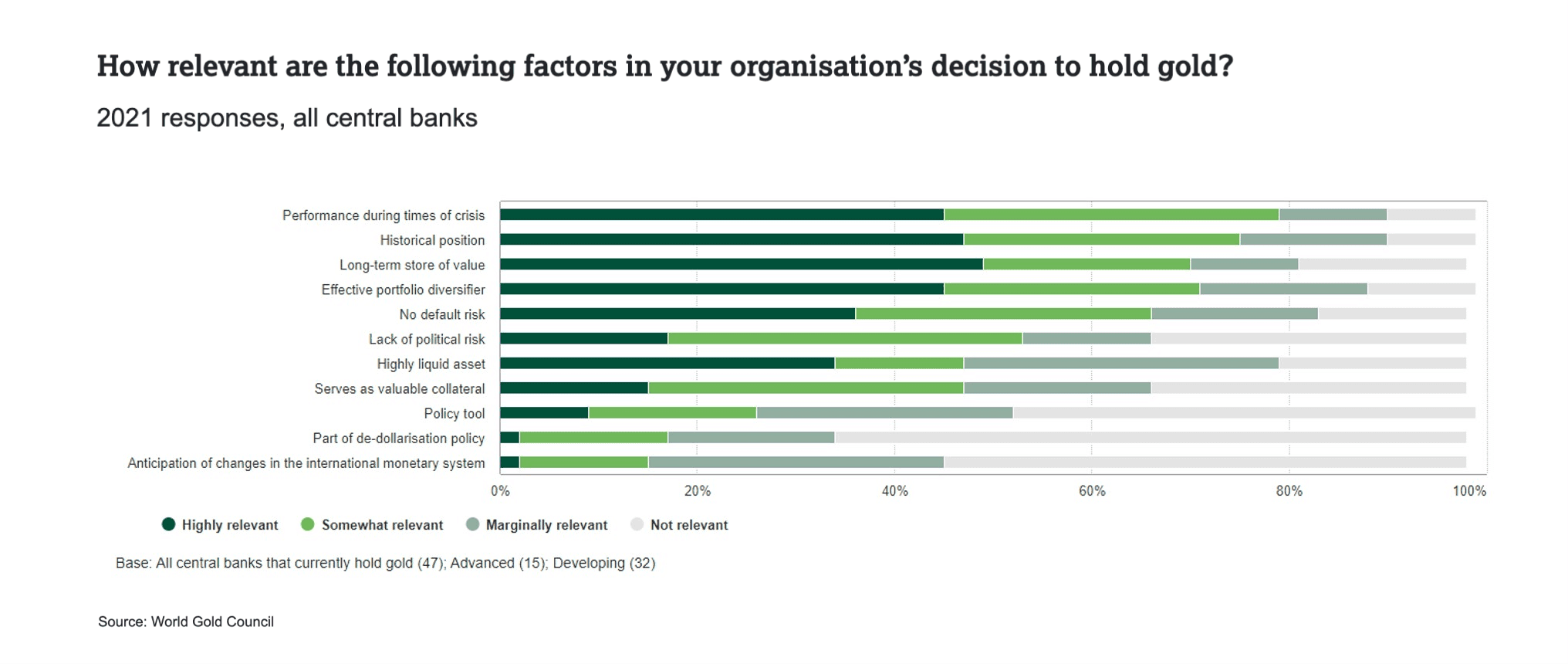

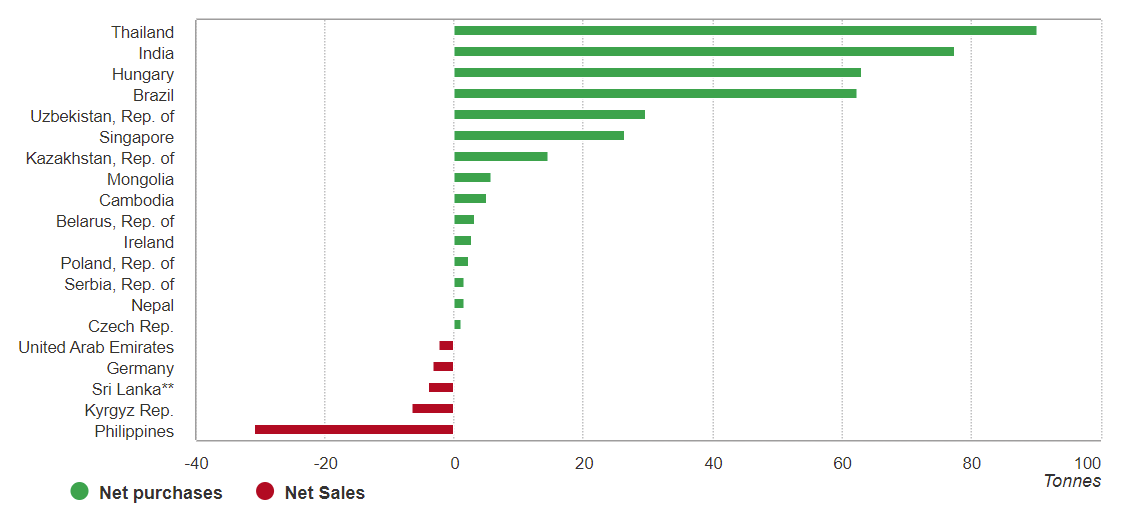

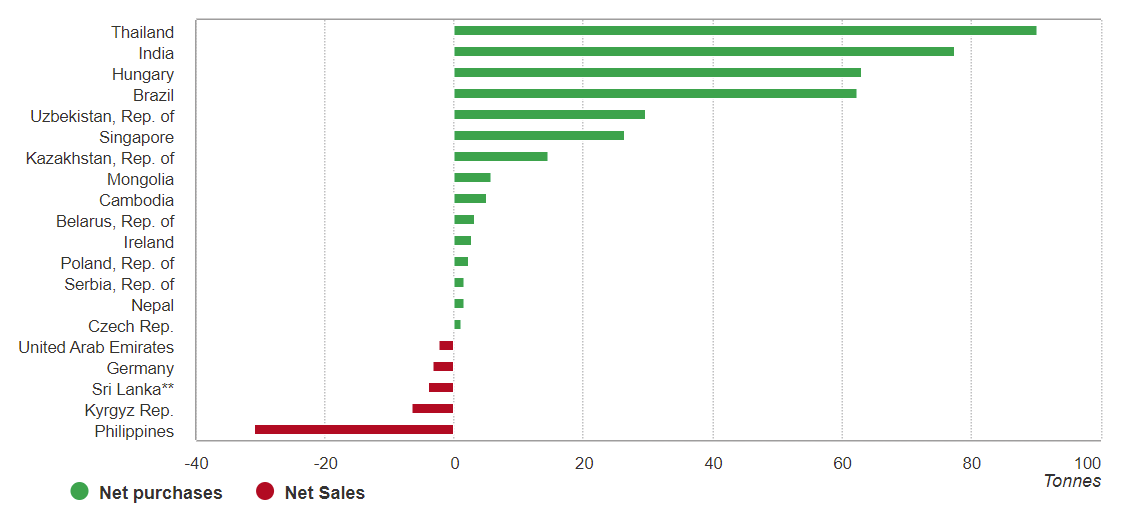

In 2021, central banks continued buying gold, with emerging countries stepping up as key net buyers. Do you wonder why? Here’s what you need to know.

In 2021, central banks continued buying gold, with emerging countries stepping up as key net buyers. Do you wonder why? Here’s what you need to know.