€750 million

in sales

190K

users

€650 million

in storage

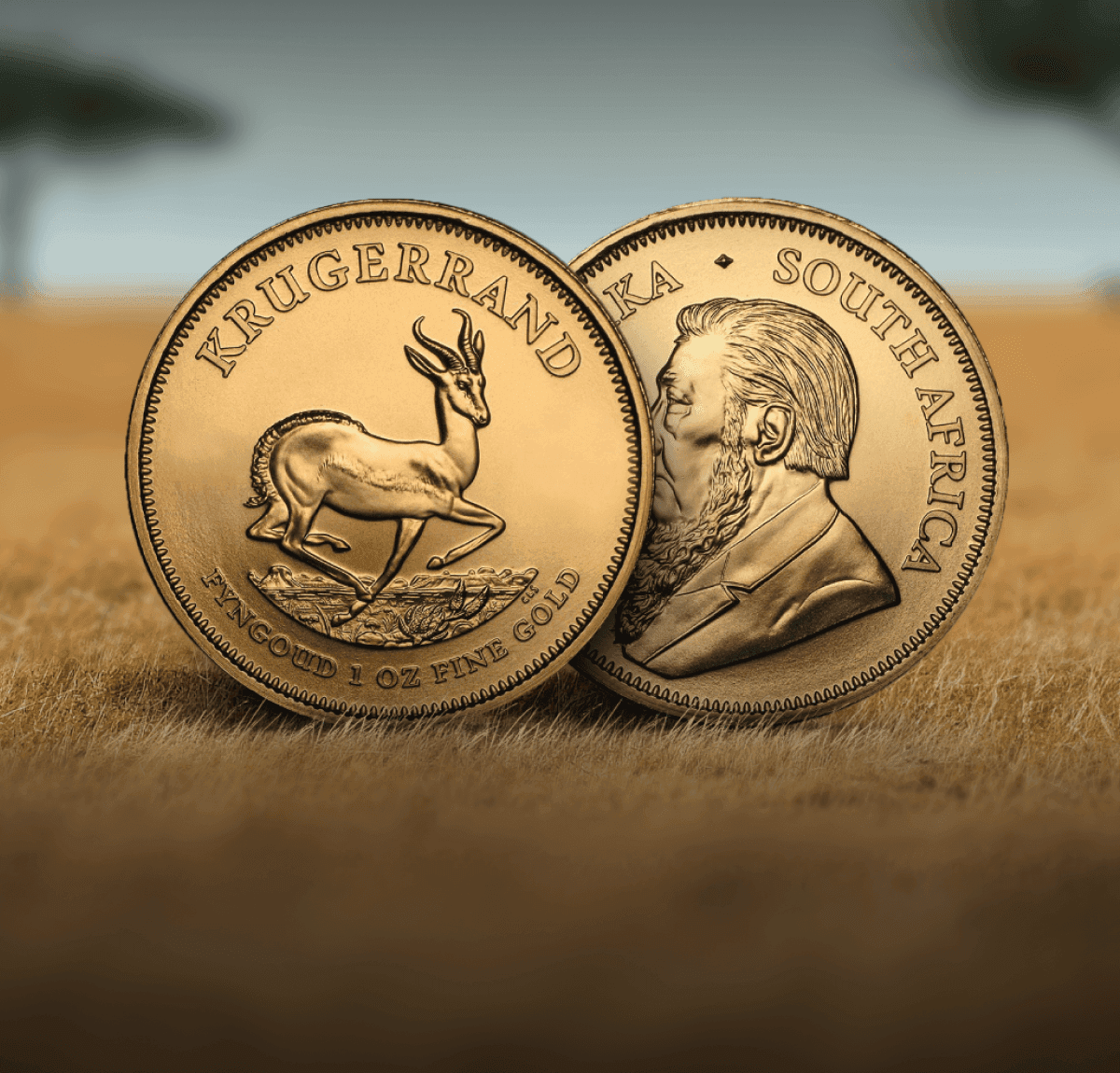

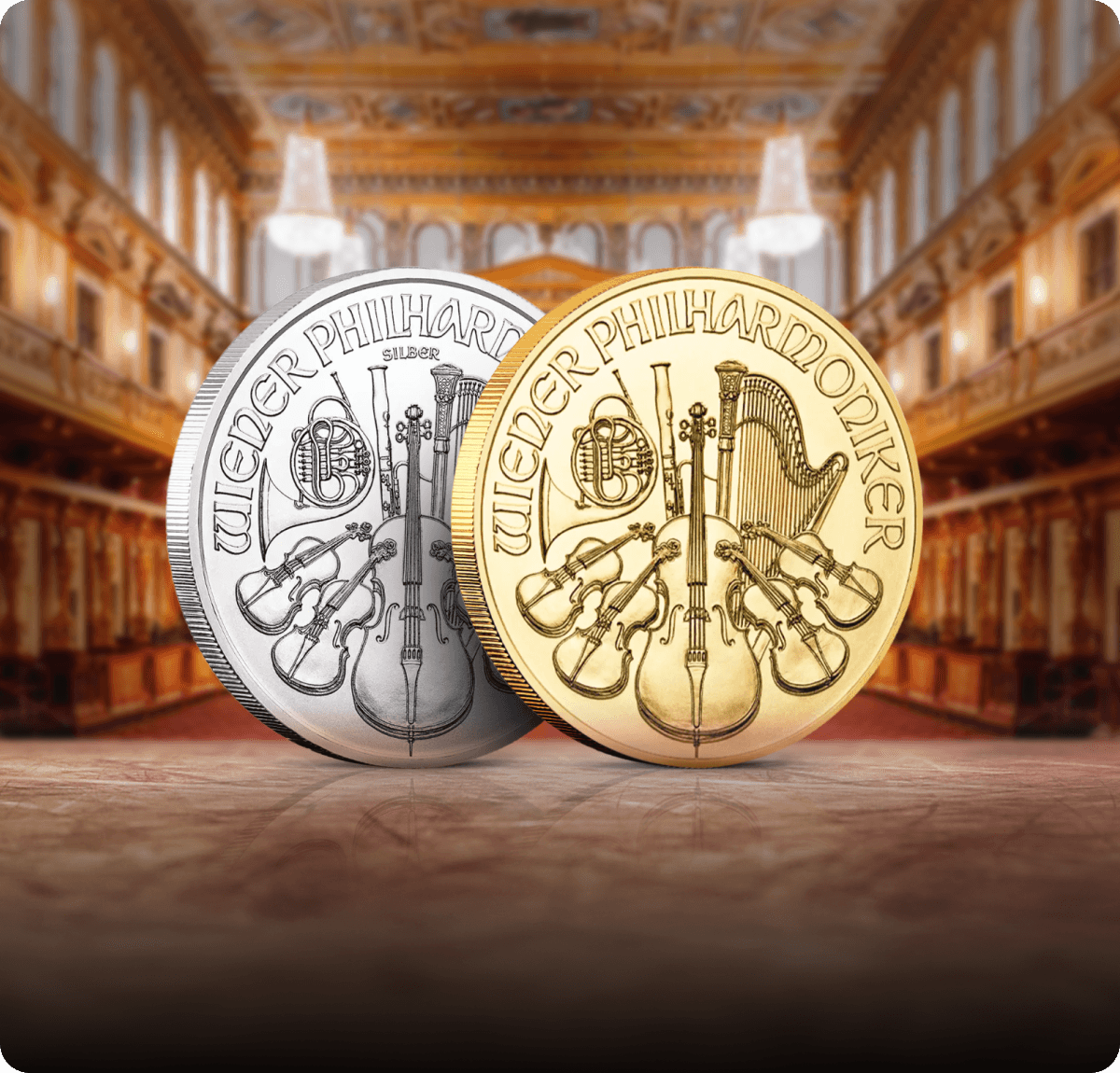

bestsellers

deals

new-arrivals

lady-fortuna

vat-free-silver

coins

If I had invested

5 years ago?

Precious metals have historically gained value in the long term.

Estimate how much you could have saved in the past 5 years.

![]() We have 3 strategies matching

We have 3 strategies matching

your starting amount!

Metal

Starting amount

Add a monthly investment

Today you would have:

€0.00

Total gains: €0.00 (0%)

Performance

numismatics

napoleon

vreneli

limited-editions

2026-lunar

2026-coins

graded-coins

Try our savings assistant

Pick the right products to secure your savings. Simply select a metal, enter a budget, and our savings assistant will help you start!

Secure your savings

Buy physical gold, silver, platinum, and palladium and build your precious metals savings from anywhere.

A global authority in precious metals

GOLD AVENUE is part of Bullion International Group, the retail division of MKS PAMP GROUP — a Swiss family-owned company that has grown into an innovative powerhouse, serving precious metals producers, users, and traders worldwide.

Learn more about MKS PAMP GROUPBullion International Group also includes such well-known brands as APMEX, MTB, OneGold, Bullion.com, the Bullion Card, and Citadel.

Learn more about Bullion International Group

Frequently asked questions

Read the most frequently asked questions from savers and investors on GOLD AVENUE and on how to buy gold, silver, and precious metals.

Do I own the precious metals I buy on GOLD AVENUE?

You own 100% of the products you buy on GOLD AVENUE. All your stored products are physically kept in our secure vaults and off our balance sheet, so you remain their unique legal owner even if GOLD AVENUE were to cease its business activities.

Indeed, GOLD AVENUE only sells allocated precious metals that belong entirely to you. Other resellers can sell “mutualized” gold, often as a 12.5 kg bar shared with other customers. Although a part of it technically belongs to you, it can be difficult to resell and is usually not available to redeem. Some resellers even sell “paper gold”, which is not physical gold itself but an asset reflecting the price of gold and not necessarily backed by real physical gold.

Is there any guarantee for my purchases on GOLD AVENUE?

All precious metals bars sold on GOLD AVENUE are sealed and come with a purity certificate. We also provide a downloadable certificate of ownership for each stored product and a printable invoice with each purchase. This way, you always have paper proof of your ownership.

Minted bars come with the CertiPAMP packaging which serves as their purity certificate. We advise leaving these products in their sealed packaging to ensure the validity of their purity certificate.

Some of our products also come with the Veriscan technology, an MKS PAMP SA application used to securely identify precious metals products and their purity.

What is the quality of the products on GOLD AVENUE?

Our precious metals bars and coins come directly from the most reputable mints and have undergone extensive quality control. Our parent company, the MKS PAMP GROUP is part of the LBMA (London Bullion Market Association), therefore, all precious metals produced by the Swiss MKS PAMP refinery are LBMA-approved. Our Swiss-made gold bars are all newly minted and 999.9 fine gold (24 carats). You can find all the information on all our bars and coins’ purity directly on their product page.

What is GOLD AVENUE Pay?

GOLD AVENUE Pay is our instant payment and withdrawal solution. It is a free and secure way to manage your funds on GOLD AVENUE. Before an order, top it up with a simple wire transfer and use it as a secure payment method. When you sell a stored product on GOLD AVENUE, your funds will be directly added to your GOLD AVENUE Pay. You can then use your funds to place a new order or send them back to your personal bank account.

If the funds on your GOLD AVENUE Pay don’t cover the full price of an order, you can simply use your saved credit cards during checkout to pay the remainder!

Read more about the payment methods available on GOLD AVENUE on our pricing page.

Can the precious metals I store with GOLD AVENUE be physically delivered to me?

Yes, you can ask for your stored products to be delivered to you 24/7, directly from your personal account.

We ship in all of Europe in 4-10 business days and all parcels are securely wrapped up and insured against theft, damage, and loss.

You can find the list of countries and our standard shipping prices on our pricing page.

Please note that if you choose to deliver your VAT-FREE silver, platinum, or palladium products, VAT will be applied back, along with shipping and insurance fees. Don’t forget to check your country's VAT rates before shipping.

What are the fees and commissions when I buy, store, or sell on GOLD AVENUE?

Like any precious metals reseller, we charge a margin (also called “premium”) on each product, it's the part of the price that covers our costs and reseller's margin. This margin is already included in the prices you see in our shop. To better understand how the price of a product works, simply click on it to see a detailed breakdown.

Any product you store with us is fully insured against loss, theft, and damage, for free. Storage is also free for up to CHF10,000 in storage value, and if you want to store larger quantities, you only pay a fixed fee of CHF8/month up to CHF100,000 in storage value.

And that’s it. That’s the only fees we will charge on GOLD AVENUE.

At resale, we do not take any fee or commission and offer instant buyback, at spot price for all the products you store with us. This means that we will pay you the full market price for your product, whenever you want to sell.

You can read more about this on our storage solution page.

Why should I save in gold in 2025?

While the gold price has seen fluctuations in 2021, it has increased by over 85% in the past 5 years, and gold has historically performed well in times of inflation and economic uncertainty.

Today, investors often buy gold for two reasons. First, to secure their savings instead of leaving their money in a savings account to be eaten away by inflation. Then, to diversify their portfolio and protect it against risks they might take elsewhere (stocks, cryptocurrencies, real estate, etc.)

Many buyers also choose to save gold on a regular basis to smooth out the changes in price that can happen in the short to medium term.

Saving in gold is a way to secure your savings and build wealth on the long term.

To learn more about savings, investments, and precious metals, visit our blog and subscribe to our educational newsletter!