Platinum coins

(16 products)Sort by Default

Related categories

View more

Filters

Metal Type

Gold (319)

Silver (178)

Platinum (16)

Palladium

Product Family

Bullion (14)

Collectible (2)

Numismatic

Product Type

Cast bars (1)

Minted bars (10)

Coins (16)

Rounds

Monster Box

Tubes

Collections

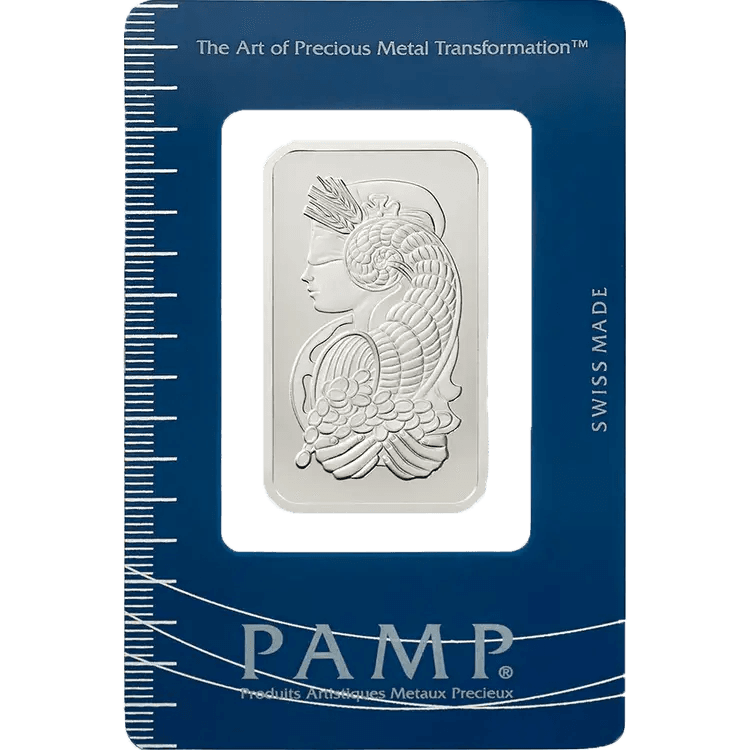

PAMP Cast Bars

PAMP Lady Fortuna

PAMP Rosa

PAMP Collectibles

American Eagle (1)

American Buffalo

Austerlitz

Australian Emu

Austrian Corona

Batman

Big Five

Bitcoin

Black Flag

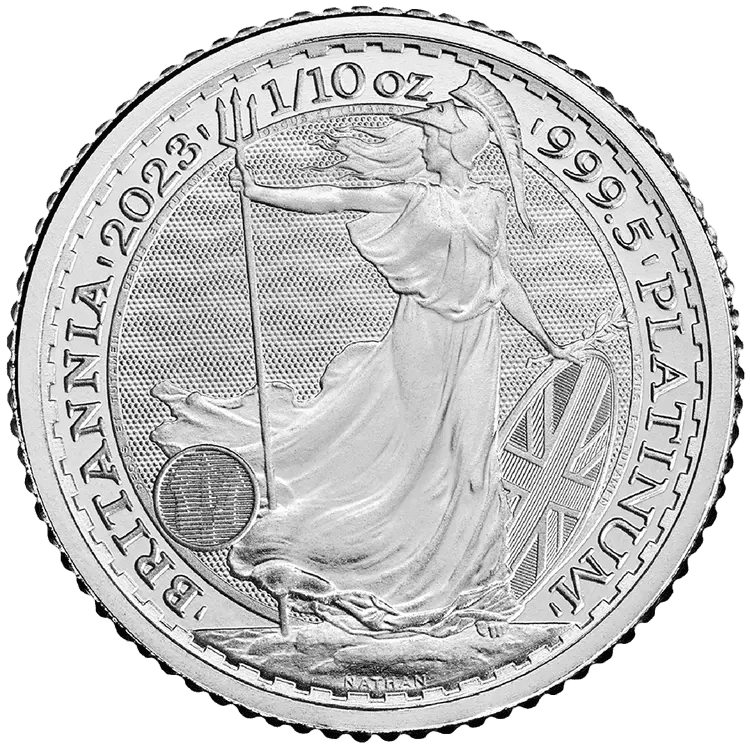

Britannia (5)

Coca Cola

Christmas Collectibles

Crypto

Czech Lion

Disney

Diwali

Dragon

Elephant

Falcon

Franc a Cheval

Gifts & Collectibles

Gold to Gift

Graded Coins

Kangaroo (2)

Koala

Kookaburra

Krugerrand

Licensed Products

Louis d'Or

Lunar (2)

Maltese Cross

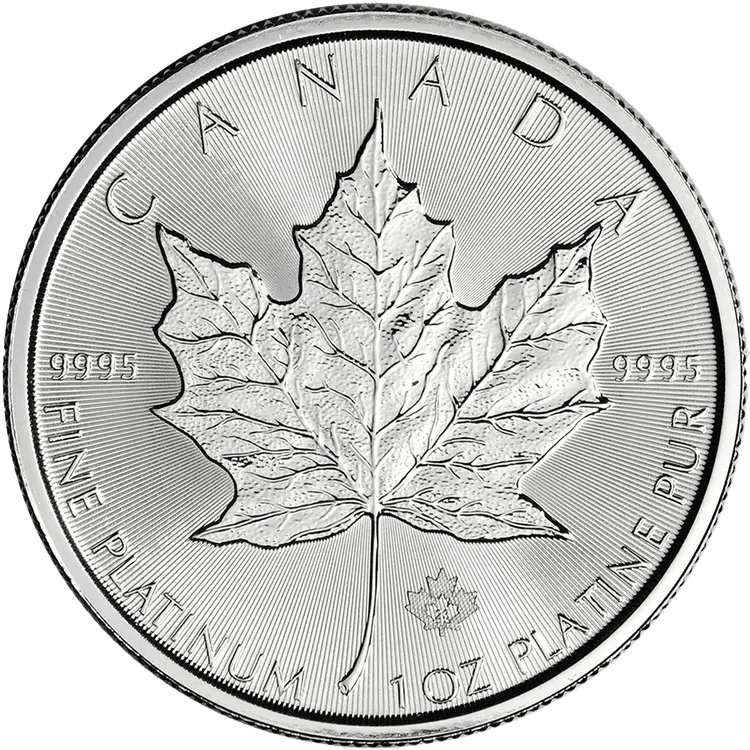

Maple Leaf (4)

Mexico Libertad

Myths and Legends

Napoleon

Noah's Ark

Panda

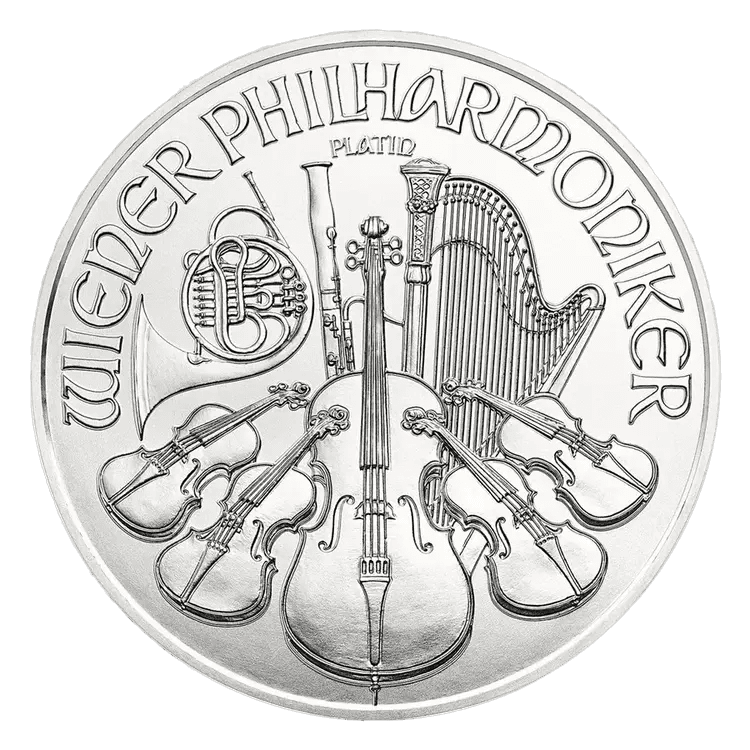

Philharmonic (2)

Silver to Gift

Sovereign

Spanish Doubloon

Star of David

Star Wars

Swan

Swiss Heritage

The Lion and The Eagle

Unesco

Vreneli

Zodiac

CGT-Free (UK only) (5)

View more

Product Selection

Deals (1)

Auto-Savings

Limited Editions

New Arrivals

Bestsellers

Price

< €50.00

€50.00 - €250.00

€250.00 - €500.00 (3)

€500.00 - €1,000.00

€1,000.00 - €2,000.00

€2,000.00 - €5,000.00 (13)

€5,000.00 - €∞

Weight

1 gram

< 1/10 oz (3.11 grams)

1/10 oz (3.11 grams) (3)

5 grams

6 grams - 9 grams

10 grams

20 grams

11 grams - 30 grams

1 oz (31.10 grams) (13)

50 grams

100 grams

250 grams

10 oz

500 grams

1 kilo

100 oz

5 kilograms

15 kilograms

View more

Brands

Allcollect

Argor-Heraeus

Austrian Mint (2)

Bavarian Mint

C.Hafner

China Gold Incorporation

Cuban coins

Czech Mint

Geiger Edelmetalle

German Mint

Gold Avenue

Heimerle+Meule

Heraeus

Italian State Mint

MDM

Mexican Mint

Monnaie de Paris

PAMP Suisse

Perth Mint (4)

Pressburg Mint

Random Mint

Royal Australian Mint

Royal Canadian Mint (4)

Royal Dutch Mint

The Royal Mint (5)

Royal Mint of Belgium

Royal Danish Mint

Royal Mint of Spain

South African Mint

Swissmint

T&S

Umicore

US Mint (1)

9Fine Mint

View more